SVOD Boom Goes Bust as Consumers 'De-Stack' Subscription Video Services (Gobs of Breathtaking Charts)

You want bad news about the video entertainment industry? Hub Entertainment Research has got it

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

The good days are over, and it's all going to suck from this point on.

OK, that is a little too dark. But what can we say, Hub Entertainment Research's latest annual Best Bundle report -- not to mention the soft interior defense of the Los Angeles Lakers Wednesday night -- has put Next TV in a dour mood.

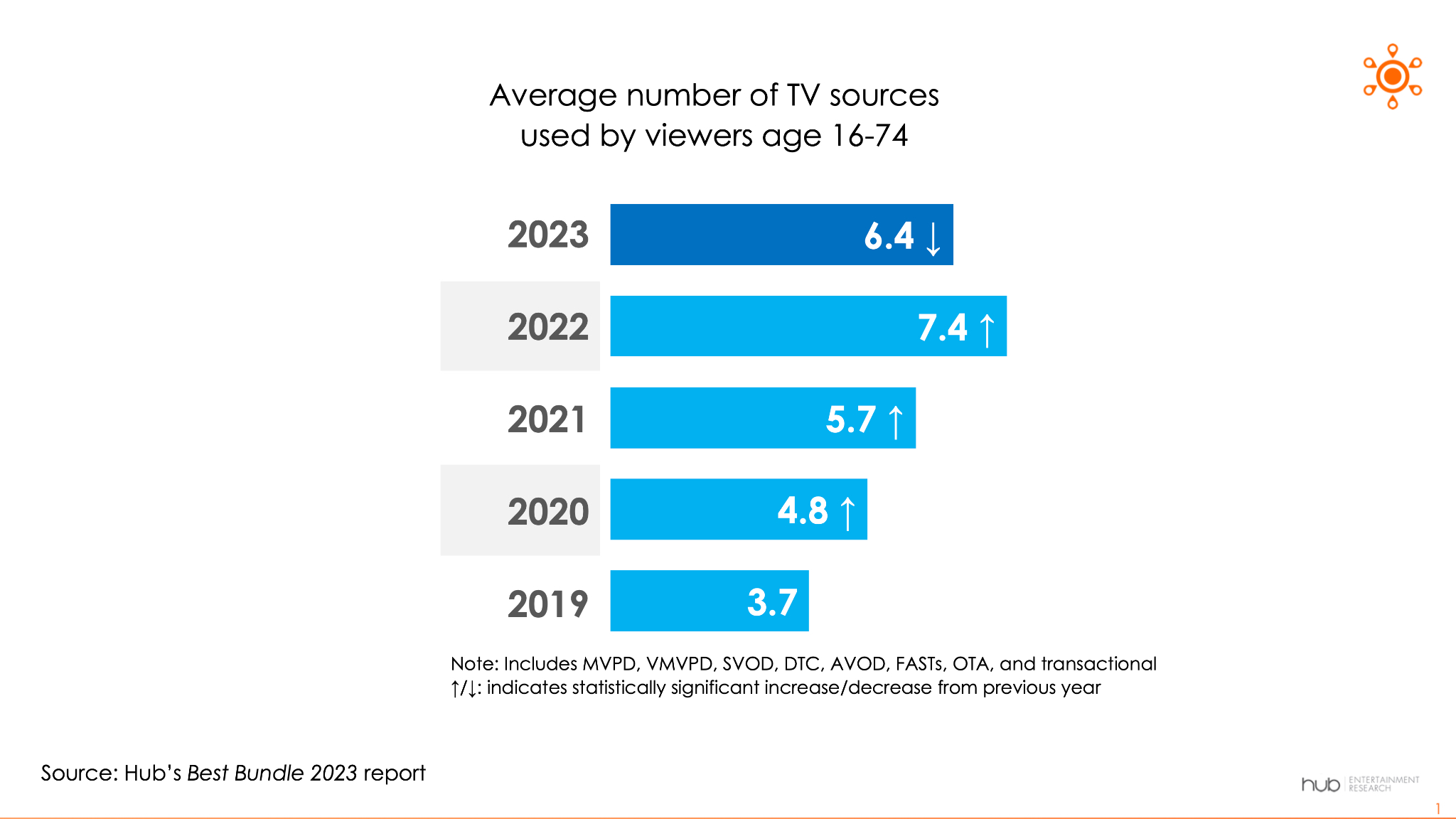

According to Hub, which polled 1,603 U.S. adult streaming consumers in March and April, the number of TV sources used per person dropped for the first time in the annual' report's history, from 7.4 in 2022 to 6.4 now.

