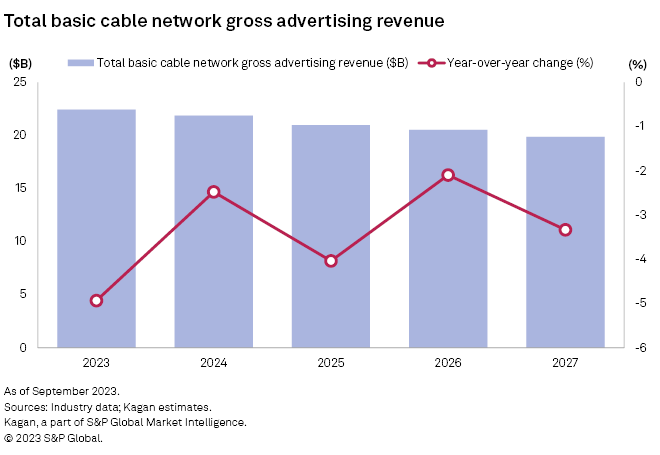

Cable-Network Ad Revenue Seen Falling Every Year Through 2027

S&P Global Market Intelligence sees 4.9% drop in 2023

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Cable networks, under pressure from factors including cord-cutting, are expected to see their ad revenue fall every year in the next five years, according to a forecast from S&P Global Market Intelligence.

S&P sees cable ad revenue falling 4.9% to $22.4 billion in 2023. By 2027, cable ad revenue will slump below the $20 billion mark. The drops will be less pronounced in 2024 and 2026, which are Olympics and election years.

Cable ad revenue finished 2022 at $23.6 billion, the lowest total since 2010, per S&P.

“Linear cable network advertising revenue is under pressure from a multitude of factors, including cord-cutting and the proliferation of ad-supported streaming services,” Scott Robson, senior research analyst at S&P Global Market Intelligence, said. “Our outlook is not calling for a total collapse of the market, however, as we believe there is still value in cable network ads over the next five years as the industry continues its slow migration to on-demand platforms."

The recent carriage dispute between Charter Communications and The Walt Disney Co. suggests that niche cable networks could get dropped by MSOs, S&P noted. That could also contribute to declines.

Cable viewership is suffering as consumers increasingly view scripted dramas and comedies on streaming platforms. That has made sports more important to linear networks. S&P estimates that ad revenue for sports networks rose 2.8% to $4.3 billion in 2022.

As basic cable’s overall viewership drops, cable TV advertising does not allow for the same level of audience targeting as digital ads. It is also difficult to track performance, but call-to-action ads are increasingly allowing for better tracking, S&P noted.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The challenge to linear cable networks will intensify as Netflix, Disney Plus, Max and other SVOD services ramp up their ad-supported tiers. At the same time, free, ad-supported streaming TV services like Paramount Global’s Pluto TV are rapidly growing advertising revenue, which is stealing share from cable networks, S&P said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.