BIA Cuts Local TV Ad Forecast by 5% to $18.5B

Over-the-air drops to $17M

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With the COVID-19 pandemic hurting businesses, BIA Advisory Services has lowered its forecast for local television station advertising revenue by 5% to $18.5 billion.

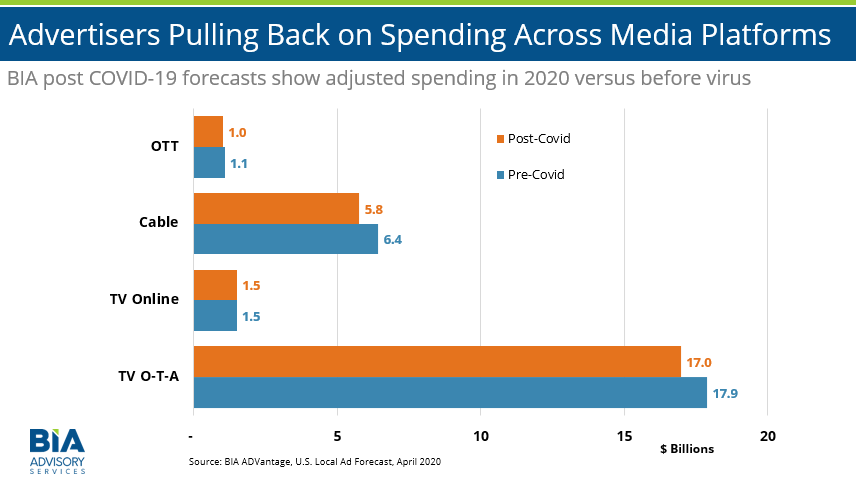

BIA breaks down station revenue as $17 billion for over the air, down 5% from $17.9 billion, plus online advertising worth $1.5 billion, unchanged.

Political advertising will total $7.1 billion during this election year, with over the air getting a 45.8% share. As candidates spend more on over-the-top advertising, station owners will benefit, BIA said.

BIA also forecasts that local cable will drop by 9% to $5.8 billion from $6.4 billion in the original forecast.

OTT revenues are expected to be $1 billion, down 9% from $1.1 billion.

“Local television stations, like all media, will see significant decreases in advertising from many business verticals like travel, leisure and retail,” said Mark Fratrik, senior VP and chief economist at BIA Advisory Services. “Political advertising will buffer those decreases in many markets that have competitive Senatorial and Gubernatorial races and in Presidential battleground states. Plus, continued growth in OTT and digital will help to soften the impact of the pandemic on advertising revenue.”

BIA also expects stations to bring in $10.44 billion in retransmission consent fees in 2020 and expects them to continue to rise.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Since we completed this forecast in early April, over 25 million Americans have filed for unemployment insurance and there is continuing economic concerns as the country moves to open back up, Fratrik said. “We expect political advertising will increase very quickly, and we anticipate certain verticals will rebound more quickly than others. It is going to be a dynamic marketplace this year, and we will continually monitor the nationwide and local economies to update our forecast based on new information.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.