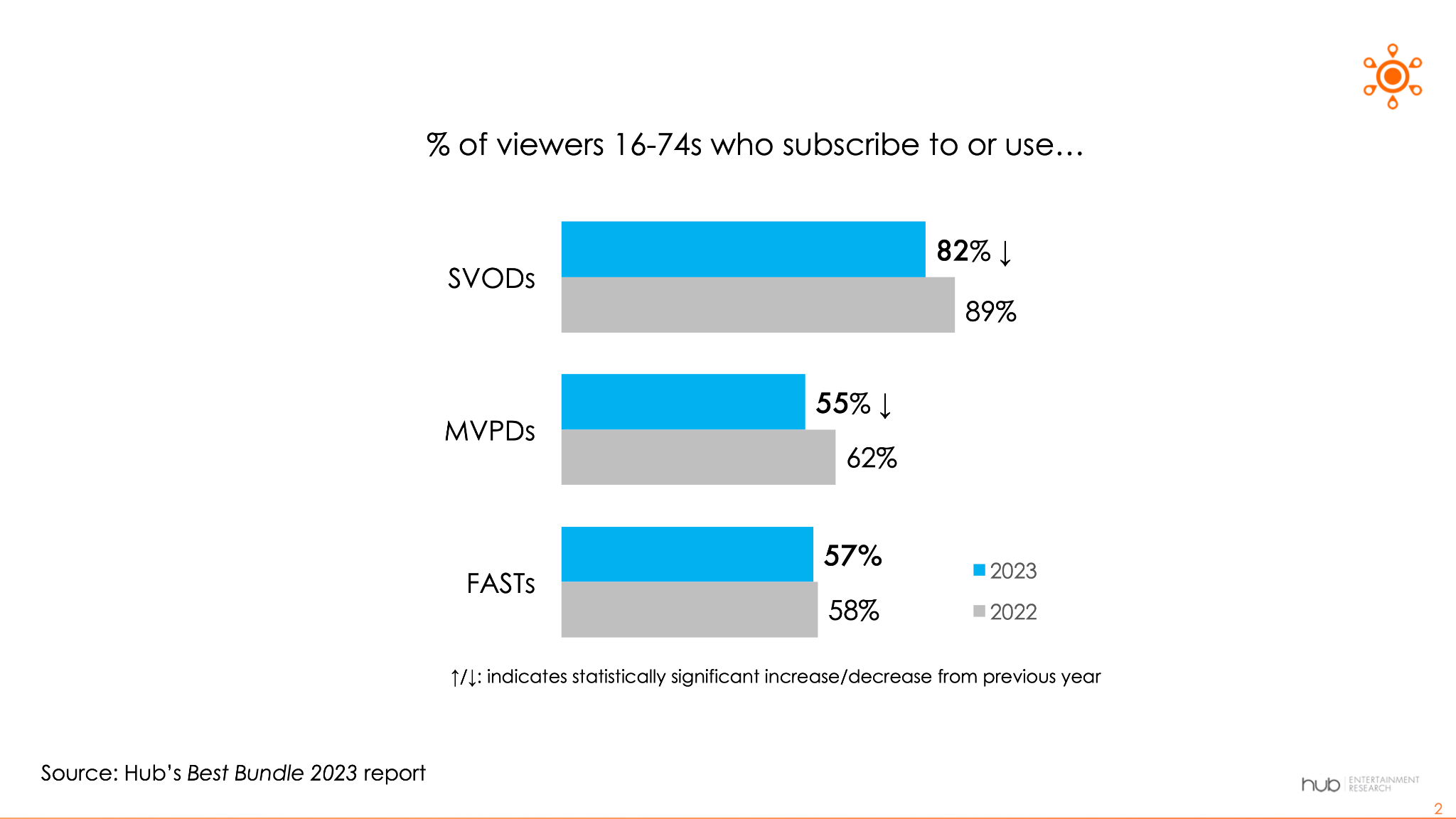

As numerous other similar navel-gazing studies have concluded, FAST usage isn't declining. In fact, Hub found that it's up-ticked a little lately.

