BIA Trims Outlook for 2022 Local Advertising Revenue

30% growth expected for over-the-air television

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

BIA Advisory Services has trimmed its 2022 forecast for local advertising revenue, but still sees big increases for over-the-air TV and over-the-top video.

Despite the headwinds caused by Russia’s invasion of Ukraine, supply chain issues, and spending cuts in the auto category, BIA sees local over-the-air TV revenue rising 30.3% to $20.4 billion. In December, BIA said it expected local over-the-air ad revenue to hit $21.4 billion. (BIA also raised its estimate for over-the-air TV revenue for 2021 by $1 billion).

Local cable revenues are expected to be $6.5 billion, up 6%.

Online TV revenue forecast at $1.9 billion, up 18%. And over-the-top TV is expected to be the fastest growing media category, with revenue topping $2 billion for a 57% increase.

BIA raised its forecast for local political advertising spending to $8.6 billion and said local TV will get a large share of that spending.

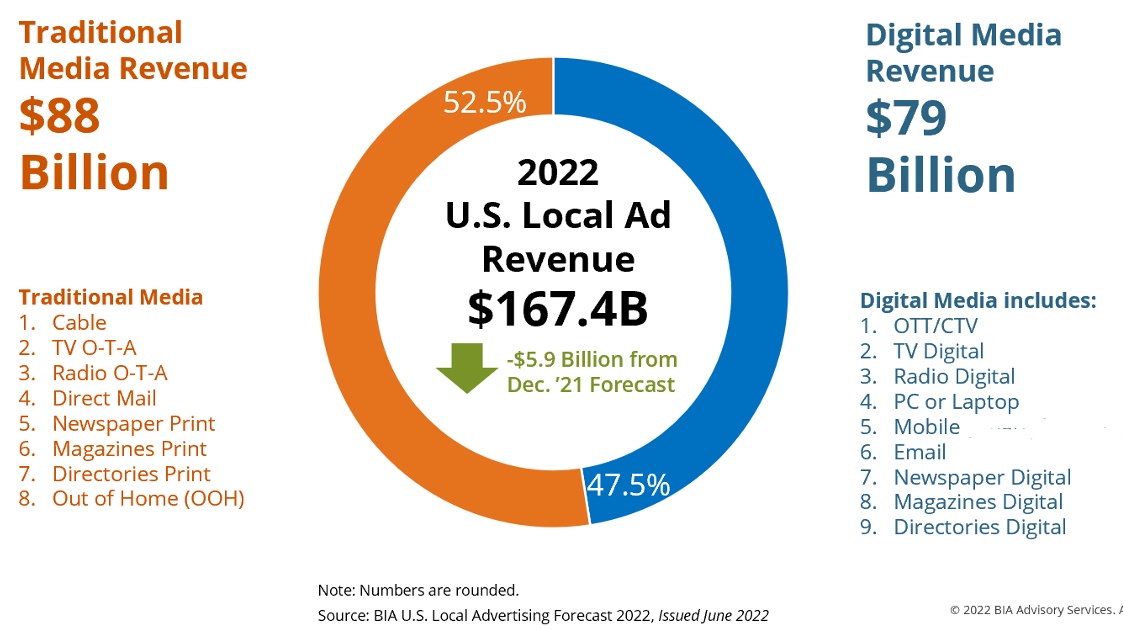

Overall, BIA sees local ad spend across all categories hitting $167.4 billion, down from the $173 billion forecast it made in December.

“The year didn’t start as strong as we had anticipated, making for a difficult first two quarters as some expected advertising spend started to retract,” said Mark Fratrik, senor VP and chief economist for BIA Advisory Services. “On the one hand, personal income continues to rise, but the cost of consumer goods, rising gas prices and inflation are having a major impact and we believe that will influence how advertisers will choose to use their ad dollars in the coming months. All of that must be weighed against what we see as positives for local advertising this year.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

According to BIA traditional media will get 52.5% of local revenue, while digital media gets 47.5%. BIA’s digital estimate was reduced slightly because new privacy measures on iPhone could slow mobile ad growth.

“We are seeing the economy play out in local advertising. For instance, people saved money during the pandemic and now, are enjoying different areas in the leisure and recreational verticals. People are spending on vacations and activities, and even going back to the gym,” said Nicole Ovadia, VP of forecasting & analysis at BIA.

“In all these areas, including political, we increased local advertising expectations. For businesses that have a direct reliance on supply chains, we have lowered expectations and will continue to monitor the situation throughout the summer fully expecting we may have to revise our estimates because the economy is in such a state of flux,” Ovadia said. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.