Audience Deep Dive: Univision and Telemundo

With insights from Inscape and iSpot

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

COVID-19 has had a tremendous impact on TV viewing and advertising on the whole, and with audience behaviors changing — especially in a time of no live sports — marketers have a lot of questions about how to shift strategies to fit life in lockdown. At the same time, consumers are looking to reconnect with some semblance of “normalcy,” and are finding ways to carry on with certain cherished traditions.

Case in point: Cinco de Mayo, which has been trending on social media all day. In honor of the celebration, we’re taking a close look at Spanish-language networks Univision and Telemundo, both of which give Cinco de Mayo major play every year. Below, insights from Inscape, the TV data company with glass-level insights from a panel of more than 14 million smart TVs, and iSpot.tv, the always-on TV ad measurement and attribution company.

Viewership Insights for Univision

Of all the active smart TVs that Inscape measures, from Jan. 1 through May 3, Univision reached 17.59%, making it No. 38 for network reach and just below ESPN Deportes’ 17.79%. (Fox Deportes had a slightly larger reach, 21.60%. As we’ve previously noted, sports-focused networks have seen declines in viewership during lockdown, but are doing perhaps better than expected as many viewers continue to tune in for airings of “classic” games and other repackaged fare.) Of all the minutes watched during that time period, 1.35% were spent on Univision, putting it in 16th place for percentage network share.

