Charter Endures Biggest Ever Quarterly Video Customer Loss Following Disney Blackout

The No. 2 U.S. cable company saw 327,000 customers cut the cord in Q3

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

With its video customers blacked out from Disney’s ABC and ESPN for 12 long days at the start of the college and pro football seasons last month, Charter Communications began steering Spectrum Video subscribers away from its own TV service and toward third-party virtual MVPDs including YouTube TV.

Turns out many Spectrum customers took Charter up on that coaching. The nation's No. 2 cable company lost 327,000 video subscribers in the third quarter, far exceeding the 204,000 customers shed in Q3 2022.

It does turn out that if you go back to the third quarter of 2013, and you add losses experienced by the long-since acquired Time Warner Cable and Bright House Networks on a “per forma” basis, there was a bigger customer loss quarter for Charter, according to analyst Bruce Leichtman. But as a standalone pay TV company? This is Charter's biggest quarter for cord-cutting, by far.

Charter's full Q3 earnings release can be read here.

Also read: CEO Chris Winfrey Says Charter Wants More Deals Like Disney’s

Charter's robust customer losses came after Comcast on Thursday reported slightly decelerated third-quarter video attrition of 490,000 Xfinity TV users.

Following its Friday morning earnings report, Charter shares were down on the Nasdaq just under 5%, but that's not because it lost linear video customers.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

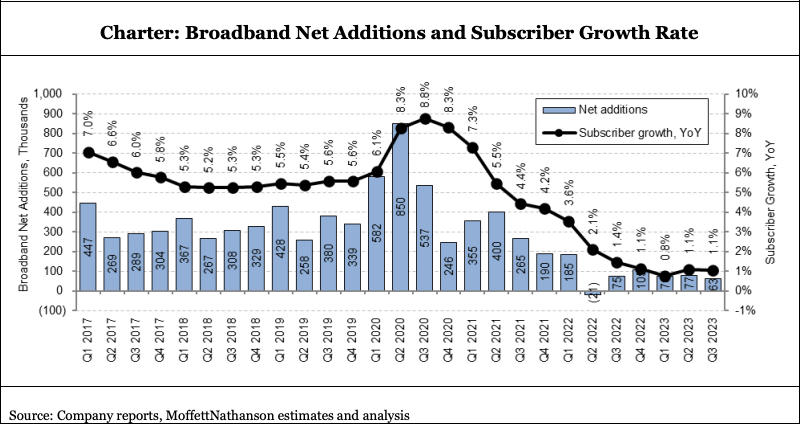

The cable operator added just 63,000 residential and small business wireline broadband subscribers in the third quarter, compared to 75,000 in the year-ago three-month period. Just as with Comcast, which lost 18,000 high-speed internet users, investors are concerned that the slow broadband growth is a sign that cheaper fixed wireless access services T-Mobile and Verizon are eating cable’s lunch.

Then again, Charter's high-speed internet customer metric was positive, and the operator also added a boffo 594,000 Spectrum Mobile lines in the third quarter.

Comcast on Thursday was dinged for reporting strong average revenue per customer numbers on weak customer growth. Charter seems to have had the opposite problem on Friday.

“Investors gave a thumbs down yesterday to Comcast’s prioritization of financial metrics over growth. Charter’s results today may or may not get a warmer greeting, but they are certainly … different,” wrote equity analyst Craig Moffett in a note to investors Friday.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!