Local Over-The-Top Ad Revenue To Grow 57% in 2022: BIA

Spending to hit $3.4 billion by 2026

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

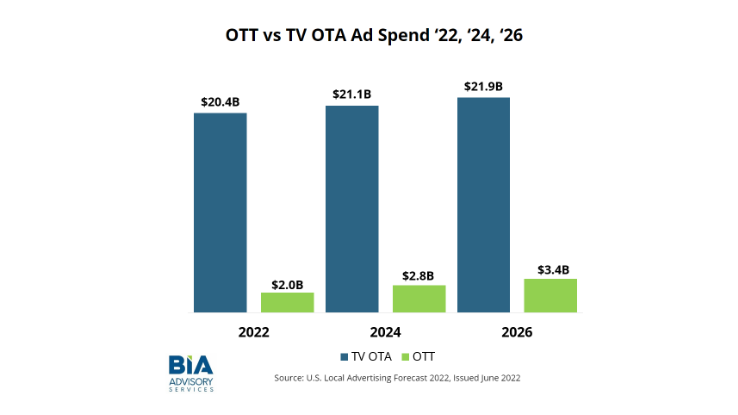

Over-the-top (streaming) is set to be the fastest-growing form of local advertising, reaching $3.4 billion in revenue by 2026, according to a new forecast from BIA Advisory Services.

Local OTT revenue is expected to be up 57% this year to $2 billion, BIA said. While growing quickly, OTT revenue remains a fraction of local over-the-air TV revenue, forecast to total $20.4 billion in 2022 and hit $21.9 billion in 2026.

“When you compare TV over-the-air [OTA] to OTT, obviously TV OTA is the juggernaut. However, the growth in OTT demonstrates that it is delivering a proven opportunity for broadcasters to grow revenue,” Rick Ducey, managing director, BIA Advisory Services, said in a release outlining results set to be discussed at today's TVB Forward conference. “Consumers continue to shift, and are sticking with, viewing habits supported by OTT. For broadcasters taking notice, it offers them an opportunity to extend the value of their traditional over-the-air content and deliver it in a manner consumers require.”

BIA attributes OTT advertising’s growth in part to the pandemic, which encouraged viewing, and to increased acceptance of streaming by advertisers, which see OTT as offering a combination of the content and audience of broadcast as well as the control and targeting of digital.

In an election year, BIA is expecting local OTT to get an extra bump from campaign spending.

The biggest spending category for local OTT is general services (lawyers, plumbers, HVAC, utilities, etc.), which are expected to spend $337 million in 2022.

Other significant categories including automotive at $273.2 million, restaurants at $202.8 million, health also at $202.8 million and finance/insurance at $182.8 million.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The mid-Atlantic region is expected to see the fastest OTT increase, with a 53% compounded annual growth rate from 2020 to 2022. The smallest increases will be seen in the Pacific Southwest at 39%.

“As OTT comes of age, we expect it to rapidly seek additional investments to reach new consumers that are harder to hit by linear TV alone,” said Nicole Ovadia, VP, forecasting and analysis at BIA. “It will be fascinating to watch the growth trend lines. To provide insights into OTT ad spending, we are slicing and dicing our forecast estimates to examine growth and expansion by verticals, regions in the U.S., by markets and more.” ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.