‘Subscription-Hopping’ Noted by TiVo During COVID

Netflix is most often added -- and most dropped

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

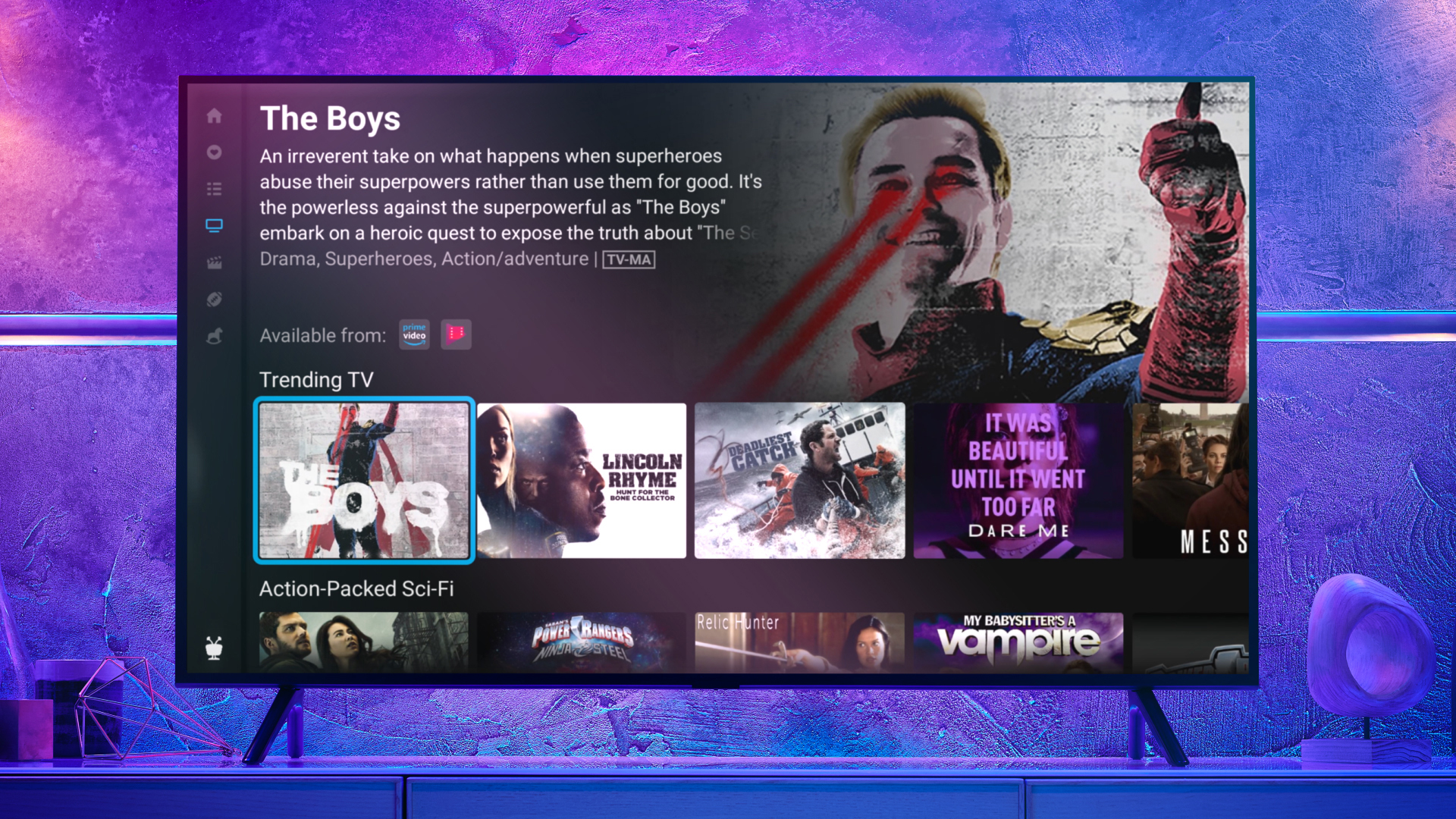

A survey by TiVo found that some viewers were “subscription hopping,” adding and dropping the growing array of video streaming services as those viewers spend more time at home because of COVID-19.

In its fourth-quarter Video Trends Report, TiVo found 25% of those surveyed added at least one new video subscription because of the pandemic. “We’re at home more and have more time to watch,” was the explanation most often given for adding subscriptions.

At the same time 15% of those surveyed said they canceled at least one video subscription due to COVID. Respondents said they dropped services because their income was affected by the virus, they were tightening their belts just in case and “we realized we weren’t watching them enough.”

Netflix was the service most often added. It was also the service most often dropped.

TiVo found that respondents spent an average of $27.72 per month on SVOD subscriptions, with pay-TV subscribers paying $25.62 and broadband only subscribers paying $30.88. TiVo noted that pay-TV costs $111 per month, including internet service.

On average, pay-TV subscribers used 6.9 streaming services, compared to 6.7% for broadband only subscribers.

During the pandemic, local content became more valuable to viewers. In TiVo’s survey, 88% of pay-TV subscribers considered local content important, up from 85% a year ago. Among broadband only subscribers local content was called important by 74%, up from 62%.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Pay-TV remained the main way people watched local content, with 57% using cable or satellite to access newscasts and other community programming. That was followed by 15% who used virtual MVPDs, 14% who used social media and free video apps and 12% who used an antenna.

The TiVo survey was based on 4,526 people ages 18 and older in the U.S. and Canada.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.