GroupM Sees 23% CTV Growth, More Political Spending, Boosting TV

TV ad revenue up 6.2% to $74 Billion in 2022, agency predicts

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Media buyer GroupM predicted that U.S. TV ad revenue will grow 6.2% to $74.168 billion in 2022, after rising 4.1% in 2021, a historic year for overall advertising revenue growth.

The bright spots for the industry are CTV and political spending. GroupM sees CTV growing 23% in 2022. And the agency expects candidates and interest groups to contribute about $7 billion to TV revenues during the mid-terms.

Also: U.S. TV Ad Spending To Rise By 4% in 2022, Zenith Forecasts

Political advertising is increasingly important to the TV business. “We expect that by 2026, political advertising will account for more than 13% of all TV advertising, up from 9% in 2020, with heavy concentrations of demand directed to a relatively modest number of local TV markets, the agency said in its report, entitled This Year Next Year--Global End-Of-Year Forecast.

GroupM notes that pay TV subscriptions continue to fall, limiting the reach potential of ad-supported TV. That trend is more pronounced in the U.S. than in other markets.

Also: Magna Sees U.S. Long-Form Video Ad Revenue Rising 4% in 2022

“Nonetheless, television will hold its own weight in absolute terms, as the defections of some advertisers will be offset by the emergence of others, while ongoing growth in political advertising...helps sustain the overall sector’s durability on a multi-year basis,” the agency said.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

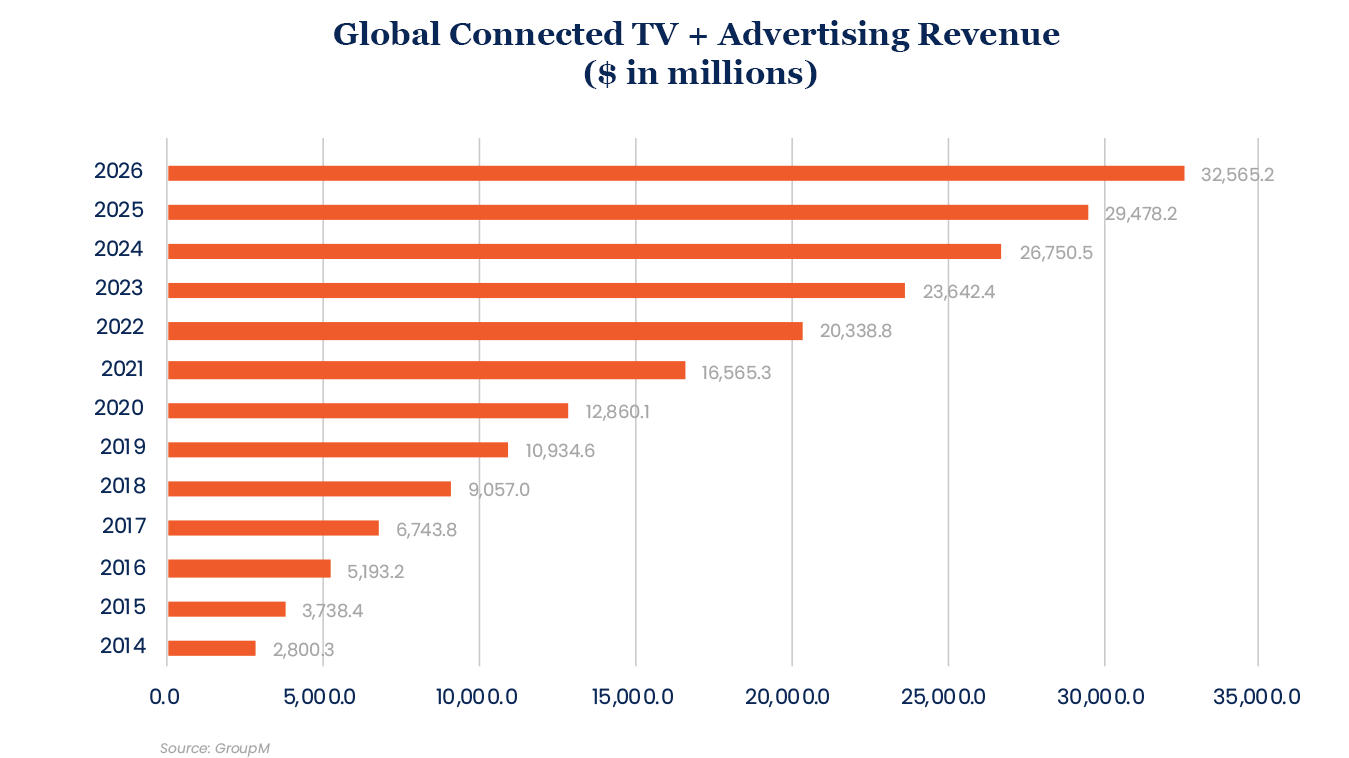

With U.S. TV companies investing in streaming, revenues are rising for both subscriptions and connected TV. GroupM said what it calls CTV plus ad revenue will be $16.6 billion in 2021 and rise to $20.3 billion in 2022. By 2026, CTV-plus ad revenues will hit $32.6 billion.

Over all, Magna has raised its estimate for growth total 2021 media industry ad revenue to 22.7% from a prior forecast of 17.3%. Naturally the increase is led by digital advertising. For 2022, the agency sees U.S. ad revenue rising 14.6%. Excluding political advertising in 2022, underlying growth would be 28.4%.

‘It’s possible that this is the fastest growth in the history of advertising,” said Brian Wieser, global president for business intelligence at GroupM.

Wieser noted that 64% of global advertising is now digital, but that larger, more sophisticated advertisers are still spending 40% to 50% of their ad buffets on television.

That’s “not because they're dinosaurs necessarily. But because large brands can use television. They can make TV work. They can take advantage of the brand building capacity and more importantly, they have the budgets to do it,” he said.

Between TV and digital most of the spending and growth is accounted for. “Yes, that does mean crumbs for everyone else,” he said.

The growth in spending is coming despite the global supply chain issues and despite concerns about inflation, which might actually be good for ad revenue because spending is often based on sales volume, and both phenomena could lead to people buying more higher-priced goods. “As long as consumers are willing to spend more money, there will be more advertising," Wieser said.

GroupM sees global ad revenue growing 9.7%, excluding U.S. political advertising. That’s up from Group M’s prediction of 8.8% in June.

Digital advertising accounted for 53.4% of all advertising in 2021, up from 60.5% in 2020, with Alphabet, Meta and Amazon accounting for from 80% to 90% of the global total. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.