Stations’ Midterm Grades Are Looking Strong

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With the midterm elections just weeks away, the spending for political spots is heating up considerably. In some TV markets, it’s nothing short of a gusher, while others, lacking hot races at the governor, Senate and House levels, are largely left out of the fun. Taken in sum, a pack of pundits says 2014 political spending at the station level looks to finish somewhere between good and very good.

Ed Atorino, managing director at Benchmark Co., says it could be the proverbial perfect storm. “You’ve got a weakened president, a screwed up Congress and issues bouncing around concerning the U.S.’ role in the world,” he says. “That will stimulate spending, and it could be a bonanza.”

A wide range of factors is used to predict how political spending will go, and Scott Roskowski, chief development officer at trade association TVB, spends a good portion of his day studying them. It’s a mix of fund-raising trends, he says, the number of competitive races and where the races are located.

Fall 2014 looks like fewer tight races, compared to previous midterm seasons, Roskowski says, and smaller markets hosting them. But fund-raising, driven by a Republican party fiercely determined to win over the Senate, and a Democratic party equally intent on retaining it, is trending off the charts. With a forecasted $6 billion being raised, half goes to television, and 80%-85% of that to local broadcast. That spells around $2.4 billion, says Roskowski, citing Kantar Media research.

“The GOP wants the Senate, and I think that will continue to influence the big spenders to open their wallets,” he says, “and donate as much as they can to the cause.”

Kantar Media reissued its forecast earlier this year, raising it from $2.4 billion to $2.6 billion, “with a potential high of $2.8 billion.” That’s a healthy climb from the $2.1 billion stations saw in the 2010 midterms— and within striking distance of the $2.9 billion spent on TV in the 2012 elections.

PAC Attack

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The super PACs, which have been the story around election season ever since the landmark Supreme Court ruling on Citizens United, again are the major wild card this time around. The PACs coughed up around $200 million in 2010 and $500 million in 2012; Roskowski anticipates the 2014 figure to fall somewhere in the middle.

“They are active,” says Paul Karpowicz, president of Meredith Local Media. “It depends on the market, but if you see a highly competitive senate race, you see PAC money.”

PAC activity is making up for the lack of blockbuster spending from boldface name candidates, such as Meg Whitman and Linda McMahon in 2010, and a generally lukewarm issues mix. While some markets are getting significant issues money, such as spending tied to medical marijuana legalization in Florida, the major ballot initiatives around same-sex marriage, health care and other hot topics in recent elections are not as robust this time around.

Karpowicz describes the political spend picture as a “mixed bag,” depending on the state. A recent Bloomberg article named Iowa, Alaska and North Carolina as particularly hot; Dale Woods, president and general manager of WHO Des Moines, says political spending started in July.

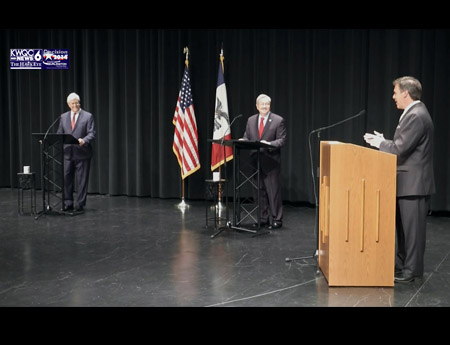

Roskowski adds Michigan, Arkansas, Colorado and Kentucky, among others, to the hot list. With a gubernatorial race in Illinois and scorching senate contest in Iowa, KWQC, the news powerhouse in Davenport (Iowa)-Rock Island-Moline (Ill.)—is perfectly situated. Ken Freedman, KWQC VP/general manager, calls it a “very active” political season, with an “enormous amount” of money coming from the PACs, including Concerned Veterans For America and Freedom Partners.

“We’ll go back to normal business in [a few] weeks,” Freedman says. “But while we’re in this window, it’s an alternative universe.”

It’s not the case everywhere. While Florida has long been a key swing state for the presidential election, a hot governor’s race has not quite spelled commensurate spending for all the news stations—yet. “We expected the races to start earlier,” says Caroline Taplett, president and general manager of WPBF West Palm Beach. “Now they’re heating up, but they’re running out of runway—there’s not enough time left to hit the forecasts.”

Spreading the News

Stations have been adding newscasts to cover the news, and offer inventory for ad buyers. WPEC in West Palm Beach debuted a 3 p.m. news in August. Several Scripps stations, including WEWS Cleveland, added the 4 p.m. newsy program The Now in August. WHO launched a 4 p.m. in September.

KWQC, for its part, expanded its noon program to an hour in August and added weekend morning news in September.

While other political ad strategies, including online and big data, get the buzz, traditional TV continues to be where the political strategists want their messages. Freedman describes spending in the Quad Cities as “2012-esque.” “It’s an amazing testimony to the power of our industry,” he notes. “These campaigns and the PACs that support them have seemingly endless resources, and decide to use the vast majority of the money on free over-the-air TV.”

FOX-COX: NEW OWNERS, GMS IN BOSTON, BAY AREA, MEMPHIS

Fox Television Stations and Cox Media Group (CMG) have closed on their station swap, which puts KTVU and KICU San Francisco-Oakland-San Jose on the Fox side, and WFXT Boston and WHBQ Memphis with Cox. Tom Raponi, VP and general manager at KTVU-KICU, will be general manager at WFXT. Gregg Kelley, VP/general manager of WFXT, moves to the GM job at KTVU-KICU, with Dana Hahn the VP and news director of the Fox-independent pair.

John Koski retains the GM job at WHBQ.

“We look forward to supporting these new stations as they continue playing key roles in their communities,” said Jane Williams, CMG executive VP of television, “providing vital news, information and entertainment to their audiences, and offering targeted sales solutions to their clients.”

Fox, which did not comment beyond the terms of the deal, is intent on owning stations in markets where NFC football teams reside.

Bill Hoffman, CMG president, told B&C when the deal was announced that it spelled good opportunity for both sides. “We ended up landing in a very fair spot,” he said.

Michael Malone is content director at B+C and Multichannel News. He joined B+C in 2005 and has covered network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television, including writing the "Local News Close-Up" market profiles. He also hosted the podcasts "Busted Pilot" and "Series Business." His journalism has also appeared in The New York Times, The L.A. Times, The Boston Globe and New York magazine.