Report: Viacom Board to Meet on Settlement

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

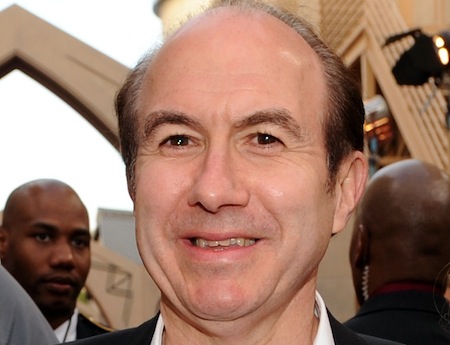

Viacom’s board could meet as early as Thursday night to discuss a settlement that could end the lawsuits between the media company and controlling shareholder Sumner Redstone and result in CEO Philippe Dauman leaving Viacom, according to reports.

Reuters says the board was expected to meet Thursday night, but that the timing could change.

There have been other media reports that the on-again off-again talks between Redstone’s representatives and the Viacom board had come closer to an agreement.

Related: Redstone’s Company Blasts Viacom Results

A Viacom spokesman had no comment.

Former Viacom chairman Redstone’s family holding company National Amusements owns 80% of the voting stock in Viacom and CBS. Over the past few months, Redstone has attempted to remove and replace Dauman and other Viacom directors from the board of National Amusements, the board of Viacom and as trustees of the trust that will control the assets when the 93-year-old Redstone dies or is incompetent to make business decisions.

Related: Redstone Granddaughter Blasts Real Estate Sale

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Dauman and some of the other Viacom directors have contested the ejections in courts in Massachusetts and Delaware claiming that Redstone is incompetent and under the undue influence of his daughter Shari Redstone. Shari Redstone is a director of Viacom, CBS and National Amusements.

For the past year, Viacom has been one of the poorest performing media companies. Ratings fell at many of its cable networks, which include MTV, Comedy Central and Nickelodeon, and ad revenue has fallen, putting pressure on earnings and sending Viacom stock to new lows.

Related: Viacom CEO Says Trials Will Lead to Resolution

Since the battle for control started, the prospect of new management at Viacom has made the company’s stock perk up.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.