Some Brands Boosted Ads After Pandemic Began

Nielsen sees growth in COVID-themed commercials

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

In the weeks following COVID-19 being declared a pandemic, the beer and wine category as well as pharmaceutical businesses increased the amount of TV commercials they ran, according to a new report from Nielsen.

The total number of advertising units dropped to 13.3 million from March 9 to April 19 from 15.3 million running from Jan. 27 through March 8, Nielsen said.

The travel category was down 60%, retail dropped 21% and telecommunications fell 17%.

The reduction in ads by businesses in those categories gave companies in some other categories, including automotive and financial services, a larger share of the messages TV viewers were seeing.

At the same time, viewing was way up as consumers worked from home.

In a blog post Nielsen warned that stopping advertising is can be risky,

“Advertising cuts could mean an extended recovery period for the media market. Brands that go totally dark for the rest of 2020 could be facing revenue declines of up to 11% in 2021,” Nielsen said. “When you take into account that it takes up to three to five years of solid and consistent brand building effort to recover from extended “dark periods” of media, marketers who maintain brand equity by adjusting their creatives—even if that means simply adding COVID-related brand awareness messages to existing campaigns—are poised to be better positioned following any recovery, immediate or prolonged.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Many of the marketers that continued their advertising created COVID-themed ads. These ads were designed to show support for their communities and to offer goods and services that better served consumers, such as curbside pickup and contact-free home delivery. Other ads featured charitable efforts.

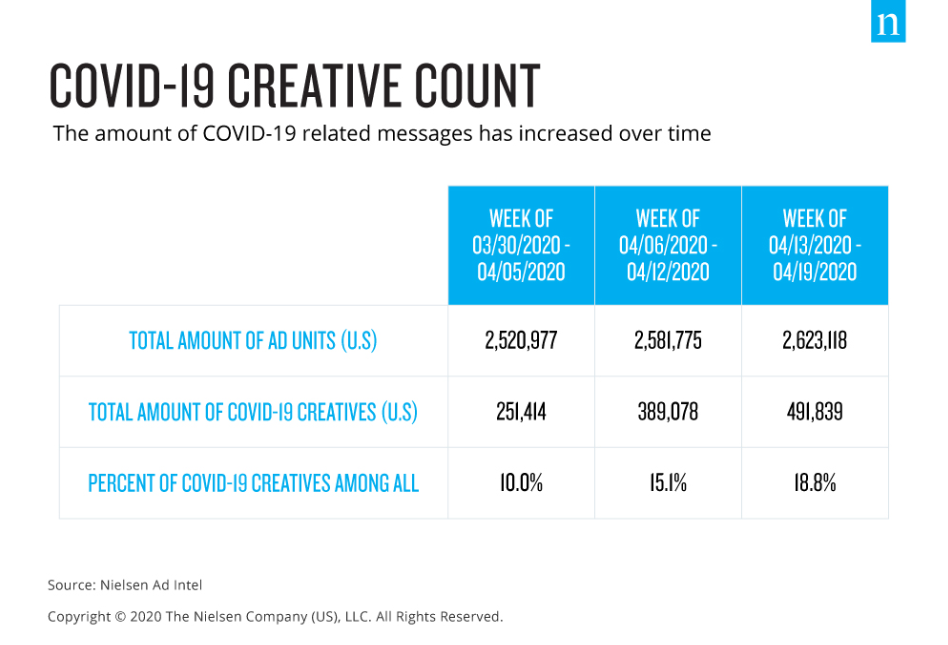

Nielsen found that the number of COVID-themed ads doubled in just a few weeks, rising from 251,000 units during the week of March 30 to 492,000 units during the week of April 13.

“For many brands, doing so was a way to maintain brand awareness, keep continuity with consumers but not be seen as capitalizing on the crisis itself,” the blog post said.

“But with a potential for a second wave of crisis in the fall or winter later this year in the U.S., dependent on states reopening and different emerging scenarios, these COVID-related messages are not simply ways to connect with consumers, but also a core indicator on not just the health of the media market, but also an aggregated look at how that market, and specifically marketers, think of the health of the actual consumers themselves,” Nielsen said. “Declines in COVID-19 themes could act as a barometer for how ready brands think the market is for getting back to focusing on ROI and their traditional core messages. And getting back to business would be that crucial elixir that can help marketers as well as media owners revive any media stagnation.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.