How the Disney-Charter Deal May Affect Affiliate, DTC Revenue

Analyst Robert Fishman sees lower earnings for Warner Bros. Discovery, Paramount NBCUniversal

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The Walt Disney Co. and Charter Communications ended the network carriage dispute that resulted in a blackout with a unique deal that involved the media company’s streaming properties as well as its traditional television networks.

Disney agreed to provide Charter with the streaming services that the cable operator argued had programming that its subscribers already paid for, while Charter got flexibility to drop some of Disney’s lower-rated, “long-tail” cable networks.

Net-net, Charter will be paying more to Disney, with the increase in wholesale fees for streaming exceeding cuts in payments for cable networks that are being dropped, most analysts have concluded.

MoffettNathanson analyst Robert Fishman looked at the Charter deal and has tried to game out how a similar deal would work out for other media companies.

Bottom line: the deal probably benefits Disney, but will be a tougher pill to swallow for its rivals.

The Charter deal would lead to several long-tail networks vanishing. S&P Global Intelligence listed some of those networks, and estimated when they would face the axe, based on when deals were up for renewal.

Fishman looked at the revenue those networks generate and how much that revenue means to their parent companies. He also weighed that loss against the upside of increased carriage of those media companies’ direct-to-consumer services.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“The most obvious risk to all media companies following the Charter renewal is exposure to longer-tail networks that could be dropped in future renewals,” Fishman says in his report.

Fishman estimates that U.S. affiliate fees for Disney account for about 17% of the company’s revenue. By comparison, affiliate fees represent 48% of Fox’s revenue, 22% of Comcast NBCUniversal’s revenue and 21% for both Warner Bros. Discovery and Paramount.

For Disney, those long-tail networks — Baby TV, Disney Junior, Disney XD, Freeform, FXM, FXX, Nat Geo Wild and Nat Geo Mundo — represent 8% of affiliate fees.

For NBCU, networks like Universal Kids, Oxygen, Syfy and E! Account for 17% of affiliate fees. Paramount networks MTV2, TeenNick, Nicktoons, VH1 and Nick Jr. account for 16% of affiliate fee revenue. Similarly at WBD, Discovery Family, Discovery Life, American Heroes, Travel, Destination America, Cooking Channel, Motor Trend, Science, truTV and Boomerang represent 15% of affiliate fees.

Fishman doesn’t see any of Fox’s cable networks at risk of being dropped.

Losing carriage of the long-tail networks would also cost media companies advertising revenue. For WBD, this would impact 10% of ad sales; for Disney, 9%; for Paramount, 7%; and for NBCU, 5%.

Adding affiliate fee and ad sales for those long-tail networks, Fishman figured 13% of WBD’s linear business revenue is at risk. That’s more than the 12% for NBCU, 11% for Paramount and 8% for Disney.

While distributors like Charter are saving money by dropping long-tail networks, Fishman argued, they will be paying single-digit percentage increases in how much they pay for the cable networks they continue to carry.

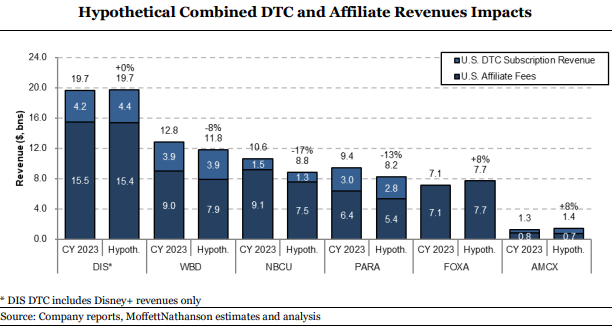

He estimated that would leave Disney’s affiliate revenues down 1% to 15.4 billion. The drops would be bigger elsewhere, with NBCU down 17% to $7.5 billion; Paramount down 16% to $5.4 billion; and WBC down 12% to $7.9 billion. Fox’s affiliate revenues would grow 8% to 7.7 billion.

What happens to streaming revenue as DTC services become part of a cable subscription is a bit more complicated. Fishman assumes that future deals will give the 60% of cable customers who don’t currently subscribe to the various streaming services and that viewers who already have the ad-supported versions of streaming services independently will drop them, rather than pay twice.

Fishman sees Disney Plus subscriber revenue rising 5% in the Charter deal, even at wholesale price levels. But other services would see less of a gain because distributors would argue that more of their programming is already including in the cable bundle, notably NFL football now on Paramount Plus and Peacock.

Fishman estimates that under this scenario, WBD subscription revenue would be flat at $3.9 billion, Paramount Plus would drop 6% to $2.8 billion and Peacock would fell 13% to $1.3 billion.

(AMC would get a big boost on a small base — up 33% to $700 million — with the added distribution cable operators could provide to AMC Plus, Fishman noted.)

All in, looking at traditional TV affiliate-fee and ad revenue and streaming subscription revenue, Disney is the only winner, while WBD sees revenues dropping 8%, Paramount down 13% and NBCU 17% lower.

Fishman notes that affiliate fees are high-margin revenue. “On the flip side, a reduction to DTC subscription revenues could have a bigger long-term impact to streaming profitability with the need to reassess associated content spending to drive subscriber growth,“ he said. “Although, this would be at least partially offset as including streaming services within the Pay TV bundle offering would help substantially reduce churn.”

In terms of earnings, Fishman is cutting his estimate for WBD by 4% for 2023, 2% in 2024 and 2% in 2025.

Ar Paramount, the earnings forecast is 1% lower for 2023, 2% in 2024 and 5% for 2025.

“At Fox, we are decreasing our FY 2024 by 2% estimates to better incorporate weaker ad trends at cable networks and higher corporate costs, but we leave our affiliate and retrains forecasts unchanged as the company stands to take an increasing share of the overall pie as distribution partners tighten the screws with their other content partners,” Fishman said.

Mofftet Nathanson is maintaining its “buy” ratings on Disney and Fox, its “neutral” ratings on WBD, AMC and Netflix and its “sell” rating on Paramount, but it is lowering its target prices for Fox, AMC and Paramount.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.