Wall Street Has More Questions About Discovery-WarnerMedia

MoffettNathanson downgrades Discovery to neutral from buy

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

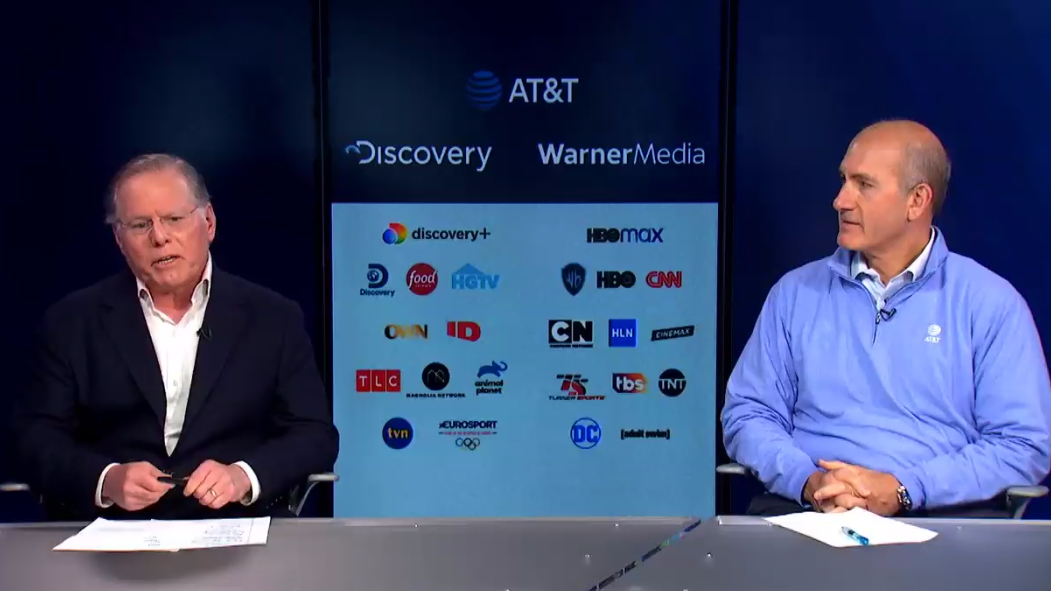

Given some time to digest Discovery’s stunning deal to take WarnerMedia off of AT&T’s hands, analysts are wondering what trying to swallow a whale will mean to the home of TV’s Shark Week.

For analyst Michael Nathanson, the questions are serious enough for him to downgrade Discovery stock to neutral from buy. Nathanson also cut the target price of Discovery stock by $14 a share to $37. Discovery closed Friday at $31.47 a share.

“The new company will be a highly leveraged play on the domestic cable networks model with options on two DTC pivots--HBO Max and Discovery Plus,” Nathanson said in a note Monday.

He said that adding the Turner cable networks muddies the waters on Discover being able to pivot. He also said that efforts to quickly scale HBO Max “is an operations shift that could be hurt by both a lingering regulatory revenue and unforeseen changes in leadership.”

Nathanson noted that building entertainment based HBO Max is a different challenge than growing Discovery Plus. But, he also noted that Discovery Plus could benefit from Turner’s sports rights and programming from CNN.

Meanwhile, investment bank Sanford C. Bernstein took a survey about the Discovery-Warner media deal and found that while most investors saw the strategic rationale for the deal, they were less convinced about the economic results (although sentiment was still above average).

Also read: Discovery-WarnerMedia combination's impact on linear networks

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Investors surveyed were also confident that Discovery CEO David Zaslav will be able to cut costs enough to meet the $3 billions synergies being touted. But they are less sanguine about management’s ability to achieve the $52 billion in revenues being forecast for 2023 and even less confident it can bring in $15 billion in DTC revenue.

There were also questions about how HBO Max and Discovery Plus will be packaged going forward. In Bernstein’s poll, 35% said Discovery’s content should be rolled into HBO Max and priced at $15, while 32% said Discovery Plus and HBO Max should remain separate with some bundling options for consumers.

"Beyond these three questions, the survey results also show that investors have relatively high confidence that the deal will go through (81% likelihood),” analyst Bernstein's Todd Juenger noted.

“Participants believe that a competing offer would be the most likely reason a deal wouldn't go through on current terms (26% probability) – a higher probability of an overbid than we would be inclined to expect. Participants expressed ambivalence about prospects for both stocks over the next 6 months,” Juenger added.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.