Comscore Gets Fresh Start With Charter, Qurate, Cerberus Funds

Comscore gains access to data to provide audience and impression-based measurement

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Comscore, whose weak financial position has hampered its ability to compete as a provider of media measurement, has wiped out its debt with a $204 million strategic investment from Charter Communications, Qurate Retail and Cerberus.

In addition to cleaning up its balance sheet, the deal gives Comscore access to data that will help it provide the new types of audience and impression based measurement that are being demanded by a changing media and advertising industry.

Also Read: ‘New Nielsen’ Introduced at Firm’s Investor Day

The deal follows a lengthy strategic review at Comscore.

At the same time, Nielsen, the leader in the TV measurement market, also conducted a strategic review. It would end up agreeing to sell its Global Connect business for $2.7 billion in November. Nielsen also announced in December plans to launch Nielsen One, which will use big data to measure all media across screens and advertising on all platforms.

Comscore said that with its new partners, it will be able to move more swiftly to provide more accurate measurement for brands, agencies and media sellers, give local markets more data for media measurement and provide smaller and independent networks with better viewership information.

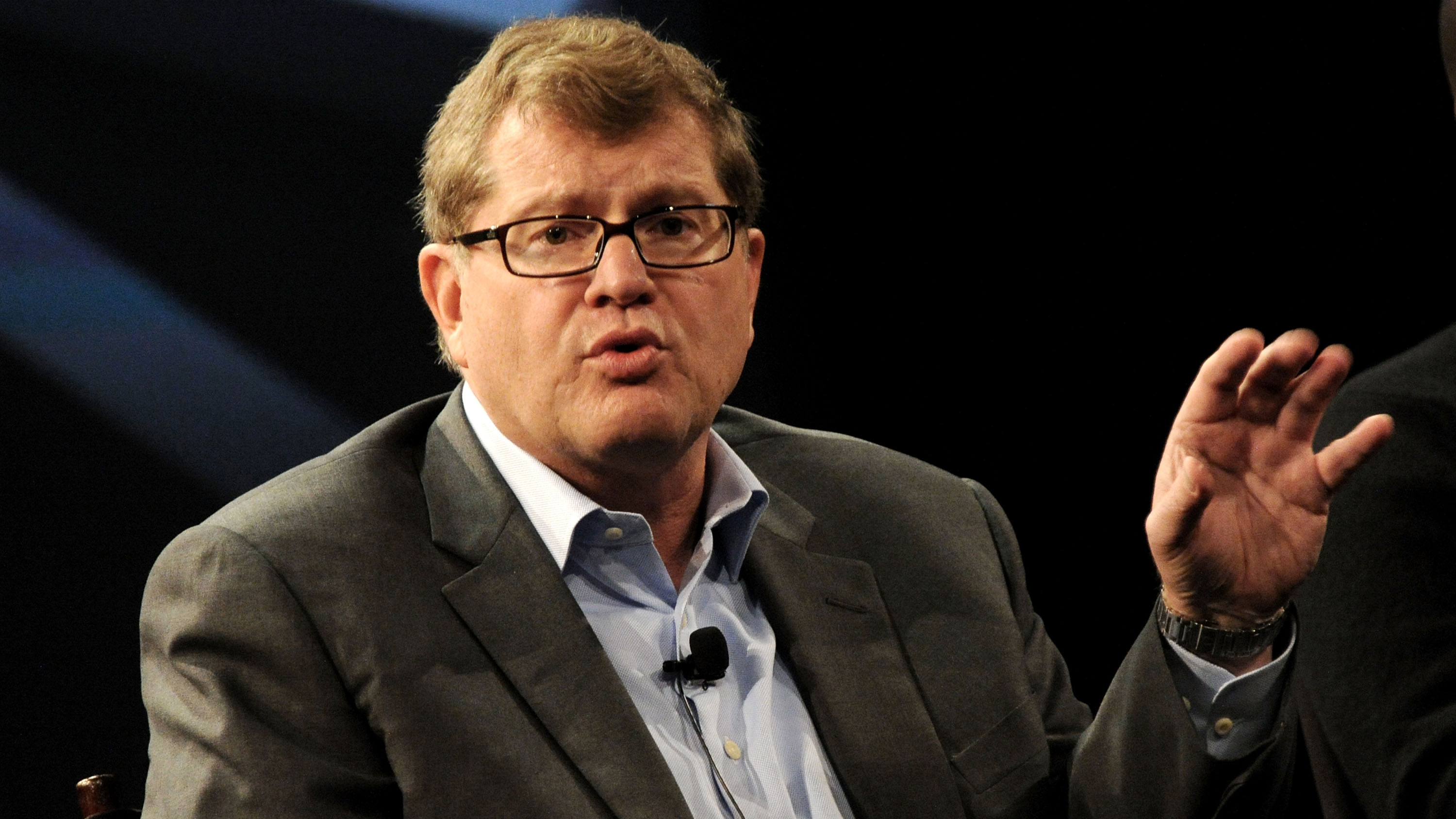

“The retirement of debt provides the company with the financial flexibility to execute our plan. The investment and commercial agreements we announced today will supercharge our ability to deliver trusted cross-platform measurement for all customers. We are built to deliver now,” said Bill Livek, CEO of Comscore.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

As part of the transaction Charter will provide enhanced access and rights to use its consumer-level data under a 10-year license.

Also Read: Comscore in Breakthrough Deal for Comcast TV Data

Last year, Comscore signed a deal giving its access to data from Comcast. That deal is being extended.

The Charter deal will also make Comscore Charter’s preferred local measurement provider for Charter’s advertising business, including its addressable advertising business.

With Charter operating in New York and Los Angeles, Livek said Comscore will be able to provide data in those markets that no other company can match.

“The time has finally come for Comscore, with its industry-leading impression-based data sets, to be able to offer advertisers, agencies and inventory owners the kind of granular measurement, attribution and reporting they will need to compete in our high-tech world. As people continue to consume content in different ways and on multiple platforms, our investment in Comscore will further enhance the television industry and Spectrum Reach’s ability to provide marketers and advertisers with effective and measurable data-driven solutions,” said David Kline, executive VP at Charter and president of its advertising sales unit, Spectrum Reach.

“More effective audience measurement will help clients to better reach targeted audiences throughout the communities we serve and ensure a greater return on their advertising investment," Kline said.

Cerberus, whose other holdings include the Albertsons grocery chain and Chrysler, will be providing expertise in advanced data and analytics, programmatic ads and media optimization.

“We look forward to partnering with the Comscore management team, Charter and Qurate to build on Comscore’s next phase of transformation and growth,” said Matt Zames, president of Cerberus. “With Comscore’s leading data and analytics capabilities, we are excited to apply our expertise and resources to help build on its portfolio of trusted products and drive value for shareholders.”

Qurate Retail, controlled by Liberty Interactive, owns QVC and HSN will be providing expertise on eCommerce.

Advertising agency and media buyer WPP is already a Comscore investor.

Comscore will continue to operate as a standalone company under current management. Charter, Qurate and Cerberus will each get two seats on Comscore’s board of directors, which will be expanded to 10 members.

Comscore has been in turmoil since irregularities were found in the company’s books four years ago. Since then the company has gone through a painstaking re-audit, several CEOs and reported operating losses.

In November, the company reported an $11 million third-quarter loss.

The investment from Charter, Qurate and Cerberus will enable Comscore to repay debt headed by Starboard Value LP.

A shareholder vote to ratify the agreement is expected to be held in the first quarter of 2021.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.