20% of SVOD Users Resubscribed to a Service They Previously Canceled

Discounts and fresh content bring them back, Aluma Insights says

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Consumers who cancel a subscription video-on-demand service frequently return, a new report from Aluma Insights found.

In the past year, 20% of SVOD users in the study said they resubscribed to a service they’d previously canceled, with 90% returning within a year.

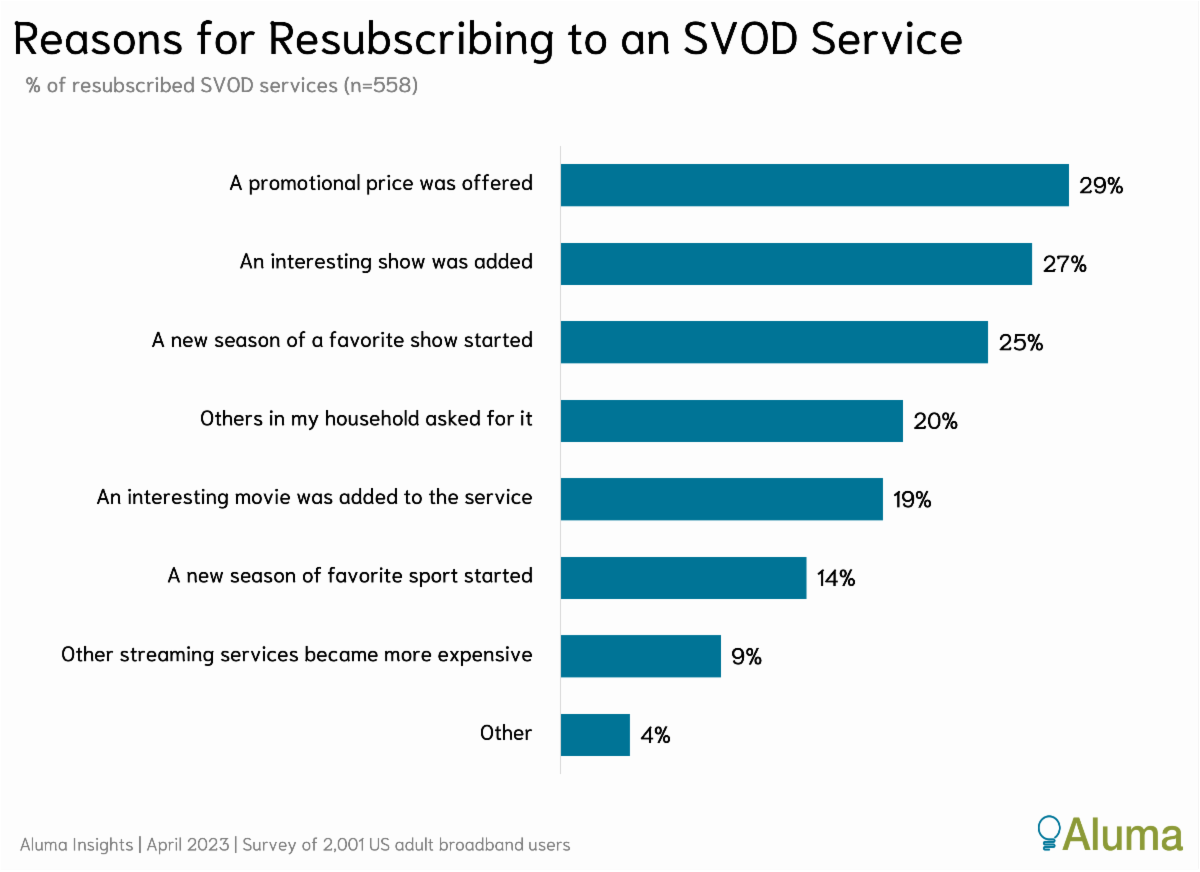

Aluma insights said that price discounts and new shows were what convinced viewers to give a service another look.

“Because someone cancels a streaming video service doesn’t necessarily mean they didn’t enjoy it or they won’t return,” Michael Greeson, founder and principal analyst at Aluma, said. “The question is what ‘hot buttons’ most encourage cancelers to reenroll.”

The fact that new and returning shows are almost as important in driving reenrollment as cost of service is an important insight. Subscription services that invest in new originals or in securing the latest hit TV series or movie will fare better in attracting return subscribers, Aluma said. “Those leaning more into low-value library content from third parties will be less successful.”

That lesson might be hard to apply as streamers cut back on spending on content in order to reduce red ink and turn a profit. The strikes by the writers and actors unions will also put a crimp in the availability of new content.

Less content at higher prices is a formula for even higher churn rates and speaks to the importance of properly tuned re-subscription strategies, the report warns.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Keep in mind the horizon for re-subscription is relatively short,” Greeson said. “Only 11% of recent re-subscriptions occur a year or more after cancellation. Responding quickly and persistently during the early months after cancellation can make a meaningful difference in re-subscription rates, especially if the key motivators of cost and content are addressed head-on.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.