Good Times forDigi-Nets...ButWe've Seen ThisMovie Before

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

mmalone@nbmedia.com | @BCMikeMalone

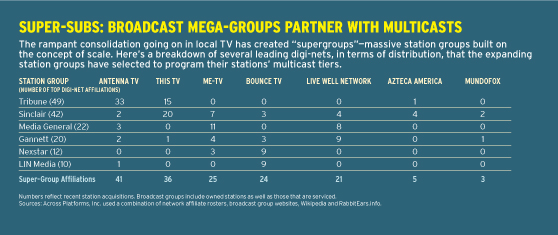

On one hand, it’s a fantastic time to be in the digi-net space. Viewers are finding the myriad subchannels, and station general managers speak of real revenue finally coming from multicast tiers that formerly aired repurposed newscasts and loops of Doppler radar. On the other hand, the torrid consolidation going on among station groups these days, such as last week’s announcement that Sinclair plans to acquire Allbritton for a little shy of $1 billion, makes it more challenging for the new players in the digi-net game to find affiliate partners from the shrinking batch of broadcast groups.

The rookie players entering the arena need deep pockets, deeper programming libraries and a deeper-still reserve of luck. “If you’re a small network, you have to be concerned when there are fewer players and fewer people to sell your program to,” says Michael Kokernak, president of digital media consultancy Across Platforms. “As a small network, how do you get face time with the CEO of Tribune when he’s focusing all his attention on [in-house diginets] This TV and Antenna TV?”

Similar to Gannett’s planned acquisition of Belo, Tribune’s blockbuster $2.7 billion pact to acquire Local TV LLC—both deals await regulatory approval— gives what will be a 42-station group substantial leverage when it comes to purchasing programming for the subchannels. For Tribune, it means vintage series such as Father Knows Best and The Partridge Family on Antenna TV, which reaches 66% of U.S. homes, and classic series and movies on This TV, reaching a notable 85.5%.

That’s a critical advantage as the demand for entertainment fare gets more intense with each new digi-net’s arrival. “We all compete for product, and there’s only so much catalog out there,” says Sean Compton, Tribune Broadcasting president of programming and distribution. “This gives us more buying flexibility, and increases the power of Antenna TV and This TV to buy more programming.”

Get More Movies!

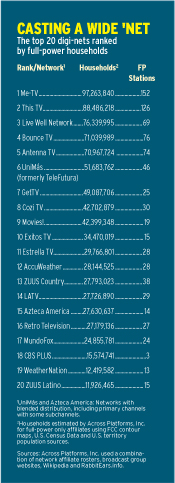

Industry insiders offer a wide range of estimates as to how much revenue the digi-nets collectively bring in per year, ranging from $150 million to $200 million, though all seem to agree the number is growing rapidly. A Me-TV rate card in Kansas City shows a 30-second spot during primetime for $15, while one in Salt Lake City goes for $60. A Bounce TV rate card in Jacksonville lists a 30-second prime spot at $20.

While the history of multicast television is relatively brief, there has never been such a flurry of activity in its lifetime. One of the best established subchannels, entertainment network This TV, breaks from a founding partner November 1; Tribune takes over programming duties from Weigel Broadcasting, and pairs with cofounder MGM, which handles distribution. John Bryan, president of domestic television distribution for MGM Television, called Tribune “the best organization to optimize the network’s growth through new content development and distribution opportunities.”

Weigel, meanwhile, split from This TV to focus on its growing Me-TV channel—as well as distributing the recently launched Movies! channel with Fox Television Stations (FTS). Movies! launched in May on 17 Fox-owned stations and has added a handful of non-Fox partners too, including Weigel’s own in Milwaukee and South Bend, Ind., and Landmark Media’s KLAS Las Vegas—good for 37.7% of the U.S. Frank Cicha, senior VP of programming at FTS, says the subchannel stands out by offering a high-end classic film experience: 16 X 9 screen resolution, limited commercials, films edited for decency, not for running time. “It’s not what a lot of people are doing right now,” Cicha says. “I think it’s finding an audience.”

Film buffs seem to appreciate the free flicks, which are primarily pre-’90s releases. “You’re a filmmaker’s dream come true,” came one Detroit viewer email to Fox. “Not only do you show classic and hard to find films, you show them in their correct aspect ratio. Big thumbs up!”

Neal Sabin, executive VP at Weigel Broadcasting, says a new movie-focused digi-net better offer something special. “People can watch movies a hundred different places,” he says. “For a commercial, ad-supported service, you have to give viewers the best experience possible.”

That includes nothing on the screen—no snipes or logos—but the feature film, he adds.

