Comcast Stock Drops As Cable Company Loses More Ground on Home Broadband in Q3, Sees Slowing Mobile Growth

ARPU for high-speed internet improved, but Comcast lost 18,000 customers as T-Mobile and Verizon combined to add another 941,000 fixed wireless subscribers

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

You are now subscribed

Your newsletter sign-up was successful

Comcast shares fell more than 6% on Wall Street Thursday after the top U.S. cable operator revealed more negative progress in home broadband customer growth in the third quarter, as well as declining expansion of its mobile business.

Comcast actually beat equity analysts’ consensus forecasts for revenue (up 0.9% to $30.12 billion) and profit ($4 billion).

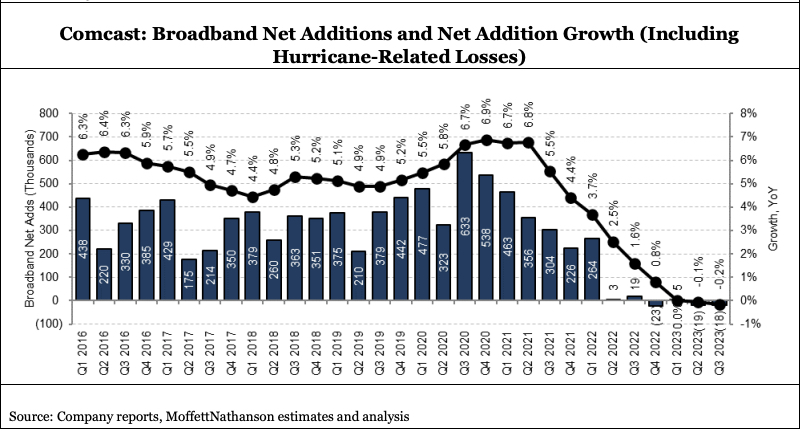

But the Philadelphia cable operator lost 18,000 wireline broadband users from July through September, compared to narrow growth of 14,000 in the third quarter of 2022. (You can read Comcast's full Q3 earnings release here.)

Average revenue per broadband customer was actually up in Q3, but the No. 1 U.S. cable company has lost 58,000 home internet users in the last year. This is bad news considering that T-Mobile and Verizon, which is undercutting Comcast and the rest of the cable business with cheap fixed wireless access home internet, added a combined 941,000 FWA customers in the third quarter.

Also Read: Shift of Sports to Streaming Will Test Broadband Networks: Comcast

For his part, equity analyst Craig Moffett in a Thursday-morning note to investors dismissed the gloom-and-doom regarding cable's broadband future, noting that FWA, while still very strong, isn't growing quite as fast as it was. Meanwhile, fiber over-builders including AT&T and Frontier have stated that their previously projected rate for new fiber passings was too high.

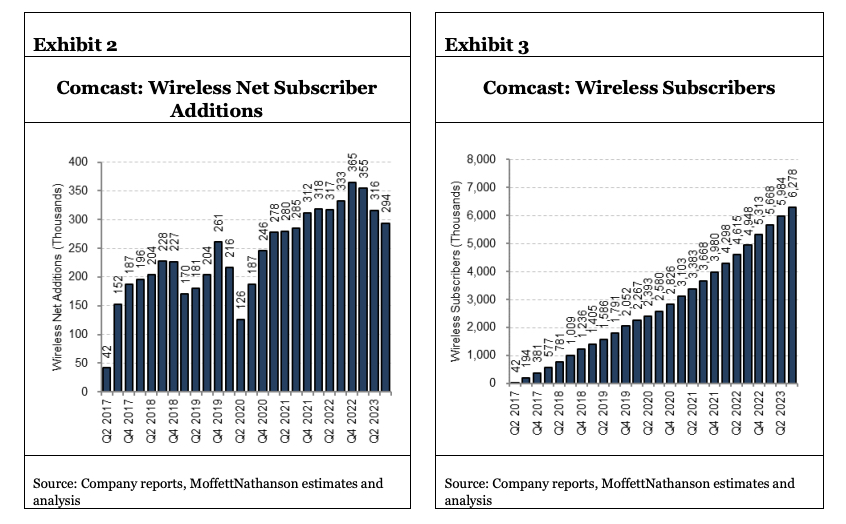

Conversely, however, cable companies led by Comcast have been making incursions on wireless’s turf, but Comcast experienced slowing customer expansion for its mobile business in Q3, adding 294,000 customers during the period. That was about 12% short of consensus forecasts.

The smarter way to stay on top of the streaming and OTT industry. Sign up below.

Comcast's wireless revenue rose 16% to $917 million in the quarter.

“Their growth in wireless, although fast by any objective measure, is more moderate than it might be,” Moffett noted. “Comcast isn’t bundling wireless as aggressively with broadband as is peer Charter (read that as, they’re not discounting it as much), and that shows in their net growth.”

Beyond Comcast’s slowing connectivity gains, U.S. advertising sales for its NBCUniversal media unit fell 8.4% to $1.9 billion in Q3.

In his investor note, Moffett struck a somewhat bullish tone in regard to Comcast's overall connectivity picture.

“This is what a late-stage cable operator looks like: slow or no unit growth in broadband, solid broadband ARPU growth, strong (but, in Comcast’s case, not blistering) wireless growth, steady business services growth … and really, really good margins,” he wrote.

Daniel Frankel is the managing editor of Next TV, an internet publishing vertical focused on the business of video streaming. A Los Angeles-based writer and editor who has covered the media and technology industries for more than two decades, Daniel has worked on staff for publications including E! Online, Electronic Media, Mediaweek, Variety, paidContent and GigaOm. You can start living a healthier life with greater wealth and prosperity by following Daniel on Twitter today!