Power Couples, Power Struggles

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Burns and Allen. Lucy and Ricky. Felix and Oscar. Networks and affi liates have been among the most successful, and enduring, partnerships in television history. They’ve had their share of Odd Couple–esque spats, all ultimately tempered by mutual respect and the realization that they are way better off together than apart.

Yet in this scorching summer of broadcast discontent, with multiple stations cut loose from their affiliated networks, the dynamics of the cooperative are clearly shifting. While no one denies that it remains a partnership, the more pressing debate heading into TV’s fall season is whether the networks and their affiliated stations are a 50-50 partnership—and if not, who has the upper hand.

With the networks—and brazen Fox, in particular— calling most of the shots when it comes to splitting up retransmission cash and deciding when an affiliate relationship has run its course, the scales appear to be tipping slightly in favor of the nets, say several industry watchers.

“Affiliates would be satisfied with a 50-50 split right now, saying their news and syndication and emergency response drives local viewership. But I don’t believe the networks agree with that, with primetime and sports providing more value than the other way around,” said Larry Patrick, managing partner at brokerage firm Patrick Communications. “Ideally, the pendulum would be in the middle. It’s my belief that it’s swung heavily in the networks’ favor.”

With station groups pushing hard on the cable, satellite and telco services that carry their signals for retrans revenue, and networks demanding a big chunk of those earnings, the debate over which side brings the most value to viewers—and to the subscription-TV services—is particularly timely. Such a debate, to be sure, is subjective, and fraught with variables—for instance, which network is being discussed, how strong a station’s parent company is, the size of the market and the station’s place in the local pecking order.

B&C polled equal parts network brass, station executives and industry figures who might be considered neutral, asking them whether the Big Four networks, or their partner stations, bring more value to viewers right now; anonymity was proffered in an effort to generate more candid discussions. As one would guess, the network people argued vociferously for their programming, while the local TV people made a noisy case for local news, syndication and their community outreach efforts.

It was the less partisan parties—investment bankers, ad reps, analysts, broadcast watchdogs—who, on balance, suggested the networks have the upper hand. While local news, with the exception of the true station powerhouses, is often seen as a commodity by viewers in a given market, marquee programming such as American Idol, Dancing With the Stars and NFL football have an undeniable air of exclusivity about them that many feel tips the scales in favor of the networks. That Fox has readily found new affiliate partners in several markets this summer indicates, to some, that the networks are playing offense and forcing the stations to play defense.

“Theoretically, it should be a 50-50 negotiation,” said Marci Ryvicker, managing director of equity research, media and cable, at Wells Fargo Securities. “But networks, with their programming and sports rights, have a little more leverage.”

Local Is Focal

Stations derive 46.8% of their revenue from local news, according to a study from RTDNA-Hofstra University, which also revealed that affiliates air an average of 5 hours and 36 minutes of their own news a day. With their rapidly increasing output—and often a half-century of community goodwill in the bank—stations believe they offer the bulk of value to viewers. Wall-to-wall coverage during the recent East Coast earthquake and hurricane served as a reminder of the role leading stations play in their communities.

“The commitment we have to local news continues to be what drives the brand of a television station,” Brian Lawlor, senior VP of Scripps, told B&C. “A news leader isn’t necessarily associated with the top primetime and top network news in a market. There are decades of brand and community commitments that make a station one of the best, if not the best, in a market. Just because you’re af! liated with a certain network doesn’t mean they should be enjoying 50% or 70% of the value that you created over decades, with or without them.”

Indeed, in those markets where a station’s local news outperforms even the primetime hits indicates how powerful the bond between viewers and the local brand can be. KETV Omaha’s late news beat all prime shows except Dancing With the Stars in adults 25-54 in the May sweeps. WCSH Portland’s 6 p.m. news notched a 16 household rating/35 share in May—better than all primetime series. (American Idol’s Wednesday average was 15.6/26 in Portland, a little higher than its Thursday ratings.)

At those stations, it’s the local brand, not the network’s, that stokes tune-in. “The stand-alone strength of a station tends to drive the balance of value in the partnership,” Steve Ridge, president of the media strategy group at Frank N. Magid Associates, said via email. “The connection with the community is an underlying foundation that clearly differentiates what a local station brings to the table.”

Networks Hold the ‘Idol’

But middling stations that are heavily reliant on their partner networks seem to be more the norm than the outliers. No one from the Big Four networks would comment on the record, indicating what a sensitive issue the changing network-affiliate dynamic represents nowadays. The network execs, emboldened by collecting substantial affiliate fees when they used to pay out reverse compensation, have been more candid about the topic while addressing investors.

“If a station is looking at what’s really bringing in the money, it’s the NFL, it’s American Idol, it’s CSI, it’s the primetime strength,” Leslie Moonves, CBS president and CEO, told the Nomura Securities conference in June. “It’s not the local news or, you know, Regis and Kelly at 9 a.m., that’s bringing in the big bucks.”

Disney chief Robert Iger was more politic in discussing earnings last month. “While [affiliates] all are encouraged by the retransmission fees coming and becoming more and more real,” Iger said, “they also realize that a lot of the value created comes from the programming that the network provides them.”

