Survey: News Consumption Down Since COVID Peak

LoopMe finds consumers spending more

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

News consumption has fallen 11% since its peak when the COVID-19 pandemic was originally declared in March, according to a new study by LoopMe.

LoopMe, an outcomes-based video platform, surveyed 8,000 people in eight countries including the U.S. in May. Its first PurchaseLoop Research Pulse Report was released in March.

The new report found that when it comes to media consumption, 27.1% have increased their gaming, 17% watched more TV shows and 16% viewed more movies.

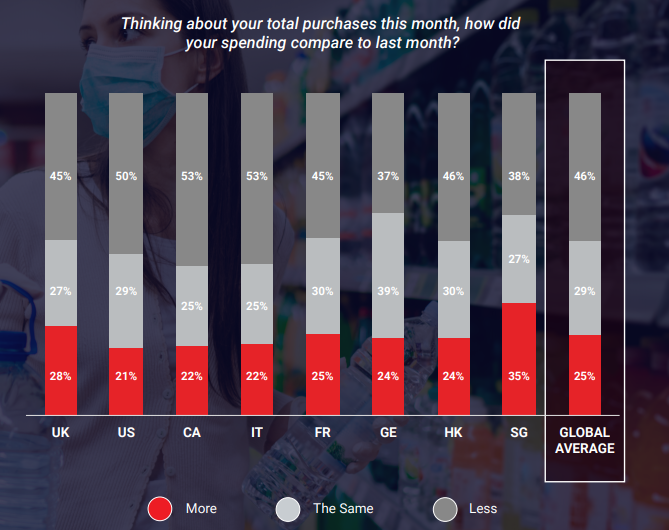

The survey also found that about only 25% of consumers have increased their monthly spending compared to the prior month, compared to 46% who spent less. Since LoopMe''s first survey, consumer spending globally has increased 5.5%.

When asked what they aspire to do most when the Coronavirus crisis ends, 57% said the wanted to socialize with friends and family. About 20% said they won’t change their lifestyle when the pandemic is under control and 11% said they’d most like to dine out.

LoopMe said that since its first survey, it has seen a significant decrease in the number of consumers globally who won’t change their lifestyle when things return to normal.

Since the earlier survey, respondents are 11% more optimistic, but only one in three said they were optimistic.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“With consumer behaviors shifting rapidly and differing per region, it’s imperative for marketers to gain real-time reads on their target audiences when planning and executing marketing campaigns,” said Stephen Upstone, CEO and co-founder of LoopMe. “With audience data of the past becoming irrelevant, now -- more than ever before -- brands are looking to LoopMe to help uncover recent trends in audience behavior to navigate the ‘new normal’ for building trust and authenticity with consumers.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.