Gray Pitching InAt Young Stations—for Real

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

After a long succession of stops, starts and more stops, Gray Television’s plum deal to help manage seven Young Broadcasting stations is finally under way. The Gray regional general managers with responsibilities at the Young outlets are reviewing budgets, and Young’s local management should have them in hand by the end of January or early February.

“It’s really moving ahead,” says Bob Prather, Gray TV president/COO. “We’re getting in there, seeing how they operate, and seeing how we can improve things.”

It has been well reported that Gray has received $2.2 million per year, going back to the summer of 2009, to help run the seven Young stations. Gray had been told to sit tight by Young, until finally getting the green light to step in near the end of 2010.

What has not been reported is the giant “incentive fee” bonus Gray is getting as part of the deal, tied to the seven Young stations’ performance in the booming election year of 2010. That figure is said to have been $6 million for 2010, in addition to the $2.2 million fee—a sum that top executives at Young and Gray did not dispute.

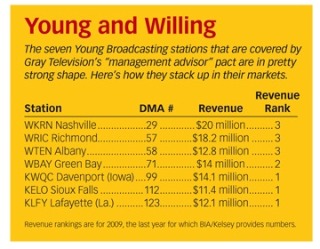

For perspective, $6 million represents about half the annual revenue at Young’s KELO Sioux Falls or KLFY Lafayette in 2009, the last year for which BIA/Kelsey provides revenue breakdowns.

“It’s a nice number,” says Prather.

Another insider to the deal is more effusive: “These guys should get a medal—they got tons of money to not do a thing.”

Young says the Gray general managers will help review strategies, processes, work flows and capital plans, among other things. The Young stations need cash to modernize newsgathering and producing; one priority may be to facilitate the sharing of local content from one station to the others. “Some of the stations are behind the times technically in terms of newsgathering and HD,” says one Gray executive who asked not to be identified.

Some of the outlets, which include WKRN Nashville, WTEN Albany and KWQC Davenport (Iowa), may expand their news output under Gray. Gray’s stations are often market leaders, and the Young batch isn’t far off the pace in a typical DMA. “We’ll look to expand where it makes sense,” says Prather. “It’s what we do best—we add news when we have the opportunity.”

Young has hired a handful of general managers in the past few months, including Stanley Knott at WKRN and Andy Alford at WTEN, and has one more GM opening to fill at KWQC. Insiders believe Young will benefit from the new sets of eyes trained on the stations by the Gray general managers. “Fresh perspective on a business that’s been a family business for a long time is a good thing,” says one Young insider.

Young and Gray may also use their joint muscle to partner on some syndicated programming buys, as Tribune Co. and Local TV do in a number of markets.

Crippled by debt payments stemming back to its outlandish purchase of KRON San Francisco a decade ago, Young Broadcasting entered bankruptcy protection in February 2009. When it emerged from Chapter 11 in June 2010, officially renamed New Young Broadcasting, the company wiped away $800 million in debt.

Vincent Young stepped down as CEO last August. Kevin Shea, managing director of consulting firm Loughlin Meghji, is calling the shots as Young’s chief restructuring officer. Based in New York, Shea has rich experience retooling broadcast outfits, having worked with New Vision and Freedom, among others, as they restructured.

Last week, Young announced it was disbanding its 67-year-old sales rep firm, Adam Young Inc., at the end of the month, citing an “increasingly complex business environment” that has forced “a wave of consolidations.”

The group is not expected to sell any stations this year, as the price gap between buyers and sellers is still vast. And after the stations’ strong 2010 showing, the Young board isn’t thinking fire sale.

Insiders say the Gray deal was held up almost 18 months because of various court proceedings associated with Young’s bankruptcy, and because it’s not a traditional local marketing agreement (LMA) setup. One insider spoke of taking extra time to get the tricky rules of engagement right for both broadcasters and regulators, to avoid having to draw them up again.

The foot-dragging—and the $8 million-plus going to Gray last year for almost zero involvement—has surely taken a toll on Young morale at the station level. But now that there is actual evidence of progress on the deal, the staffers can better focus on the business at hand.

“From what I’m seeing and hearing, people are relieved to be past it,” says Shea. “They’re looking forward to regrowing this thing, and re-establishing their stations as a strong voice and strong leader in the community.”

E-mail comments to mmalone@nbmedia.com and follow him on Twitter: @StationBiz

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Michael Malone is content director at B+C and Multichannel News. He joined B+C in 2005 and has covered network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television, including writing the "Local News Close-Up" market profiles. He also hosted the podcasts "Busted Pilot" and "Series Business." His journalism has also appeared in The New York Times, The L.A. Times, The Boston Globe and New York magazine.