Some are starting to wonder if the network-affiliate model still delivers on one of its initial purposes. “Networks used affiliates to sell ads nationally. Now they do that with cable,” said Kip Cassino, executive VP at ad research firm Borrell Associates. “If the big reason [to partner] stops being big, the relationship between the network and the station is going to change.”

Several sources brought up the case of KRON San Francisco—and its value as an NBC station until it lost the affiliation in 2002—as an example of how important a Big Four affiliation is. (Young Broadcasting bought KRON for a record $820 million in 2000, but could not sell the station at a bargain-basement price after it lost its affiliation.) “Station groups need to affiliate with a network,” said Ryvicker. “You see a company like Young go bankrupt when they lose their affiliation.”

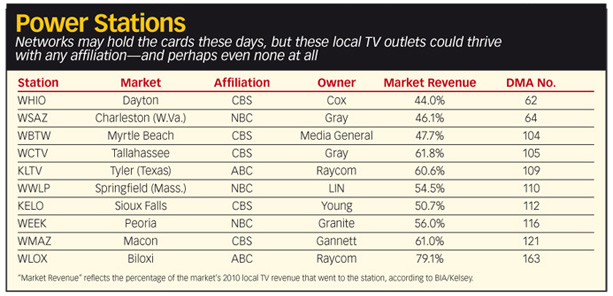

A more recent example of what happens when a station loses an affiliation is Nexstar’s WTVW Evansville (Ind.), which asserted its independence on July 1 after a split with Fox. Five weeks later, Nexstar divested WTVW for $6.7 million, while acquiring the market’s ABC affiliate, WEHT, for $18.5 million. WVTW and WEHT were virtually tied in 2010 revenue, according to BIA/Kelsey.

Management at WTVW, WFFT Fort Wayne, KTRV Boise and the former KSFX Spring! eld (Mo.) are learning about the challenges of making a go of it without those network studs in prime. (Nexstar’s WFXW Terre Haute also lost its Fox affiliation, but aligned with ABC as of Sept. 1. Nexstar did not return numerous calls for comment.) KSFX, relaunched as KOZL “Ozarks Local,” debuted My Name Is Earl and Everybody Loves Raymond in its 8-9 p.m. slot Sept. 1, offering little hope of matching the ratings, and promotional might, that Glee and American Idol had produced. KTRV, for its part, is shooting for 70-75% of the ad rates it used to get in primetime, on the backs of 30 Rock and Law & Order reruns.

“If you no longer have American Idol and football,” said Larry Patrick, “almost nothing you put on will deliver those numbers for you.”

A handful of independents, such as Post-Newsweek’s WJXT Jacksonville, are successful. But network programming vet Garth Ancier is fairly perplexed when he hears talk of stations going at it without a network in their corner. “It’s very clear the value of a station, particularly now, really is based on its network affiliation to a great degree,” Ancier said.”What do you offer that’s unique to cable operators, or viewers? There’s no question a strong newscast is an asset and a differentiating factor in the market. But network programming, and sports, is where the real value lies.”

Of course, a network with no local broadcast partners isn’t much of a proposition either. “A network without strong affiliates is, in my view, dead on arrival,” said Bill Fine, president and general manager of WCVB Boston, an ABC affiliate. “They can go with a different platform, as some have threatened but have never done, as everyone knows they’ll lose a substantial amount of audience.”

Figuring Out Fox

A station’s leverage is directly correlated to its position in the market; several sources made the point that the top two stations in a DMA hold the balance of power with their network, the rest relegated to a more subservient position. “A weaker local news station tends to be at the mercy of the ebb and " ow of network performance,” said Magid’s Ridge. “Stronger af! liates are in a position to control their own destiny.”

Then there’s the complicated case of Fox, which provides its af! liates with far less programming than ABC, CBS and NBC, yet is, by nearly all accounts, the most aggressive in its retrans demands. “It is interesting that Fox is driving the hardest bargain despite providing just two hours of programming per day, while the Big 3 networks provide roughly nine hours of programming per day,” read the Coady Diemar Partners’ “Media Maven” report in June.

Yet several Fox affiliates say less network fare is better, especially when it includes Idol, the NFL and, if the hype is to be believed, The X Factor. “More [network] time does not mean better time when the network’s news brand sucks,” said one GM. “Fox gives us good sports, and lets us do [more] syndication and local programming.”

With a hot hand in prime, Fox has continued to cut ties with laggard affiliates throughout this strange summer, while ABC, CBS and NBC have thus far not drawn up divorce papers. If networks indeed have a slight upper hand right now, industry vets say these things are cyclical, and what goes around may indeed come around before long.

Despite their differences, leaders on both sides of the aisle seem to agree that these clashes must be put aside if broadcast television is to retain its relevancy amidst a barrage of competition. “At the end of the day, all would say they’d rather have a healthy partnership with the network than not,” said Marci Burdick, senior VP of broadcast at station group Schurz Communications. “Economically, it’s in both of our interests.”

E-mail comments to mmalone@nbmedia.com and follow him on Twitter: @StationBiz

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Michael Malone is content director at B+C and Multichannel News. He joined B+C in 2005 and has covered network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television, including writing the "Local News Close-Up" market profiles. He also hosted the podcasts "Busted Pilot" and "Series Business." His journalism has also appeared in The New York Times, The L.A. Times, The Boston Globe and New York magazine.