The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Earlier this summer, Next TV reported for the first time a trend of consumers ‘destacking’ their subscription streaming services, and that fewer were planning on subscribing to additional streaming plans in the future.

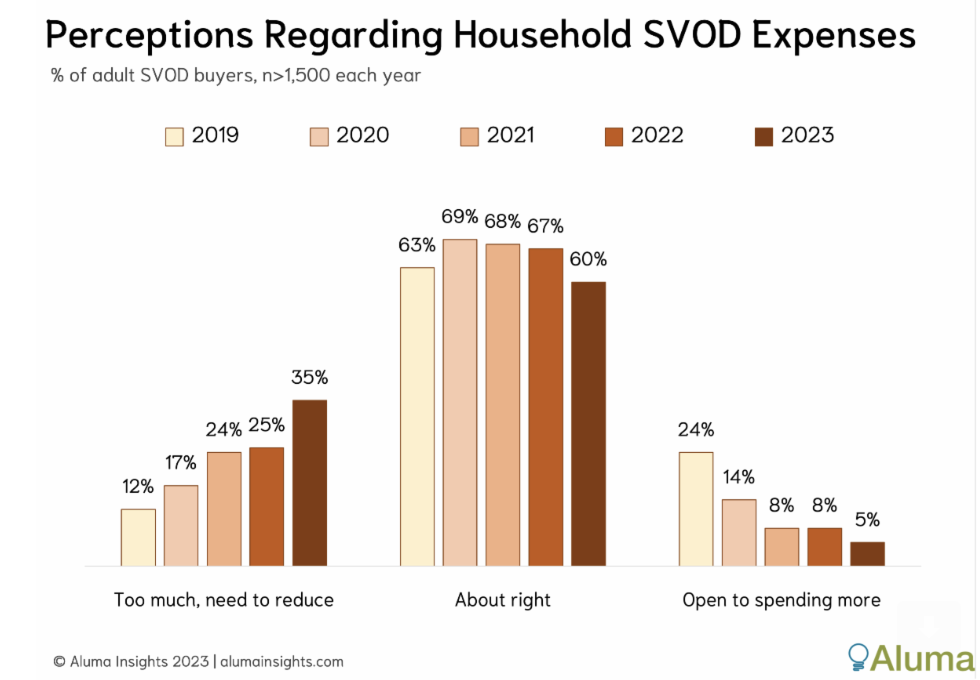

New data reported by Aluma Connected Media Insights corroborates that finding, showing that 35% of subscription-based video-on-demand (SVOD) customers believe they are spending too much on services like Netflix and are looking to cut back.

This figure represents a 40% increase in customers looking to cut back vs last year, and nearly three times greater than the amount in 2019.

Furthermore, only 5% of all customers would be interested in spending more on SVOD services, down 38% from 2022.

This downward trend has remained largely steady throughout the past four years, as customers have gradually become dissatisfied with the aggressive market prices set by streaming services in an attempt to generate revenue.

“That only one-in-20 SVOD buyers are open to adding a new subscription service is the latest indicator that U.S. demand for services is largely exhausted,” said Michael Greeson, founder and principal analyst at Aluma. “This does not mean mature SVOD providers will not add subscribers, only that such additions will be fewer, require more aggressive discounts, and be zero-sum purchases — that is, for every new service added, another must be canceled.”

Broadband is already available to more than 90% of U.S. households, leaving only 10%, or roughly 14 million households, unserved by SVOD providers. Furthermore, even if those without broadband were brought online, there is no guarantee that they would be interested in streaming video services in the first place.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Consumers are getting increasingly frustrated by expanding streaming expenses and it is only getting worse. With many SVOD providers like Max prioritizing the optimization of revenue via increased prices, decreased content spending, and widespread layoffs, growing subscriptions has taken a back seat in today’s streaming industry.

Coupled with the ongoing strike by writers and actors, which makes the production of new content challenging, viewers will almost certainly see a decline in quality of content even as the price for SVOD services increase.

However, consumers may also see benefits from competitive pricing between suppliers, leading to SVOD bundles that combine services from various operators and offer subscribers a discount on standalone pricing. Rather than Disney’s Disney Plus/Hulu/ESPN Plus bundle, Greeson suggests, consumers might see deals that more closely resemble pay TV services — “super bundles” that derive elements from multichannel programming models.

“Content owners that have long competed head to head with one another will engage in strategic bundling with competitors,” Greeson said. “This is not some kumbaya moment for the streaming industry, but a strategic necessity for SVOD operators, much as joining cable TV bundles was for large over-the-air broadcasters more than 50 years ago. It’s about survival in a hyper-competitive marketplace.”

Jack Reid is a USC Annenberg Journalism major with experience reporting, producing and writing for Annenberg Media. He has also served as a video editor, showrunner and live-anchor during his time in the field.