News

Latest News

E.W. Scripps Folding Scripps News, Eliminating 200 Jobs; Stock Jumps 15%

By Jon Lafayette published

Scripps News president Kate O’Brian leaving company

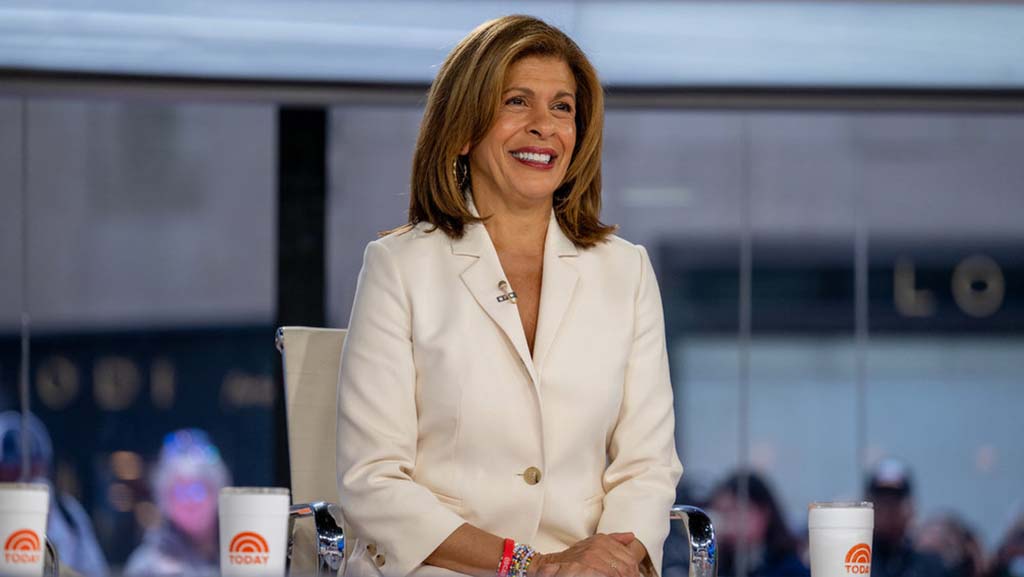

Hoda Kotb To Step Down From ‘Today’ Co-Anchor Post

By Michael Malone published

She joined the NBC morning show in 2007, and will stay on into early 2025

Horizon Sports & Experiences Signs Shark Beauty as Title Sponsor of College Basketball Women’s Champions Classic

By Jon Lafayette published

Caitlin Clark’s alma mater among top teams to compete in games to be broadcast by Fox in primetime

Inscape Working With Locality to Provide Viewing Data Across National and Local Linear TV and Streaming

By Jon Lafayette published

Brands will be able to determine incremental reach of campaigns

IAS Expands Media Quality Product to Identify Misinformation on YouTube

By Jon Lafayette published

Global advertisers can determine brand safety and suitability

Singing Janitor Wins ‘AGT’ Season 19

By Michael Malone published

Richard Goodall rode Golden Buzzer and some Journey classics to a million bucks

‘Agatha All Along’ Levitates to Top of TVision Power Score Rankings

By Jon Lafayette published

Emmys boost 'Shogun,' 'Hacks'

Anthem Sports & Entertainment To Buy Hollywood Suite, Canadian Channel Operator

By Jon Lafayette published

Acquisition would double Anthem's networks in Canada

The smarter way to stay on top of broadcasting and cable industry. Sign up below