Ad Views in Premium Video Jump 17%, FreeWheel Says

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Advertisers continue to flock to premium digital video, according to a new report from FreeWheel.

Premium ad views grew at 17% year-over-year, driven by strong double-digit growth of full-episode and live stream monetization, FreeWheel said in its 2nd Quarter Video Monetization Report. Video starts were up 26%.

FreeWheel noted that advertisers have expressed concerns about fraud and viewability in some forms of digital advertising.

Related: AdMore Integrated Into Mediaocean Buying System

Despite that, “premium video publishers have doubled down on their efforts to demonstrate superior value and develop creative products that advance advertiser goals,” FreeWheel said. “Even with the content and device landscape looking markedly different than in the recent past, premium video is well positioned to overcome industry headwinds and deliver another great season.”

Ads in live digital video grew by 20% to account for 21% of total ad views, up from 17% a year ago. The bulk of the live views—73%—were in sports programming. Live news ad views jumped 150%.

The bulk of ads continued to be viewed during long-form content and full episodes at 61%, unchanged from last year, with 93% of the episodes being entertainment shows, compared with 5% for sports and 2% news.

Related: Survey: Programmatic TV Gains With First Party Data

Ads in shorter clips were down 2% and for 18% of ad views, down from 22% a year ago.

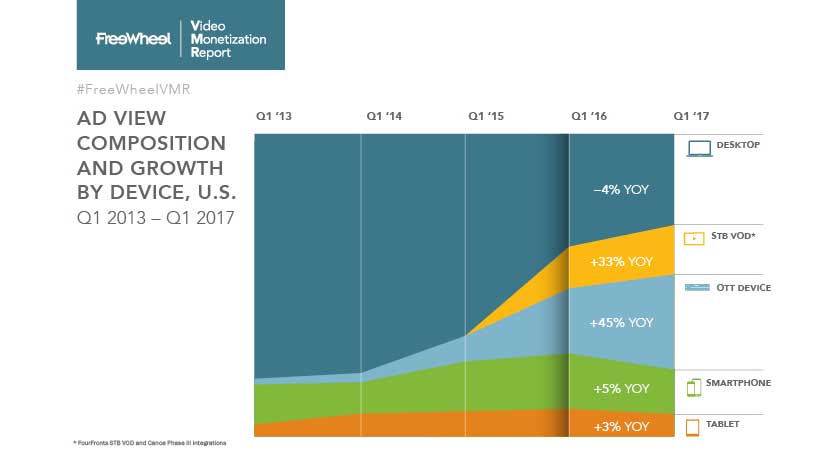

The growth in video monetization is further accelerated by the adoption and acceleration in usage of OTT device platforms, according to FreeWheel. Driven by full episode and live viewing, OTT grew to 29% of ad views in Q2 2017. At the same time, desktop ad views declined to 27%, the smallest share it’s had since the VMR was first published over 5 years ago.

The success of digital video is one reason why digital media companies are shifting out of text.

“We continue to see other digital content businesses pivot to video, from Mic and Buzzfeed to Facebook with its new dedicated Watch,” the report said.

For the second consecutive quarter, over-the-top devices claimed the title of largest platform for premium video monetization, growing 32% year-over-year. Meanwhile, ad views on desktop, the second largest platform, declined 15%.

“It’s no surprise that the devices that dominate the living room, STB VOD and OTT, skewed heaviest toward full-episode content,” the report said. OTT had more than double the live ad view share of tablets, indicating that people use OTT devices to augment traditional linear TV viewing while tablets may be used more for catch-up viewing.”

More video ads are being bought using automated programmatic technology, according to FreeWheel.

Programmatic accounted for 11% of ad views overall with private marketplaces overwhelmingly preferred as the transaction model for programmatic deals. Programmatic buying was up 5%, but ads bought directly, grew even faster at 10%

“Historically, premium publishers have used programmatic as a secondary monetization strategy,” the report said. “However, they are gradually increasing the volume and variety of inventory they make available for purchase through automated channels. For now, the growth of traditional direct-sold ad views still outpaces that of programmatic as publishers are figuring out how best to take advantage of those demand sources in safe and transparent ways.”

Premium video publishers are trying to retain control over which ads they serve and protect the value of their inventory by selling in private market transactions. FreeWheel found that 96% of programmatic impressions were sold in private marketplace transactions, which provide control and transparency for buyers and sellers.

Premium video delivered high ad completion rates across all content and ad units, despite concern that viewers may be deterred by poor ad experiences, FreeWheel said.

Viewers completed 97% of mid-roll ads in full-episode content and 92% in live streams. Mid-roll ad loads stayed at around four per break and only 16% of ads repeated during a full-episode.

Many TV networks have been with lower ad loads on linear television and have been gradually reducing the number of ads on digital streams as well in order to boost the value of their ad inventory.

Across all content, ad formats and ad durations, the ad completion rate in Q2 2017 for premium video was 85%.

FreeWheel noted that this is significantly higher than what other digital channels have reported. It said that Facebook recently published a completion rate of 70%+ for in-stream video ads up to 15 seconds. This doesn’t take into account ads that were longer than 15 seconds, which may have an even lower completion rate on Facebook’s platform.

The category running the most ads in digital content is consumer packaged goods at 20%. That’s followed by retail at 14%, financial and business services at 13%, auto at 13% and entertainment and media at 10%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.