Viacom Not Pulling Plug on Secondary Networks

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

As Viacom focuses on its six flagship networks, its other channels aren’t going away anytime soon.

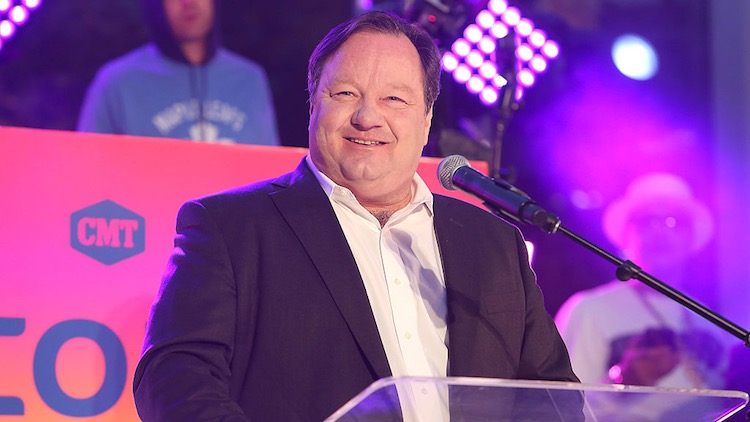

Viacom’s new CEO Bob Bakish outlined his strategy for turning the struggling company around during its earnings call Thursday morning. A key part of the strategy is focusing on six core networks: BET, Comedy Central, MTV, Nickelodeon, Nick Jr. and Paramount, which will become the new name for Spike in 2018.

But at a time when many see weaker networks being culled—NBCUniversal is converting Esquire into an online brand and shutting down Cloo—Bakish said that networks like TV Land, CMT and VH1 are strong, just not flagship-worthy.

Related: How 'Nashville' Hit Ratings High Notes Moving to CMT

“Networks like TV Land, like CMT, VH1 have real prospects going forward. They are not though global prospects; they are not film prospects,” Bakish said. “We will be looking at resources, and we will do some inevitable shift in resources. But again, you should not interpret this as a light switch move of a whole bunch of networks going away, because that’s not what this is about.”

Smaller networks like MTV Live, NickToons and Centric weren’t mentioned.

“Clearly, Viacom has too many networks. There has to be a rationalization,” analyst Todd Juenger of Sanford C. Bernstein said in a research note Thursday morning. Juenger counts 19 “non-core” networks at Viacom.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“The problem is—these non-core networks contribute a lot of incremental profit. Which makes sense, because even though they only collect nickels-and-dimes of affiliate fees, there is very little content investment, which means very high incremental margins. And they absorb overhead that will exist regardless,” Juenger said.

Using data from SNL Kagan, Juenger said those 19 non-core networks generate about 29% of domestic network revenue and 28% of domestic network earnings—just under $1 billion.

“This is one of many examples of why a Viacom turnaround plan is so difficult. 25 networks cannot survive,” he said. “We don’t believe you can recapture that $1 billion of EBITDA from raising the price on the core 6 networks.”

Viacom CFO Wade Davis noted that as far as distribution revenue goes, Viacom sells its networks as a bundle. By making the flagship networks strong, the bundle is more attractive,” he said.

And at a time when there is consumer demand for skinny bundles, eventually their consumers will be offered bundles that feature entertainment channels but not expensive sports networks. That would be good for Viacom, which loses some leverage with traditional distributors because it doesn’t have sports.

“If you look at the flagship six, the flagship six is essentially the strongest entertainment pack you could get in the market because you have pre-school kids, young adults, you have comedy, you have African Americans and you’re going to have the marquee general entertainment network. And if you look at viewing shares, and the like, that’s a very significant cornerstone,” Bakish said. “And so, I believe ultimately, the market will embrace that.”

Bakish, who is looking to forge a more collaborative relationship with distributors, said the company had already talked to some distributors about rebranding Spike.

“We started conversations with our distributors early this week. In fact I had a conversation with the CEO of one of the largest MVPDs last Friday and I talked about this strategic move,” Bakish said. “It’s important to note that from a contractual standpoint there are no issues with this. It’s a rebrand of Spike. The definition of Spike includes movies and the like. There’s no contractual problems. But we wanted our key clients to hear from us first, and that’s what we did.”

Bakish also said Viacom has had conversation with media buyers and key advertising accounts about its strategic plan. He said the feedback was very positive.

Viacom is also putting together a cross-network ad package for the upfront called Epic. Bakish called it “the most comprehensive cross-portfolio package Viacom has ever offered,” saying it spans nine networks, 20 tentpoles and 60 returning series.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.