SportsGrid Builds FAST Channel With Amazon Freevee Agreement

After bolstering distribution bankroll, network will bet on polishing its programming

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

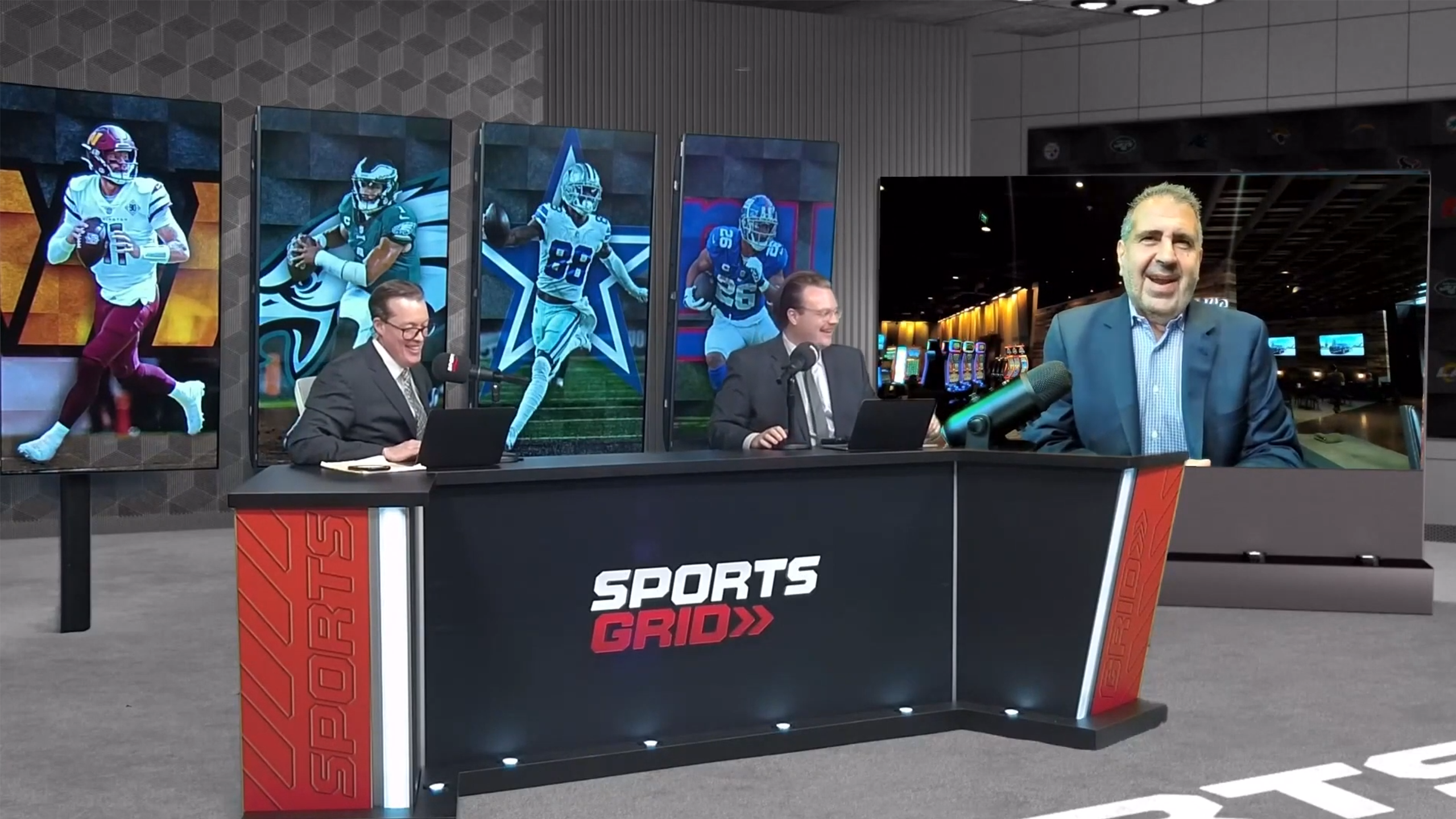

SportsGrid said it reached a distribution deal with Amazon to launch its 24-hour fast channel dedicated to sports betting odds and information on Freevee.

