Paramount Lays Out Plan To Reduce Streaming Red Ink

Subscription price hikes, savings from combining Paramount Plus with Showtime are key

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

After reporting streaming losses of $575 million on its direct-to-consumer business in the fourth quarter, Paramount Global looked to assure analysts and investors that it had plans for reducing the red ink and pointing the company towards cash-flow growth by 2024.

It’s a song and dance media CEOs are being forced to perform as investors seek profits rather than subscriber growth. The Walt Disney Co. CEO Bob Iger last week wowed Wall Street with plans to cut costs by $5.5 billion and reduce headcount by 7,000 in order to goose his company’s bottom line.

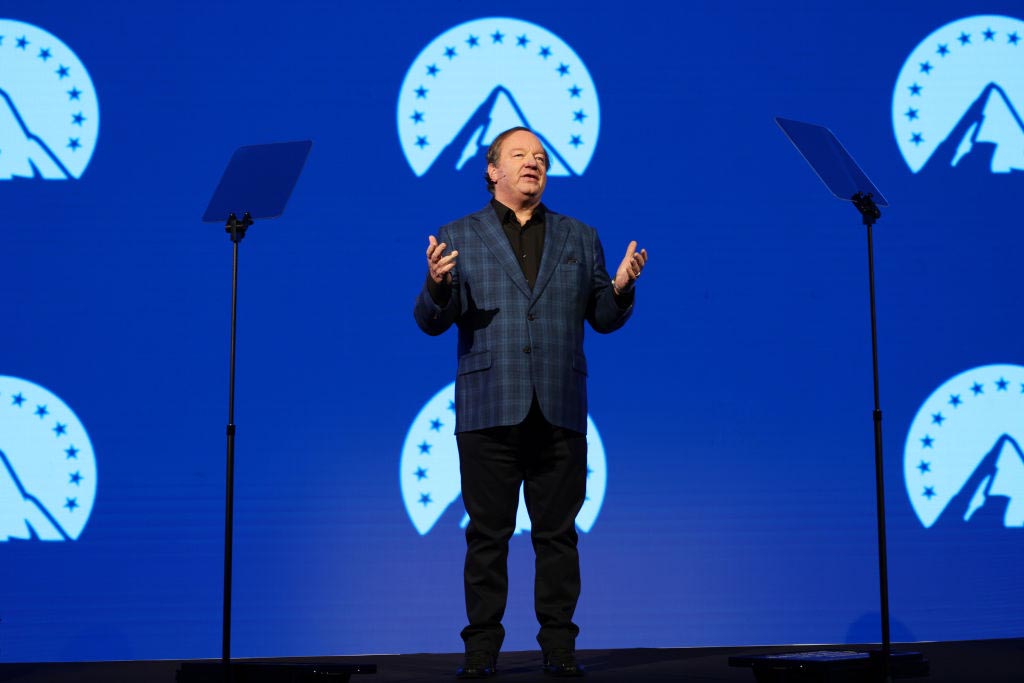

On Paramount’s fourth-quarter earnings call Thursday morning, CEO Bob Bakish said 2023 would represent peak investment in the company’s streaming business.

“The combination of streaming investment and the current state of the ad market will impact earnings and cash flow in 2023,” Bakish said. “We see that narrowing significantly in 2024 resulting in meaningful total company earnings growth and a return to positive free cash flow.”

The components to making streaming profitable are increasing revenue, controlling content costs and operating efficiently, which sounds simple but is probably easier said than done.

Increased revenue will come in part through prices increases which will come later this year when Paramount Plus is combined with Showtime.

“The [current] Paramount Plus offering is far from the industry price leader,” Bakish said. “We are on the value end of the pricing spectrum and so in 2023 we will raise prices.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Paramount’s strategy for managing programming costs is to partly focus on franchises and to partly use the programming it does pay for across its multiple platforms to maximize return on investment, rather than having a streaming-only content focus. Having popular franchises with built-in fan bases makes it easier to attract and retain subscribers, Bakish said.

Combining Paramount Plus with Showtime will make it easier for Paramount Plus to hold subscribers when the price goes up, Bakish said. Paramount Plus’s premium tier, including Showtime, will go up by $2 to $11.99 a month. The lower-priced essential tier, without Showtime, will rise by $1 to $5.99 a month.

Paramount chief financial officer Naveen Chopra said the company is betting that the combination of Paramount Plus and Showtime “provides a better experience for consumers while simultaneously unlocking material financial benefits for both our TV media and DTC businesses.”

There will be some reduction in the total number of subscribers, but that should hurt DTC revenues.

According to Paramount’s analysis, the overwhelming majority of Showtime engagement is driven by key franchises, which comprise less than half of the service’s content amortization expenses, Chopra said. By focusing on those franchises — and licensing or writing off the rest of Showtime’s programming — Paramount Plus will keep Showtime subscribers happy, preserving that revenue stream while reducing content expenses.

The write-offs will be substantial: Chopra told analysts there will be an impairment charge in the first quarter of $1.3 billion to $1.6 million.

Warner Bros. Discovery has been similarly removing programming from HBO Max, taking writeoffs and using the content to start free ad-supported streaming TV channels.

Of course, when two organizations like Paramount Plus and Showtime are put together, there will be cuts and cost savings. Chopra said this combination will result in $700 million in annual savings.

"By 2024, our plans also include reductions in headcount and product and technology expenses as we capture the full-year benefits of integrating Showtime and Paramount and we lap a full year of costs associated with international expansion,” Chopra said.

Taking the steps to build revenue, reduce content spend and integrate showtime and paramount “allows us to turn the corner towards streaming profitability,” Chopra said. "The financial impact of what we have planned for 2023 gives us confidence we can continue to deliver compelling content to consumers and distributors, grow earnings and free cash flow in 2024 and create long-term value for shareholders.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.