Vevo Campaign for Credit Karma Wins Advanced Advertising Innovation Award

Multiplatform ads drove increases product awareness and brand consideration

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

A campaign to promote Credit Karma’s new checking account submitted by Vevo won the inaugural Advanced Advertising Innovation Award for best use of multiple platforms.

The award will be presented Nov. 18 at the Advanced Advertising Summit produced by Broadcasting+Cable parent Future plc. The winners for best use of branded content and best overall campaign will be announced over the next two weeks.

Also Read: Gamut OTT Campaign for Merrell Wins Advanced Advertising Innovation Award

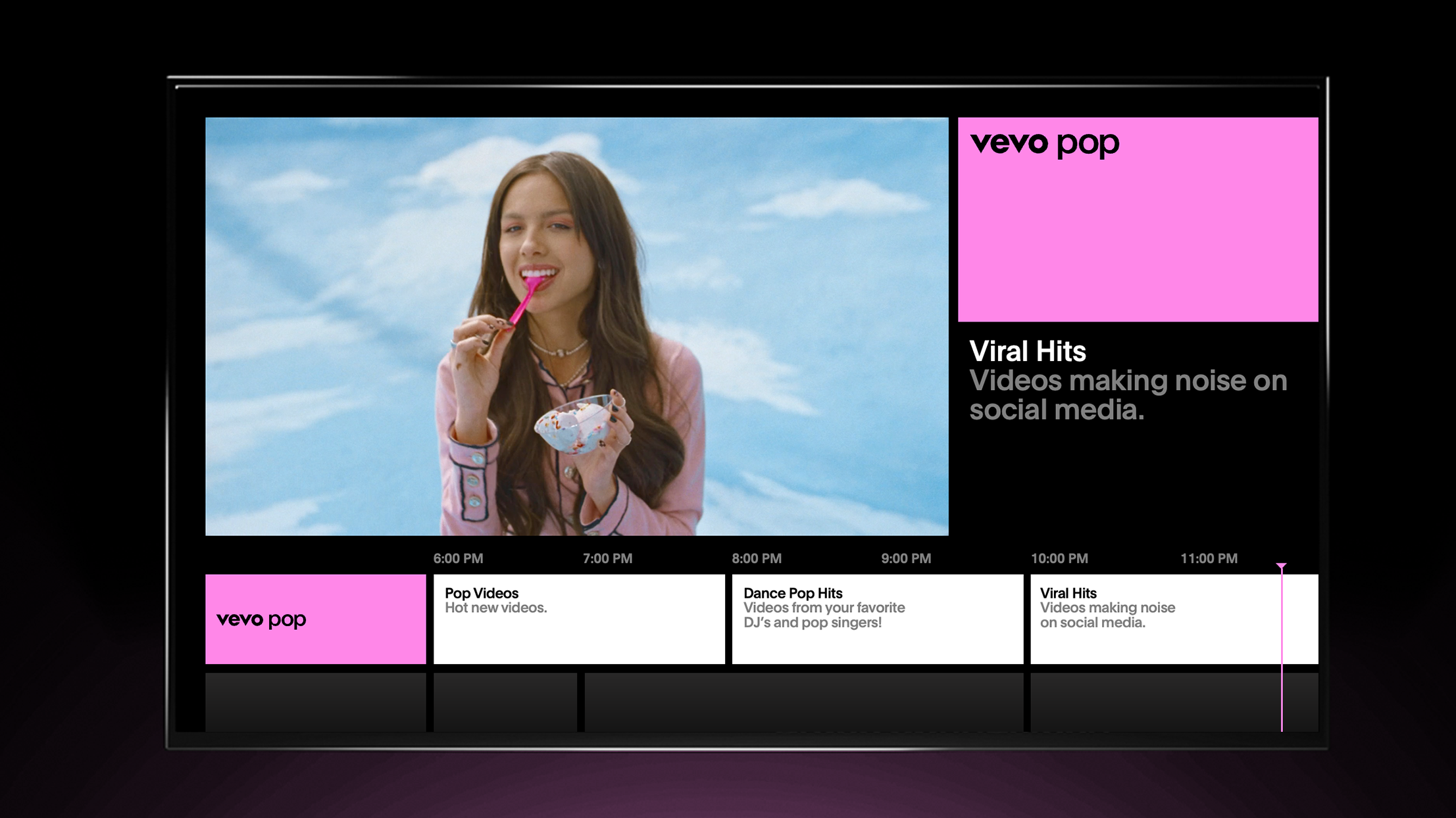

Credit Karma wanted to promote its new checking account product. Brands turn to Vevo, the music video network, to achieve incremental reach on top of its linear TV campaign, while also driving awareness, favorability and purchase intent.

Ads ran on Vevo, which was able to reach younger viewers--including members of GenZ-- and cordcutters via ads running on desktop, mobile and connected TV (both linear and app).

The campaign has been running since mid-June 2021.

For attribution and post campaign analysis, Vevo and Credit Karma worked with iSpot to measure incremental reach on CTV and Disqo to gauge brand lift. Those metrics were important to show that Credit Karma was finding new customers for its checking account product.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

According to iSpot, 36% of Vevo’s connected TV campaign audience was unduplicated with traditional linear TV. That means about 4 million unique viewers who never saw the Credit Karma Money campaign on linear TV were exposed only through Vevo.

That unduplicated audience on Vevo CTV was reached despite Credit Karma spending millions of dollars advertising on premium TV programming including the NBA Finals, Stanley Cup Final and the Tokyo Olympics,.

According to Disqo, the campaign on Vevo lifted brand metrics. Brand consideration was up 11%, product awareness was up 10%, brand favorability was up 9% and ad recall rose 8%.

Looking at current versus prospective customers, brand consideration was lifted 9% and favorability rose 8% more among people who were not current customers of the brands.

Judging by credit score, the campaign drive a 20% increase in brand consideration, 11% in product awareness and 14% in brand favorability for those with a credit score under 580. For those with credit scores between 740 and 799, product awareness was up 18%, brand consideration was up 20%, ad recall rose 16% and brand favorability was up 14%.

The campaign was particularly successful among consumers that consider themselves “very financially unstable,” with a 16% increase in financial product awareness, a 10% gain in brand consideration, 13% in new financial product awareness, 14% in ad recall and 11% brand favorability.

The gains across customer groups is important because Credit Karma products are designed to help with personalized time and tools to help consumers make financial progress.