A second compelling entrant in the entertainment digi-net space is getTV, which Sony Pictures Television launches this fall. The channel too will focus on classic films—those primarily from the ’30s through ’60s, says Superna Kalle, senior VP of U.S. networks at Sony Pictures Television and general manager at getTV, which will debut on 24 Univision subchannels. Kalle says the net will reach 44% of U.S. households at launch. “We definitely saw an opening in the space,” she says. “TCM is the only other one doing these kinds of movies.”

The newbies join the likes of classic TV channel Me-TV, ABC’s Live Well Network, NBC’s Cozi TV—which launched in January, Spanish language players such as MundoFox and Estrella TV, and the African-American targeted Bounce TV, among many others, on the multicast tier, making it feel a bit like the early days of cable television all over again.

“People figured out there’s a business there,” says Sabin. “They said, hey, if little Weigel can do it, why can’t we?”

Spreading the News

Amidst the myriad network programming options available for their dot-twos and dotthrees, other stations are opting for local news on their multicast tiers—whether it’s a 24/7 news and weather channel, or a unique newscast pre-empting a net’s scheduled programming. Local TV’s WNEP Scranton has 10 p.m. news on its Antenna TV channel. Hearst TV’s WXII Winston-Salem is averaging close to a 1 household rating with its year-old 10 p.m. news on Me-TV. The decision to air news came from the fact that a substantial number of viewers had found Me-TV, says Hank Price, president and general manager, and that WXII’s news crew is a powerhouse. “There was only one 10 p.m. news in the market, and I felt like there was a bigger appetite than that,” he says. “Me- TV has been a huge success, and we saw this as a new opportunity.”

The new entrants to the dot-two space are working hard to stand out. For starters, they need high quality programming, decent channel placement with the multichannel video programming distributors and a clear point of differentiation amidst the thicket of competition. For some, original programming mixed in with the classic series and films is a way to bust out of the clutter. Bounce TV, which inked its first renewals with the likes of Raycom, LIN and Belo, among others, plans 100 hours of original programming in 2014, including the sitcom My Crazy Roommate and the pop culture roundup series BRKDWN. Cozi TV’s originals, which complement vintage shows from the NBCUniversal and Sony libraries, such as Magnum, P.I., include the reality show Next Great Family Band.

Just as brand-defining original shows elevated the profiles of cable channels AMC (Mad Men, Breaking Bad) and IFC (Portlandia, Maron), Kokernak says quality original programming will help the digi-nets earn their place on the programming guide. “The cable networks took off when they had an original hit,” he says. “It can’t all be reruns forever.”

Despite the challenges, the newer digi-nets don’t seem terribly fazed by the shrinking number of groups available to sell their networks to. Kalle of getTV acknowledges that it’s “hard to get anyone’s attention” on the station group side amidst the frenzied M&A activity, but says a digi-net is well on its way when it lands one of the new supergroups as an affiliate partner. “In one sense, it’s easier because it’s one-stop shopping,” she says. “If you get a large group done, you’ve got many markets.”

Since multicast network WeatherNation already has a foot in the door at Gannett— it’s on KUSA Denver and KARE Minneapolis, among others—WeatherNation president Michael Roberts sees consolidation differently than if WeatherNation was on the outside, pitching its multiplatform weather content to the big dogs. “If anything, I think it actually helps us,” he says. “It may open some doors at Belo so we can come in and enhance their weather products.”

Content Still the King

Several on the subchannel side say the networks featuring distinct quality programming will win out despite the contracting landscape of buyers out there. The folks behind Bounce TV like to say their network is tailored to viewers’ demands—as opposed to a repurposing of a studio’s library. “The great networks live on regardless of consolidation,” says Jonathan Katz, COO of Bounce. “If you create a great full-service network that resonates with viewers, you’re going to have a long-term partner in the market.”

For his part, Sabin has seen just about everything on the multicast front since launching This TV in 2008, and taking Me-TV national two years later. Some digi-nets died premature deaths, and some even failed to launch, despite early buzz, snazzy marketing campaigns and big-name backers. Me-TV, meanwhile, is seen as an example of doing multicasting right: Since moving beyond the Weigel markets of Chicago and Milwaukee, it reaches the most households among diginets, gets national ratings, is a primary channel in a number of markets—and is no longer even considered a digi-net by Sabin and, surely, some viewers.

He’s thankful he got in before the rush. “If the product is good enough and stations make money and viewers like what they see, that can overcome a lot,” Sabin says. “But if people think they can get in now—unless you own a large group, or unless your business model doesn’t involve 70% of the U.S., it’s gonna be tough.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Michael Malone is content director at B+C and Multichannel News. He joined B+C in 2005 and has covered network programming, including entertainment, news and sports on broadcast, cable and streaming; and local broadcast television, including writing the "Local News Close-Up" market profiles. He also hosted the podcasts "Busted Pilot" and "Series Business." His journalism has also appeared in The New York Times, The L.A. Times, The Boston Globe and New York magazine.