Amazon Prime Video Set To Grab More Than $1 Billion in Ad Revenue in 2024

MoffettNathanson sees e-commerce giant’s move as more bad news for linear TV

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Amazon Prime Video can expect to generate more than $1 billion in 2024 as it starts selling advertising this month and that could rise to more than $1.7 billion in 2025, according to a new report from MoffettNathanson Research.

That number is for what MoffettNathanson calls “core Prime Video” and does not include ad revenues from Thursday Night Football, Twitch or Freevee.

“Amazon offers advantages in top-of-funnel reach and bottom-of-the-funnel targeting that are unique in the market and could easily siphon dollars from most competitors in time as they scale their go-to market efforts,” the report said.

The strength of what Amazon brings to streaming advertising is more bad news for traditional television.

“For linear media, we see this as another emerging pain point for cable network viability,” the report said. “For connected TV and ad-supported video on demand, while there is a race to the bottom from the emergence of free ad-supported streaming television (FAST) channels and non-targeted AVOD [ad-supported video-on-demand], Amazon could pressure the middle to higher end of the market, given its scale of impressions at relatively affordable prices.”

Prime Video’s core ad revenues are seen rising to $2.261 billion in 2026 and $2.757 billion in 2027.

MoffettNathanson called Amazon’s decision to automatically give all current Prime subscribers the ad version of the service a “savvy decision” that will quickly give it the kind of scale —70 million subscribers — that streaming leader Netflix is still trying to build more than a year after its launch.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The 15% of U.S. Prime Video households MoffettNathanson believes will choose to pay $2.99 a month to avoid ads would contribute about $400 million in incremental subscription revenue to the service.

Giiven Amazon’s e-commerce capabilities, MoffettNathanson said, its entrance into the ad market will affect all of its competitors.

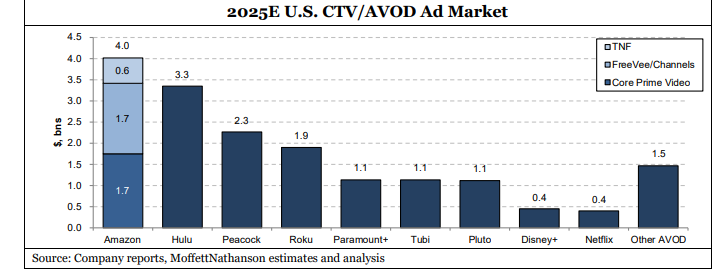

If you add in spending on Thursday Night Football and Freevee, Amazon will have have $4 billion in connected TV and AVOD ad revenue in 2025, the biggest total in the market, according to MoffettNathanson. By comparison, ad revenues for Hulu would be $3.3 billion, Peacock $2.3 billion, Roku $1.9 billion, Paramount Plus, Tubi and Pluto all at $1.1 billion.

Netflix’s 2025 ad revenues are expected to be just $400 million according to the report.

Helped by the elections and Olympics, MoffettNathanson expects traditional TV ad revenues to grow 1% in 2024. TV will resume its downward trajectory with a 9% drop in 2025.

With Prime Video entering the market, the AVOD market is expected to grow 18% in 2024, up from 17% in 2023.

“Putting this alt logether, we strongly believe that the emergence of advertising dollars on Amazon Prime Video, plus the continued secular tailwinds in CTV/AVOD, will be the most detrimental for the long tail of non-top 20 cable networks — especially those without live content,” the report said.

MoffettNathanson said that the media companies likely to feel the most pain are Paramount and AMC Networks, because of their lack of diversified profitability away from linear TV and the limited live content on their cable networks.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.