Sports Executive of the Year: Skipper Keeps ESPN Ship Steady As She Grows

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

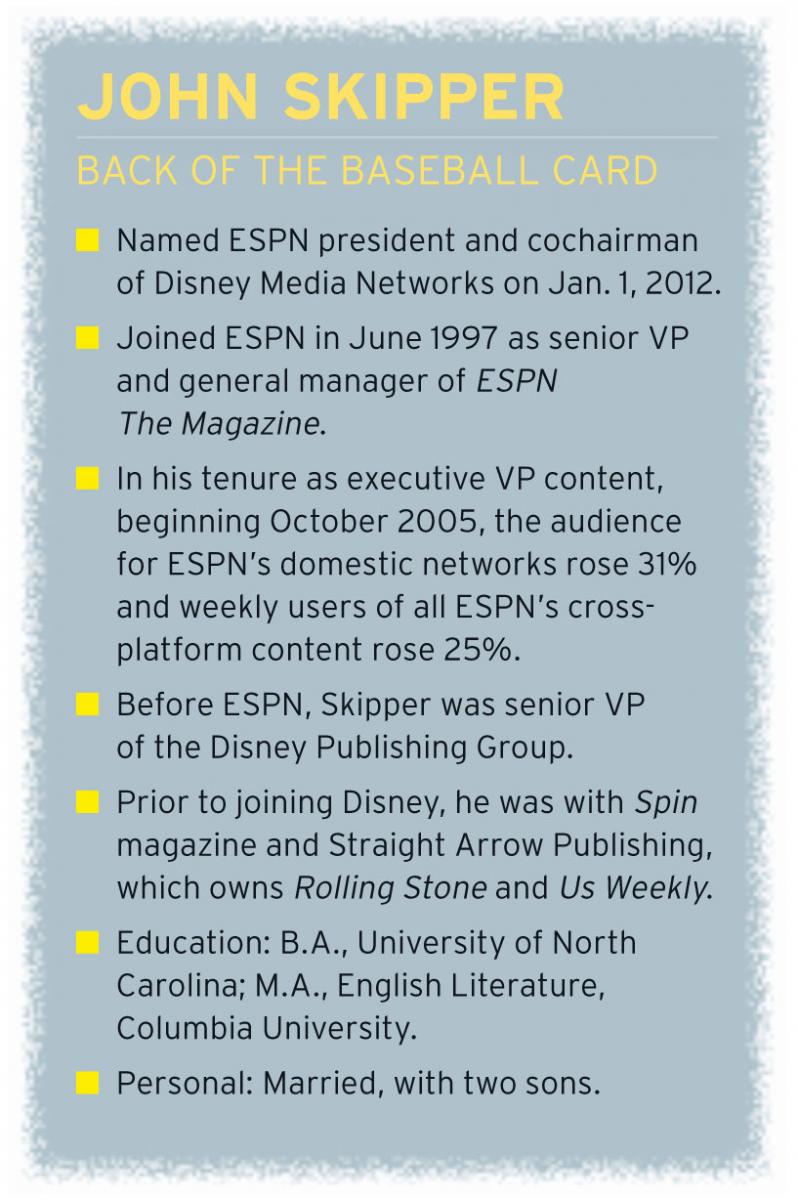

The sports business has never been a more prominent part of the TV playbook. Despite new pressure from political and business critics complaining of skyrocketing rights fees, media companies are putting bigger bets on sports and looking to take on ESPN, which bills itself, without exaggeration, as the worldwide leader. Since being named president of ESPN and chairman of Disney Media Networks in January 2012, John Skipper has maintained that leadership. ESPN’s ratings more than double all other sports networks, driving affiliate and ad revenues at record levels, and the gentleman for North Carolina has pushed the company to innovate and exploit new technologies. That’s why Broadcasting & Cable has named Skipper Sports Executive of the Year. In an interview with B&C business editor Jon Lafayette, Skipper tells how ESPN has reacted to changes in the business.

ESPN was doing pretty well when you were put in charge. What would you say you’ve brought to the party and done a bit differently?

I’ve always maintained, and never had it disputed, that I was lucky enough to step into a job where the company involved, ESPN, was in very good shape thanks to George [Bodenheimer, Skipper’s predecessor]. He had this fabulous run and I’ve always felt it was my job to try to build upon that and maintain that.