“It’s a very big deal,” Louis Maione, SportsGrid founder and president, told Broadcasting+Cable. “We think it’s a beautiful partnership. I think it’s complementary on all levels.”

Maione said SportsGrid could also get carriage on Amazon Prime Video and other Amazon platforms in the U.S. and internationally.

As part of the agreement, SportsGrid will also help develop content for Amazon. “We look forward to the Amazon partnership to innovate and develop new tools to engage and redefine the sports viewers betting experience,“ Maione said.

SportsGrid has been built by focusing first on distribution, Maione said. Available on Vidaa, Samsung TV Plus, Roku, LG, Vizio WatchFree Plus, TCL, Stirr, FuboTV, Xumo, YouTube and Plex platforms, SportsGrid claims 60 million unique viewers. With Amazon, it should shoot up to 110 million, Maione said. “This FAST phenomenon is not going to end,” he said.

(SportsGrid launched digital broadcast channels in several markets with Nexstar in 2021, but it didn’t work out.)

That has the business running at a profit and could generate EBITDA (earnings before interest, taxes depreciation and amortization) of $15 million to $20 million this year, Maione said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Following the Amazon deal, Maione said, SportsGrid plans to hire senior programming, ad-sales and marketing executives and “add sparkle” to its on-air content.

It will be raising its profile with a marketing campaign using the slogan, “Be Smarter on SportsGrid.” If the campaign clicks, it could go all the way to the Super Bowl. “If opportunity knocks and we get our EBITDA up to $15 to 20 million, next year we’ll spend $5 to $7 million on a commercial,” Maione said.

Maione, who started his career on Wall Street, where he discovered the value of information that could help colleagues win their high-stakes fantasy leagues, says he’s turned down offers to buy SportsGrid. “We’re not for sale, but eventually someone will buy it,” he said.

With its distribution, SportsGrid operates with a “media as a service model.” That means SportsGrid reaches out to FanDuel, DraftKings, BetMGM and other sports books and endemics and offers to work with them to produce shows. Those companies pay to have those shows as part of SportsGrid’s schedule and reach its audience.

SportsGrid uses its customers' logos, talent and licenses to make the programming attractive. If a company has a deal with the NFL, for example, its show on SportsGrid could include game highlights.

“Why is that good for the platforms and the distributors?“ Maione asked. “Because the content gets better and better every year and you get better and better-shared talent.”

On top of that, SportsGrid and its distribution partners can sell commercials under either inventory-share deals, where SportsGrid sells some of the inventory, or revenue shares, in which the platform sells the ads and splits the revenue with SportsGrid.

Maione said SportsGrid will be hiring an industry veteran he declined to identify as global head of programming, talent and creative in March to polish the network’s programming, including launching an anchor show that will feature a combination of talent and information.

The new programming head will help get SportsGrid the right talent, put them in the right position and have them appear at the right time of day, Maione said, giving the brand a higher profile.

“Think of us as a CNBC for sports betting and sports knowledge,” Maione said. “We like to say we up your game, we up your IQ, we up your edge, we up your odds. It’s smarter to be on SportsGrid.”

SportsGrid also has a new website and app in the works.

Maione says SportsGrid is not a tout service, pushing its picks. Nor does it profit by referring viewers to betting operators through affiliate deals.

“We help them be smarter at the water cooler,” he said. “And if they choose to bet, go right ahead. We don't tell people to bet and pay for our picks. We're not a tout. We just give good insights and opinion.”

That approach could make the company attractive to media companies, betting operators, affiliate operators, data companies or tech companies.

“In every category, we’ve had somebody interested. Currently, we have four out of five,” he said. “So yes, there’s always M&A activity, but we’re not for sale.”

At least not yet. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.