With Disney Leading in DTC Content, Analyst Sees Mergers Ahead

Wells Fargo's Steven Cahall sees Warner-Discovery getting 178 million subs by 2024

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Content is king in the direct-to-consumer streaming wars with The Walt Disney Company in the lead and Steve Cahall, analyst at Wells Fargo sees more deals like the proposed WarnerMedia-Discovery merger on the horizon as media companies seek enough ammunition to compete.

“We think the Discovery-WarnerMedia transaction represents a Media maxim: DTC is a content arms race, and scale is most necessary. More content leads to stronger engagement, which reduces churn, creates pricing power and drives margins. Netflix and Disney are putting this playbook to work, others hope to follow,” Cahall said in a report Tuesday.

“More is better and we expect more media deals that favor content scale,” he said.

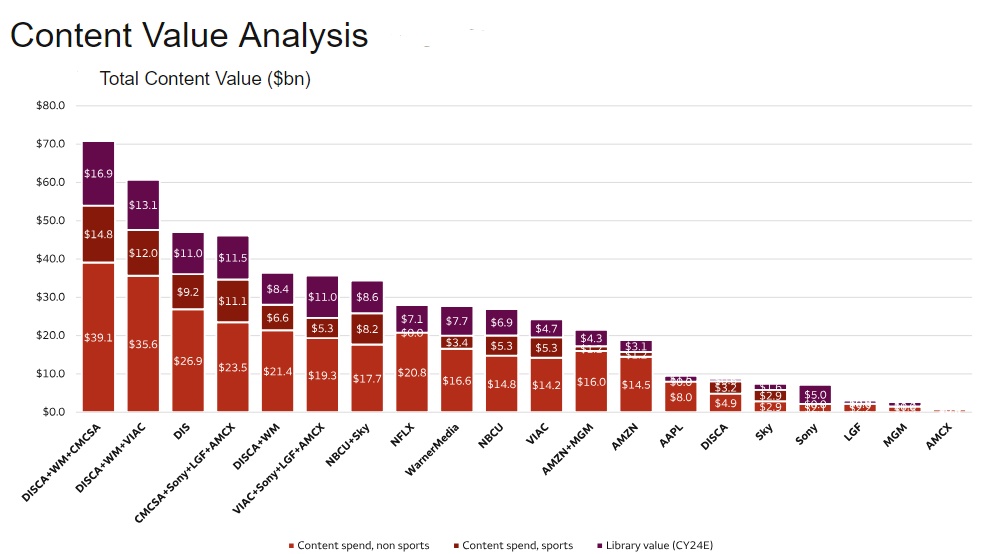

In his report, Cahall looked to put a value on each media company’s spending on content and how much their programming library is worth.

Also Read: Discovery-WarnerMedia Deal 'Doesn’t Really Change Much', Says Bob Chapek

Cahall puts Disney’s 2024 content value at $47 billion (or $38 billion without sports) to lead the industry.

The next biggest is Discovery and WarnerMedia at $36 billion. Cahall sees the combination getting to 178 million subscribers by 2024, behind Disney, Netflix and Amazon.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Comcast’s NBCUniversal/Sky content is valued at $34 billion but Cahall notes that not much of Comcast’s content drives DTC businesses.

Netflix’s content value is $28 billion, ViacomCBS is $24 billion and the combination of Amazon and MGM totals $22 billion.

In fifth place, Viacom has some decisions to make, according to the report.

“Even if curtailing licensing and folding in Showtime OTT, the recent mergers of Discovery and WarnerMedia and Amazon and MGM means tougher competition ahead. In our view it's worth considering all the options especially since scaled studios are now proven to be rare gems,” Cahall said.

The report looks at other combinations that would have huge content value, including Warner-Discovery combining with NBCU and Sky ($70.8 billion), Warner-Discovery and Viacom ($60.7 billion), NBCU/Sky plus Sony, Lionsgate and AMC Networks ($46.2 billion) and Viacom plus Sony, Lionsgate and AMC Networks ($35.7 billion).

Eventually, if you spend big on content you can get enough subscribers so that the cost per subscriber starts to come down, as illustrated by Netflix, Cahall notes.

“In short, everyone wants to be like Netflix,” he said in the report. “In 2020 NFLX had $58 in content amortization per average subscriber and from big content spend comes engagement, which reduces churn and drives pricing power through to margin expansion.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.