Streaming Executives Surveyed Expect Strong Growth in 2021

Applicaster report offers tips for expanding OTT business

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Executives in the booming streaming media business expect strong growth again in 2021 and are looking to make changes to attract additional viewers and make more money, according to a new report from Applicaster.

The report, entitled The State of OTT Revenue 2021, found that 18% of those surveyed expected their streaming app audience to grow by more than 75%, while 19% predicted up to 75% and 27% foresaw a 27% increase.

The report offers tricks for growing in the OTT space. One is to add apps on apps on Samsung and LG. Their sets have 44% penetration of the U.S. market and at this point their app stores are not too clutters.

Building a Roku Channel is also important because of Roku’s share of time-spent viewing.

Execs looking for growth should launch apps based on themed brand extensions and plan to be flexible and willing to make changes soon after an app is launched.

“Media executives understand viewer behavior will continue to evolve, long after apps launch. It’s not enough to keep pace by making changes in their app offerings, they need to continuously adapt their business models as well,” said Devra Prywes, CMO & CPO of Applicaster. “It’s clearly important for these businesses to create a matrix of options and experiment with offering low-priced, or free, options to be accessible to an even greater audience, especially price-conscious ones.”

According to the survey, OTT execs expect their growth would come organically, 33% of respondents said, 28% expected to grow as they added platforms and 23% said that increased marketing would fuel growth.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The survey found that the vast majority of apps include advertising as part of their monetization strategy, with in-house sales teams driving most of the value. Local advertising is outpacing national advertising and product placement and sponsorships are being used widely.

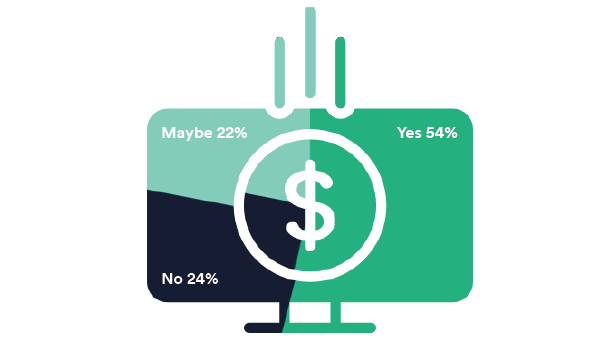

More than half of those surveyed said they were changing their monetization model over the next six month, with another 22 considering a change. Most will add AVOD, which supports offering their service free or at a lower price point.

App stores are viewed positively by OTT executives with 46% saying they plan to manage new subscription for mobile and TV with in-app signups and sharing 30% of revenue with app stores.

“The study clearly shows top media executives are diversifying streaming and revenue models amidst this tsunami of digital content demand,” said Ido Hadari, CEO of Applicaster. “COVID-19 changed how we consume media, and brands are getting increasingly creative in mixing and matching different revenue models to be able to serve the expanding number of cord-cutters, cord-nevers, and cord-shavers.”

The report is based on a 10-question survey answered by 95 professions business streaming video apps, with 52% of them broadcasters, 27% direct-to-consumer video brands and 20% multi-channel aggregators.

“Typical OTT 'streaming wars'’ analysis covers nine famous providers (Netflix, Hulu, Amazon Prime, Disney Plus, Apple TV Plus, Peacock, HBO Max, Paramount Plus, and Discovery Plus)," Applicaster said. “But there are hundreds of additional providers worldwide, including 300 streaming services in the U.S. alone. Applicaster launched The State of OTT Revenue 2021 Study to understand how the majority of streaming brands are planning for growth and monetizing their content.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.