Magna Sees Improved Ad Market With Little Help for Traditional TV

National TV spending is forecasted to fall 3.2% despite 11.3% gain in streaming

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The U.S. ad market showed improvement in the second quarter, but the main beneficiary was digital advertising, leaving the outlook for linear TV ad spending stagnant, Magna, the forecasting and intelligence unit of IPG Mediabrands, said.

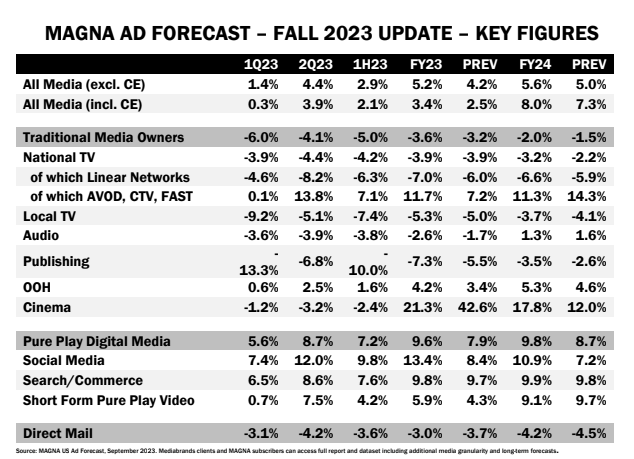

With the signs of recovery, Magna upgraded its forecast for 2023 ad spending to forecast for all media to 5.2% from its previous forecast of 4.2%. But Magna said that traditional media owners will see revenue down 3.6% in 2023, while pure-play digital media companies will see a gain of 9.6% compared to the earlier forecast of 7.9%.

Magna painted a similar picture for 2024, with digital media gaining and traditional outlets stuck in the mud.

In the first half of 2023, nonlinear streaming TV ad sales — ad supported VOD, connected TV and free, ad-supported streaming television channels — grew by 7%, Magna said. “But so far, the attractiveness of these new formats for consumers and advertising is just mitigating, not offsetting, the long-term decline of traditional linear formats in audience and ad sales,” Magna said in its report.

Magna pegs 2023 national TV advertising spending as falling 3.9%, unchanged from the previous forecast, with linear networks down 7%, compared to 6% in the earlier forecast, and ad-supported video-on-demand, connected TV and free, ad-supported TV (FAST) rising 11.7%, up from 7.2% in the earlier forecast.

Pure-play digital media outlets are expected to finish 2023 up 9.6%, an upward revision from 7.9%, with digital video rising 5.9% from 4.3%.

“Six months ago, the media industry was bracing for recession, but advertisers kept calm and continued to support their brands and sales through media investment,” Magna executive VP, global market intelligence Vincent Létang said. “As the U.S. economy and advertising spending were both stronger than expected so far this year, and digital media is finally recovering from its 2022 woes, Magna raises its full-year ad revenue growth forecast to +5.2% for 2023 to reach $337 billion.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

For 2024, excluding special events like the Olympics and the election, Magna sees all U.S. ad spending rising 5.6%, compared to the previous forecast of 5%.

Including the Olympics and elections, ad spending is expected to increase 8%, up from 7.3%.

Magna sees national TV down 3.2% in 2024, a bigger drop than the 2.2% decline forecast earlier. Linear networks’ accounts are expected to shrink 6.6%, while AVOD, CTV and FAST grow 11.3%.

In its previous forecast, Magna saw linear dropping 5.9% and AVOD, CTV and FAST up 14.3% for 2024.

Local TV ad revenues are expected to grow by 28% compared to 2023, thanks to an incremental $5.7 billion generated by political demand and induced spot inflation.

Magna sess pure-play digital media rising 9.8% in 2024, up from the prior forecast of 8.7%, with short-form, pure-play video up 9.1%, compared to the prior forecast of 9.7%.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.