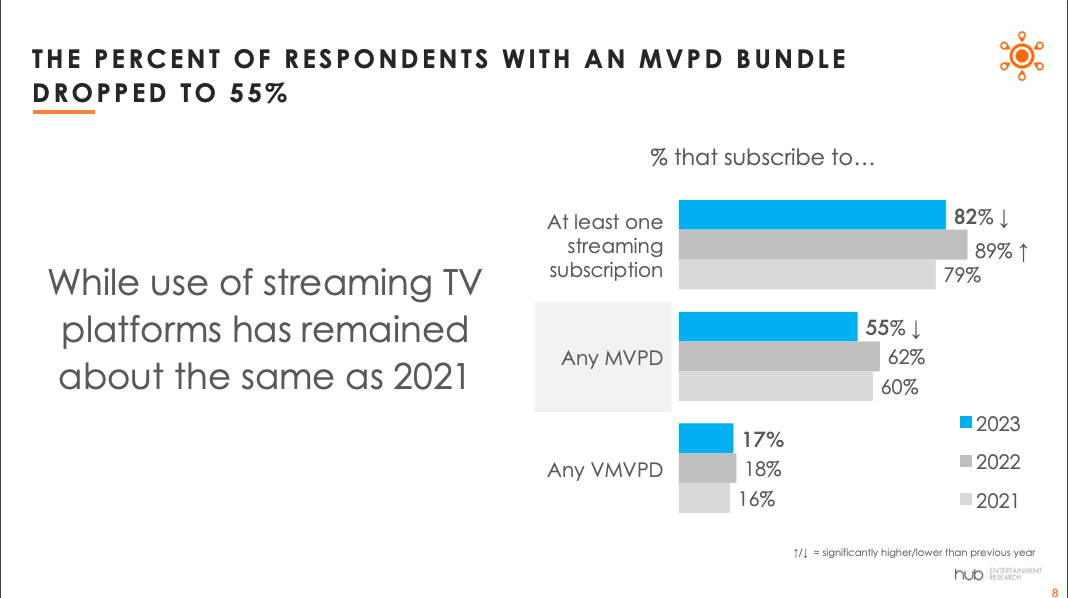

Rather, inflation-conscious consumers are not only cutting the cord on pay TV, they're now "de-stacking" (Hub's term) subscription streaming services.

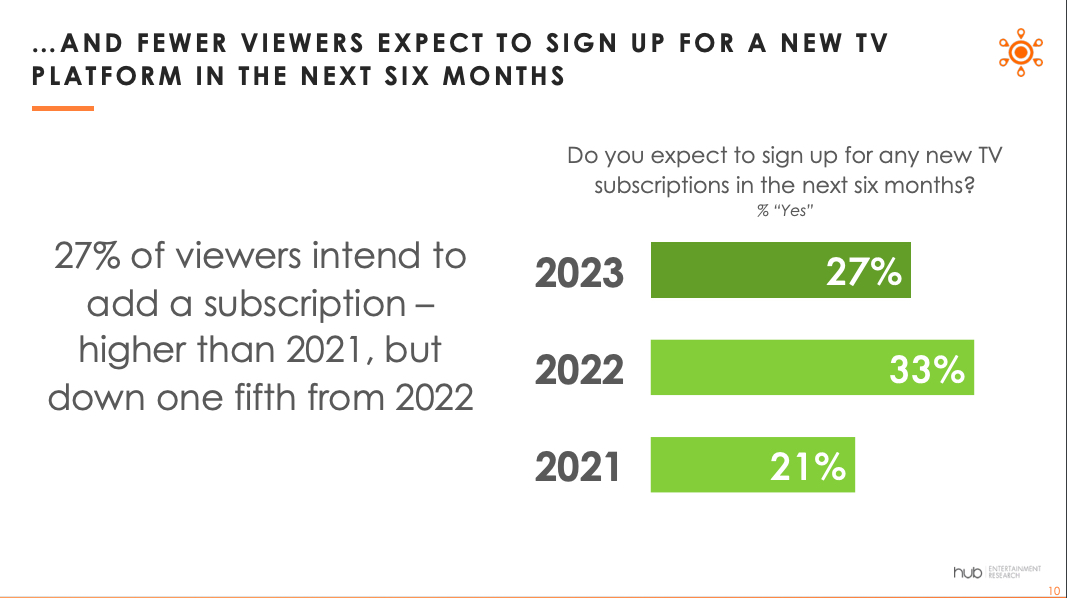

Only 27% of consumers said they plan to add a subscription streaming service in the next six months vs. 33% last year, according to the survey.