Obviously there’s some personal differences of style between George and myself, but as you know, George has remained executive chairman and he urges me not to try to be him. I’ve got to be myself, but continue keeping those principles that created success at ESPN at the forefront.

We have to take those principles and react to different circumstances. The circumstances have changed a little bit in the last couple of years. I took over on Jan. 1, the same day NBC Sports launched their new network, and Fox, 18 months into my tenure, launched their new network, so we do have more competition to deal with. We have what everybody would acknowledge seems to be an ever accelerating change in technology and the adoption of digital technology—we have that to deal with. We have challenges in the advertising market, in the economy, the pay-television environment.

The short answer is I haven’t tried to make a shift in values or priorities. I’ve tried to be myself. We try to apply those things that have long contributed to ESPN’s success to what are ever-changing circumstances.

In the last year, ESPN has made big deals with sports rights holders and distributors. Which were most important in terms of dealing with changing circumstances?

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The U.S. Open Tennis deal pushes us even further in the direction of making sure that we have championship content on ESPN. It moves like we did with the British Open towards starting and finishing events. I think the distinction between broadcast and cable has never been less significant and I think that’s going to be true when the semifinals of the men’s basketball tournament go to Turner this year, and we’re going to have the new championship of college football. We have the current one. So that deal in terms of the profundity of what it signifies was I think fairly important. I think the WNBA deal—I think women’s sports continue to grow and become more important. The deal with the WNBA solidifies that. In some ways in terms of solidifying our position in an important sport, our new 20-year agreement with the SEC is pretty profound. I love it because we hold rights to that conference till 2034.

We see a lot of discussion about the competition with ESPN. And you can see we take a long view. Our intention is to remain the leader in this space for a long time.

There are some deals you have to walk away from. How do you make the decision not to do a deal?

Two things: One thing is we always prioritize, and second, we have financial goals and targets and we have a pretty good understanding of what our revenues are going to be. We have operating income and margin targets. We spend within the parameters that those provide us.

With new developments, people tend to view all events through a prism of, oh, now you have competition, but it doesn’t really create a fundamental shift. It’s just another variable. We had the BCS at one point, we then did not have it, and we have it back now. We had NASCAR at one point, then we didn’t have it, then we got it back. It hasn’t changed that much. We’ve always had competition. It’s always shifting, whether it’s Yahoo sports or the new Fox Sports 1 or the league networks themselves or the competition for eyeballs with social media sites, that’s part of adopting to new competition at all times. But it goes back to a simple question. When we don’t do deals it’s a question of prioritization and finances.

What’s going to happen with the NBA, speaking of deals?

I’m not a clairvoyant but we prioritize that very highly and we value our relationship there and we think we’ve been an outstanding partner.

Let’s say Disney CEO Bob Iger woke up one morning and decided to trade you to one of the networks you’re competing with. What’s the first thing you would put in place?

I don’t know if I want to answer that. The competition is fierce enough. I have no intention of providing any advice. If I had to answer, I don’t think I’d answer honestly.

Knowing that the competition was coming, were there any steps you took this year that you might not have otherwise to defend your position?

I contend and I believe genuinely that competition is good for us. We like competing and I think that’s a fundamental characteristic of sports, right? I’m not sure we’d know how good Alabama is [until] they played somebody. It’s hard to answer in isolation, but I mean it sincerely, we looked at a number of things we did and they were good for us relative to competition. I think launching Keith Olbermann’s show at 11 o’clock was good for us relative to the competition. I think it’s highly possible we would have done it anyway. We’ve been paying attention to SportsCenter and trying to make sure that it can be as sharp as it is. We’re moving to bigger studios next year. I think that is going to be very profound relative to our competition. But it’s hard to suggest we wouldn’t have done it. We have a long track record of innovating and launching new things and continue to adopt new technologies. And I continue to believe that we are doing what we have been doing, but doing it very aggressively. We hiked our level of aggression a little bit. So maybe we’ve done 10 things and we would have done seven if we hadn’t had the competition.

Did your competitors make any moves that surprised you?

We were surprised by the aggression of Fox on the U.S. Open Golf. I would say that was a surprise. I would suggest I was a little surprised—and I’m going to be gracious here and only tell you the surprises that were positive—by the NBC Sport Premiere League on Saturday morning. It’s not that I didn’t expect them to do well but I’ve been surprised at the quality overall of the execution. But we do not believe that any profound shift in the landscape has occurred.