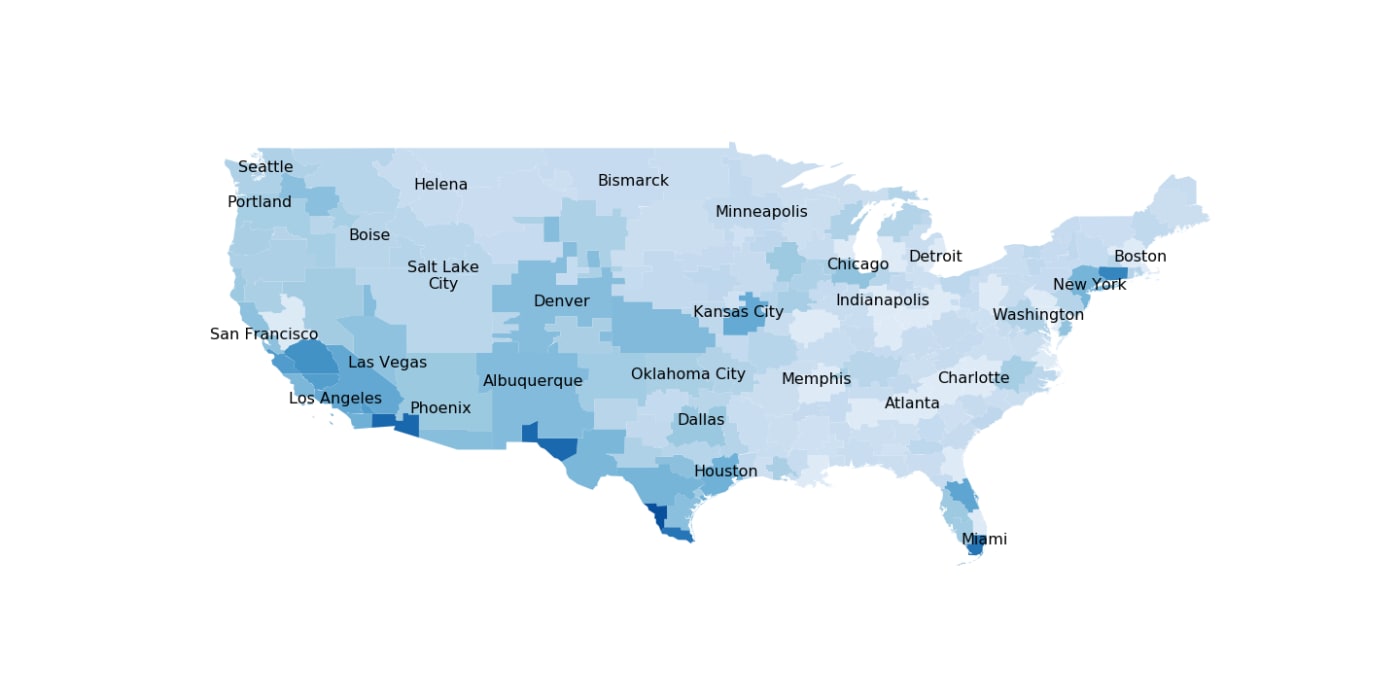

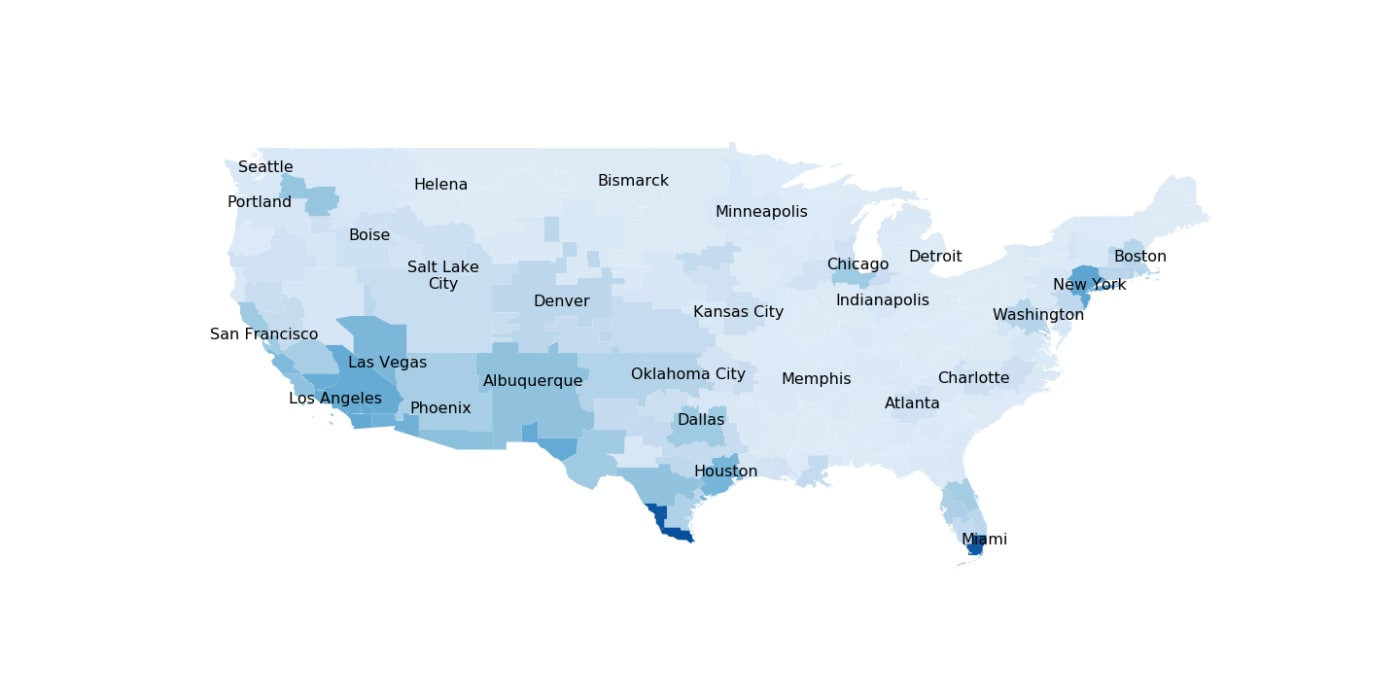

When it comes to Univision’s audience location, DMA data from Inscape shows higher rates of household tune-in in the Southwestern U.S., as well as some hot spots in Florida and the Northeast. (On the heatmap, the darker the color, the more households tuning in.)

