Advertisers Look To Spend More on All Forms of Video, Survey Finds

Advertiser Perceptions said 24% plan to spend more on linear TV

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

As more forms of television emerge, advertisers are looking to buy more video of all types, a new survey by Advertiser Perceptions finds.

According to Advertiser Perceptions’ latest Video Advertising Convergence Report, 50% of advertisers said that video was the most valuable media in terms of achieving their goals.

TV, including linear, addressable, connected TV and over-the-top, was the most important form of video, cited by 47%, up from 36% in a similar survey two years ago. Digital video was cited by 46%, down from 53% in the earlier survey.

Half of the advertisers surveyed said they plan to spend more on video advertising this year, with the average increase at 25%. (Overall ad budgets will go up to accommodate more video spending, according to 75% of those surveyed).

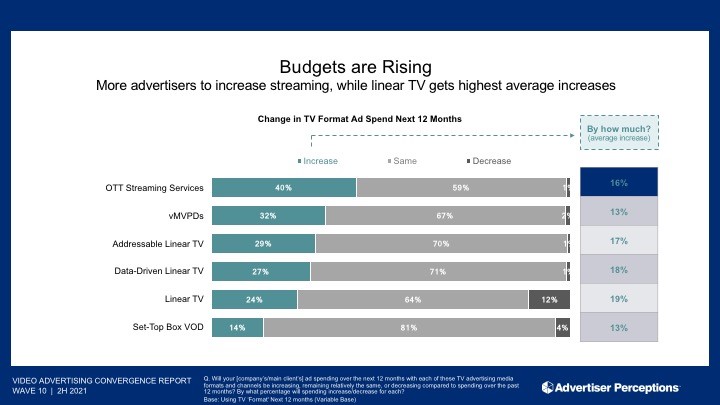

OTT streaming services will see spending increases from 40% of those surveyed, with the average increase coming in at 16%. Only 1% planned to decrease spending on OTT streaming services.

Also: Upfront Buyers Driven By Fear of Missing Out, Survey Finds

Virtual MVPDs will see an increase from 32% of those advertisers, 29% said they would increase spending on addressable linear TV and 27% plan to increase spending on data-driven linear TV.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

When it comes to linear TV, 24% said they planned to increase spending, with just 12% saying they planned to cut spending. The increased spending on linear TV averages 19%, according to the survey.

“The rising video tide is lifting all boats, just not equally,” said John Bishop, VP/business intelligence at Advertiser Perceptions. “Streaming is attracting priority attention as the medium adds content and audiences, while linear TV continues to get the highest dollar volume. As streaming grows in forms and value, we can expect to see more innovation and advertiser investment.”

The increase in streaming has led more than half of advertisers to buy video ads programmatically in the past year. They expect to increase their activity this year.

Advertiser Perceptions interviewed 250 U.S. advertisers – 63% agencies, 37% marketers – in October 2021 for its latest Video Advertising Convergence Report. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.