In the second quarter, ESPN had a 30% decline in ratings. Did you learn anything from that dip in the road?

There’s nothing more mysterious than why ratings go up and down. We can account for some of it, right? We had some different comparables in the period. But yeah, it made us pay attention more. I don’t know how to define exactly what we did or what it does but we did move some programs around relative to time slots and tried to sharpen up our shows and make sure we’re doing a little bit more storytelling. We’ve been a little bit more aggressive at cross-promotion across our networks. And ratings have gone back up. We had a very good July-August-September quarter. We are in the midst of a very good quarter.

Has Mr. Olbermann given you any gray hairs yet?

I think it would be impossible to tell since the only ones I have are gray. No, he’s been a pleasure to work with so far. He brings something unique. That opening monologue has a breadth of intellect and wit and historical reference that you just don’t get many places. The show has performed well. I will point out that it is the second highest-rated sports show in the 11 p.m. time slot and we’d always rather compete with ourselves.

I think over time we’ll think of other ways to use Keith. He’s a very bright guy, he’s very good at television and so far we’ve had a fun time. Some people have already lost their over and under [bet on whether he’d still be with the network]. I hope to deliver for everybody who took the over.

You’ve done better than most in terms of technology and apps. What’s the next technology that’s going to affect your business?

I think mobile. In September we had the first occurrence where we had more mobile digital users than desktop users. We had 73 million users, overall 47 million used mobile and 36% of those were only on mobile. So we’re doing good business with advertising on mobile but it’s still developmental so we have to work with that and figure out how to do it and see how it works for them.

And we have to be cognizant of other new things, these other robust platforms are important to us. We’ve recently announced a deal where we’re going to have our content on Roku. Look at Apple TV; it may be the best kind of presentation of ESPN content anywhere. The presentation on XBox matters to us. I hasten to add—and I’ll probably just beat you asking the questions of course—that all of those are provided on an authenticated basis. We regard them as complementary and incremental to the delivery of our content through traditional distributors.

You said you support the current model, but have you ever sat back and said, if people could just buy ESPN, this is how much they’d be willing to pay for it if they were big sports fans?

It’s not our intention to move in that direction. We would be remiss subject to our executive fiduciary responsibility not to spend some time looking at those things and developing models, but at this point I’m not prepared to reveal any data. I will tell you what we believe is that live sports rights provide the greatest ability to adapt to changing environments if necessary but we don’t yet see us anywhere near that place right now.

ESPN has a lot of influence over the sports it covers. Is there any interest in ESPN owning a league or controlling events it televises?

The answer to that right now is no. Right now we don’t see a real opportunity. We have really thrived by sticking to what we do well. We serve sports fans. We want people to believe that ESPN is their home for live events, news information, analysis, commentary, scores, fantasy games, and now I don’t particularly long to change the business model and own the leagues. The leagues are probably better doing what they do.

You mentioned fantasy sports. Do you play fantasy sports?

I have several fantasy sports teams, all of which are performing poorly. In most cases, I have partners who try to help me because I just don’t have the time. I have won leagues in the past, and I was particularly good at basketball. But my performance is miserable now and I don’t spend as much time doing it as I did.

Bottom line: Is sports still a good business?

I believe sports is central to our culture right now, partly because I think it provides some social and cultural commonality. I don’t mean that to sound too highfalutin, but I just think having something in common to talk about, with all the polarization in politics and with the splitting of interest in things like movies and music, well it’s just not the same kind of mass culture that it once was and everybody’s not watching the same three television networks. I think sports provides that, which makes it central, and the fact that it’s live makes it uniquely valuable.

I think the sports business is the most predictable growth business in entertainment. And I think that’s why you see so many new entrants and so much interest in it.

So again, I could have given you a short answer, which is just yes. We strongly believe sports is a growth business and that’s why it’s a bit of a canard that new entrants may necessarily affect ESPN’s performance. ESPN has every opportunity to continue to grow based on the growth of the industry and these new entrants may actually stimulate more growth, and we may actually turn out to be the greatest beneficiary of that growth. And again, our intention would be to provide the best content for fans, and adopt technology and be innovative because we do believe that growth will be there if we do those things.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.