GeneralEntertainmentProgrammers Pull Out theBig Guns

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

RELATED: Landgraf: 'Go Big or Go Home'

General entertainment has become the place to be if you’re a cable programmer. At a time when cable operators and other distributors are looking at their costs and viewers are considering cord-cutting and watching whatever they can find on the Web, more networks are pushing to create big-ticket scripted shows, possibly turning the smaller niche channels that originally defined the cable industry into endangered species.

Last week, FX Networks president John Landgraf announced that the News Corp. unit is launching the general entertainment network FXX that will aim at 18-to-34-year-old viewers with scripted comedies now and dramas in the near future. FXX will be part of a suite of three networks—along with FX and the movie channel FXM—and Landgraf said he plans to fill that suite with 25 scripted shows per year, or about the same amount as the traditional broadcast networks produce.

CBS, which just bought 50% of the TV Guide Network for about $100 million, might also look to tap CEO Leslie Moonves’ golden touch with programming and push into the general entertainment cable space. Newcomer Participant Media also said it was creating a network, Pivot, aimed at millennials. While planning new spins on traditional TV genres such as dramas, talk shows, reality shows and even variety, Pivot president Evan Shapiro declared his channel was in the general entertainment game.

Everybody Wants to Get Into the Act

Many other channels have been looking to move more into the general entertainment category, and nothing creates a bigger bang with both distributors and advertisers than scripted shows. Viacom’s Spike is moving more toward general entertainment with scripted shows in development. History Channel’s scripted The Bible and Vikings were among last week’s highest-rated programs in all of TV, alongside The Walking Dead, which generated audiences as impressive as the awards other scripted shows garnered for the once-obscure movie network AMC. And with former FX and Fox chief Peter Liguori now running parent Tribune Co., WGN America is pursuing a general entertainment strategy and will eventually be looking for scripted shows to redefine the network.

Streaming video players such as Netflix and Amazon are starting to get into the scripted game themselves, so established programmers are also building ways to have their programming support the current ecosystem.

Will the television business support the influx of more general entertainment competitors? “I don’t think the world needs another general market entertainment channel for the sake of reruns,” said David Bank, managing director of equity research at RBC Capital Markets. But Bank adds, based on talks with programming executives at distributors and affiliate sales people at the programmers, “If you could put on differentiated content, it would drive carriage, absolutely.”

It’s not just the NFL that creates leverage when a blackout threatens during carriage renewal talks. Bank said that if a program develops a following of only 1 million or 2 million vocal viewers, that translates into subscriber revenue. “Fan engagement with these cult-type shows is enough to drive carriage and affiliate fee increases,” he said. “A show like The Walking Dead on a niche network drives carriage. So it’s about the content.”

Busy Marketplace

Putting money into cable programming has also become a better investment, thanks to the streaming SVOD business. “What the digital distributors have done—meaning Netflix, Amazon, Hulu and whoever else comes along—is they’ve provided a syndicated marketplace for even those kind of funky serialized shows, like [FX’s] The Americans,” Bank said. “Well, it’s a pretty good show. It’s getting ratings and it’s probably going to have a life somewhere in digital syndication.”

Original content also helps cable networks increase the rates they charge for advertising. At FX’s upfront presentation last week, media buyers said they were impressed by the original content that will fill the three channels. Francois Lee, senior VP at MediaVest, liked having more channels and more programming aimed at 18-to-34-year-olds. “They’re so fragmented,” Lee said. “The more ways we have to reach them, the better.”

CBS and its partner Lionsgate—which produces shows including Mad Men— have not announced plans for the TV Guide Network. In a statement, Moonves said, “We’re excited to bring CBS’ programming and production assets to the venture, and work with Lionsgate to rebrand and grow a channel that will be increasingly valuable to our carriage partners.”

On Wall Street, analyst John Janedis of UBS said that paying $100 million-$125 million for TVGN’s 80 million subscribers was a bargain. “Given the content libraries of both CBS and Lionsgate, the deal would appear to be a cheap way to distribute their content,” Janedis said.

FX’s Landgraf expects Moonves to be a formidable competitor. “I wouldn’t bet against Les,” Landgraf said. But the key question, Landgraf added, is, “How much are they going to be willing to spend” to program the channel? With a new channel, “you have to put on better programming than your carriage really deserves.”

Beating the Broadband Drums

In a more competitive world, Landgraf said he thinks being big is a benefit: “It’s better to be a heavyweight than to be a middleweight punching up.”

And in an environment where cable universe growth has stalled and operators are looking to rein in spending growth, Landgraf said it’s important to be a must-have channel.

“If and when there’s any kind of shakeout in the marketplace, it’s the non-must-have channels that are really going to struggle,” Landgraf said.

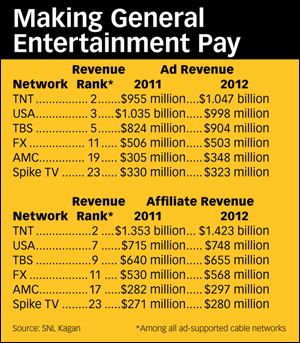

David Levy, president of ad sales, distribution and sports for Turner Broadcasting, is also a fan of having networks with heft.

“When we go into our negotiations with our partners on the distribution side, it’s nice to have the portfolio of brands that we have and the strength of the brands that we have. We don’t have what we would call a lot of niche, lower-tiered networks,” Levy said.

Levy noted that a lot of smaller networks were launched as part of transmission agreements with big media companies. “Are they as needed as they were in the past? That’s a question for the negotiators and their other media partners,” he said.

FX and Participant both outlined plans to address online viewing and support cable operators. Participant will be available to consumers who subscribe to either a video service or its broadband product. Shapiro said that its survey of millennials found that while more than 20% were considering dropping cable, more than 20% of the broadband-only respondents said they were considering getting cable.

FX’s expanded program offerings will be made available on-demand to authenticated cable subscribers and through operators’ video-on-demand services.

Original programming will be available the day after it airs and a Movie Bin offering will put 40 movies a month on VOD that will not be available from a streaming service, increasing the value of a cable subscription, Landgraf said. “Our point of view is, let’s provide content, better content, better user interfaces, more access, so at least if you’re paying for television you’re getting something extraordinary, something special,” he said.

The VOD service is also an opportunity for advertisers who wish to grab viewers watching movies on commercial-free streaming services or DVDs, Landgraf said, asking media buyers, “If you could advertise on Amazon Plus or Netflix, would you?”

E-mail comments to jlafayette@nbmedia.com and follow him on Twitter: @jlafayette

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.