MiQ: OTT Surpassed Linear TV Globally During 2020

OTT content consumption growing faster among those 35 and older

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

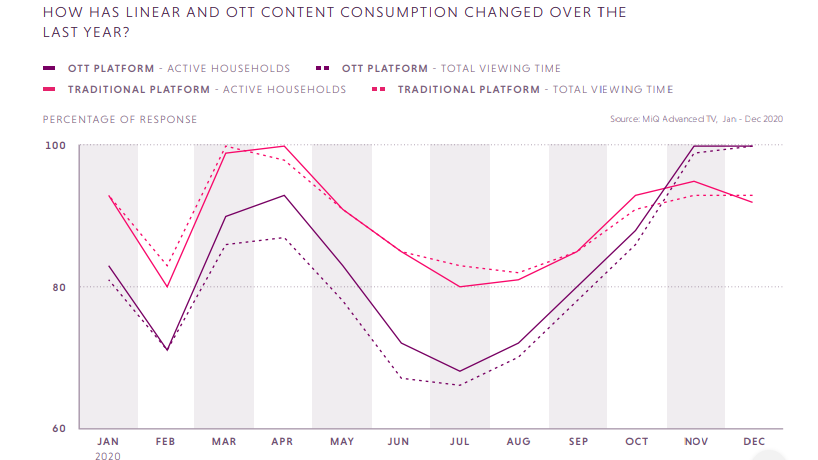

More people were consuming content on over-the top platforms than on traditional TV by the end of last, according to a new multinational report from programmatic company MiQ.

The COVID-19 pandemic boosted usage of both traditional TV last year in the U.S. and five other countries, with a spike happening between March and May, the report said. In that period, nearly 100% of viewers watched some traditional TV. Around 90% were watching over the top at that point.

Usage dipped until turning upwards again in July. By November, nearly 100% of of people were content on OTT platforms and about 95% were using traditional TV, according to MiQ.

“Content consumption on OTT platforms has grown 19% among people aged 18-34, the traditional OTT loyalists. But it’s grown even more strongly among people aged 35 and older (21%), many of whom are likely to be new to OTT,” the report said.

MiQ said the growth in OTT ad inventory was less a boon for marketers than a mix back.

In the early stage of the pandemic, which viewers were locked down at home, there was a decline in the viewability of ads.

Since then, viewability has improved to above pre-pandemic levels, MiQ said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Video completions have also recovered from a slump in March-April 2020 and are up 3.8% year-on-year with consumer responses to video ads being more pronounced in the U.S., Canada and the U.K.

“In short, it’s taken a while for the increase in online activity to start paying dividends for marketers, but the data is starting to suggest that the year in lockdown has made consumers more receptive to online advertising, particularly in the more mature programmatic markets like the US, Canada and the UK,” the report said.

MiQ's data comes from digital devices as well as viewing information from connected TVs. It compared its data with results of a survey of global customers conducted by Sapio Research to identify changes in consumer considerations.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.