Top AVOD Platforms Generated $3.5 Billion in Ad Dollars Over 12 Months

Kantar unveils new intelligence offering

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Ad supported streaming has become a big business.

According to a new AVOD ad tracking service launched by Kantar, four of the leading platforms generated $3.5 billion in ad revenue in the 12 months ended in September.

Hulu was the leader with $1 billion, followed by Paramount Plus with $822 million, Peacock with $279 million and Tubi with $250 million.

Kantar plans to expand its coverage of the AVOD market in 2022 to include more than approximately $8 billion in reported AVOD spend from platforms including Pluto TV, HBO Max, Discovery Plus and Prende TV. Pluto TV alone is expected to generate $1 billion in ad revenue in 2021, according to parent company ViacomCBS.

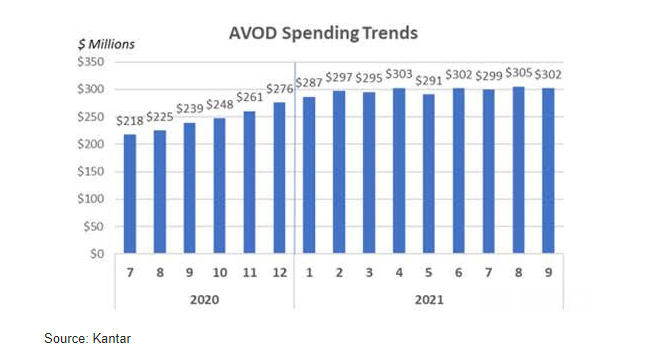

Looking at September 2021, Kantar said the top AVOD platforms garnered $302 million in ad revenue, up 46% from $239 million in September 2020. Ad revenue peaked in August 2021 at $305 million.

“AVOD is one of the fastest growing platforms for ad investment due to its ability to deliver targeted, incremental reach,” said Stephen Davis, global product leader for advertising intelligence at Kantar. “We are bringing this new service to market as it is essential for the industry to have insight into ad spend trends in the category in order to make better, informed decisions for both buying and selling. Kantar is now uniquely positioned to provide insight into how brands are managing video strategies across media from linear TV, online video, YouTube, and now AVOD.”

The top streaming ad category was media and advertising at $573 million over the 12 months. Other big categories including retail, communications, pharmaceuticals and automotive.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Among the top individual advertisers spending on AVOD are Capital One at $74 million, Verizon, at $57 million and Geico at $50 million. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.