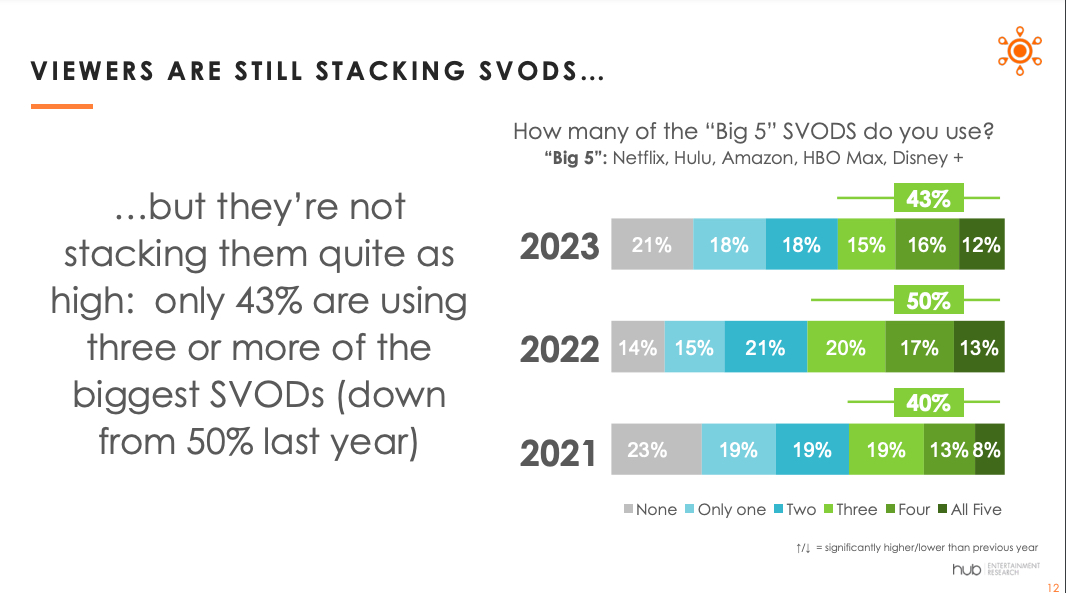

And significantly more consumers reported using none of the five biggest U.S. SVOD services, relative to a year ago.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

“Booms don’t last forever, and inflation and economic worries may have finally slowed the roll of consumers looking to stack traditional and streaming subscription TV services,” said David Tice, senior consultant to Hub and co-author of the study. “However, FASTs have maintained their momentum this year; in a time of economic uncertainty, ‘free’ is a powerful differentiator.”

Placing this all at the feet of the demand side is probably too simplistic. The major SVOD suppliers -- at least those attached to big media companies -- have engaged in a major pivot, led by Warner Bros. Discovery, drastically cutting losses on direct-to-consumer streaming at the expense of platform growth and scale.

There's less content on the major SVOD services these days. And the prices are higher. As a result, more folks are churning out. Fewer are signing up.

On Wednesday, Disney reported a 26% year-over-year first-quarter decline in DTC EBITDA losses to $659 billion, but also revealed a loss of 3.4 million streaming subscriptions globally for the quarter.

Meanwhile, resembling the confounding nuance of the broader economy, U.S. subscription streaming companies are making more money on SVOD -- 22% more last year, according to research released last week by Omdia.

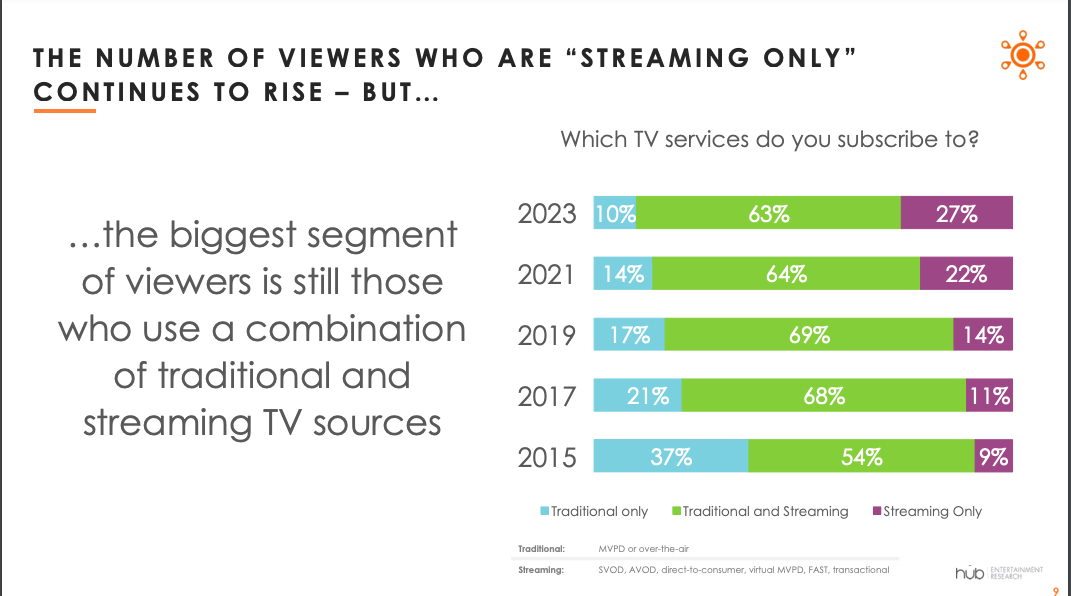

And as Hub itself confirms, U.S. consumers may be subscribing to fewer streaming services ... but they're not streaming less.

In fact, the percentage of U.S. consumers who identify themselves as "streaming only" is larger than ever.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!