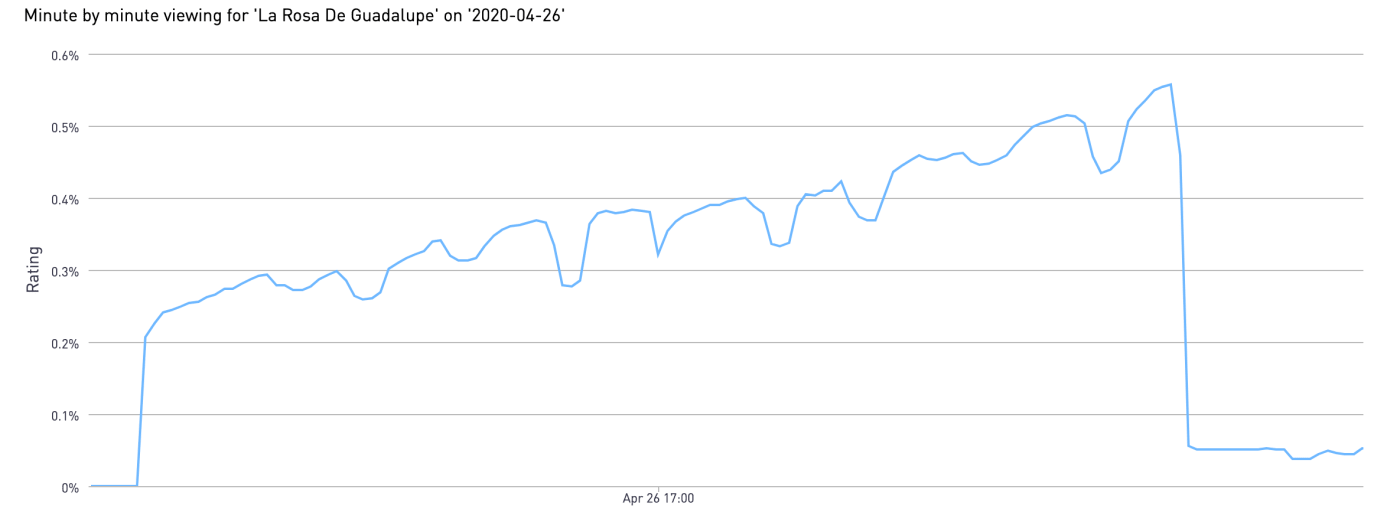

The top shows on Univision so far this year, based on the percent of households watching, include La Rosa de Guadalupe, Noticiero Univisión, Amor Eterno, Primer Impacto and El Gordo y la Flaca.

Diving even deeper, Inscape can reveal minute-by-minute trends for anything that airs on Univision. For example, here’s a look at viewership for two episodes of La Rosa de Guadalupe that aired back-to-back on April 26; tune-in rose gradually, peaking at the very end.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

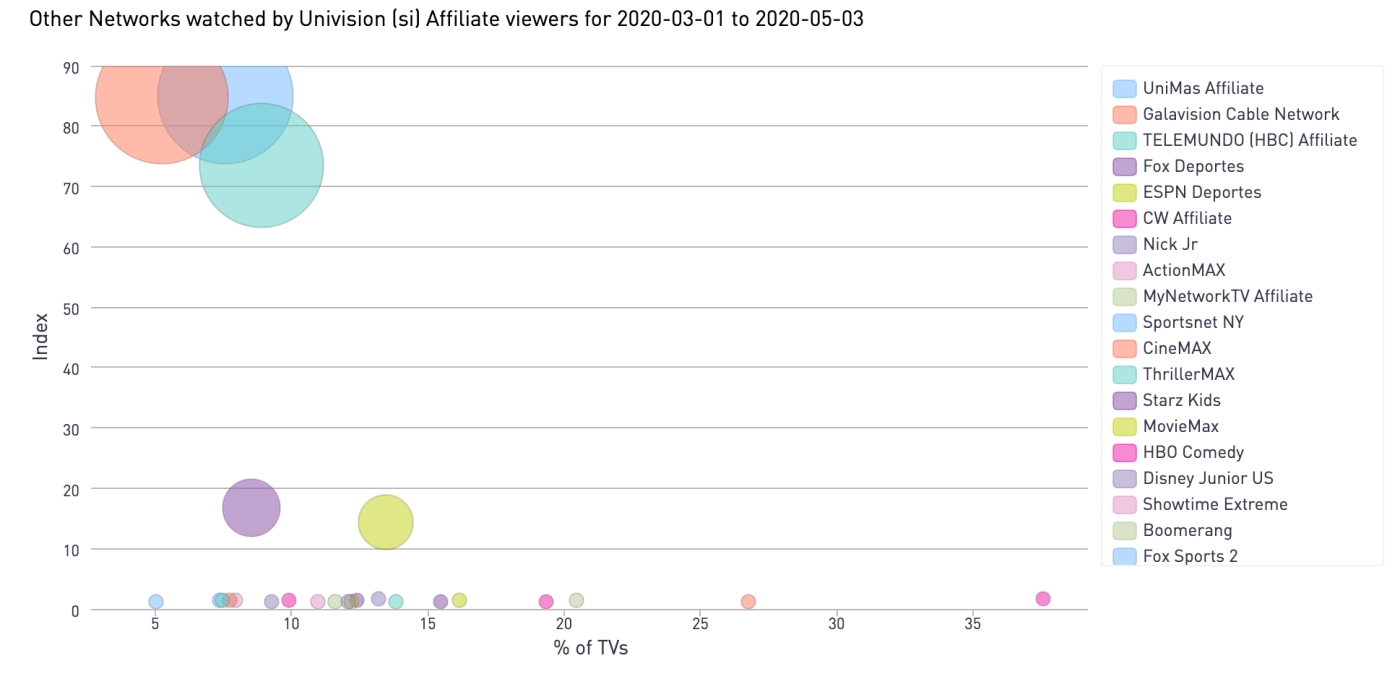

Going further, we can examine what other networks and shows were being watched by Univision viewers recently (March 1 through May 3). Perhaps unsurprisingly, other Spanish-language networks top the list — UniMas, Galavision, Telemundo, Fox Deportes and ESPN Deportes. When it comes to other shows watched off-network, Un Nuevo Día, Exatlón Estados Unidos, and Noticias Telemundo are popular choices.

Advertising Insights for Univision

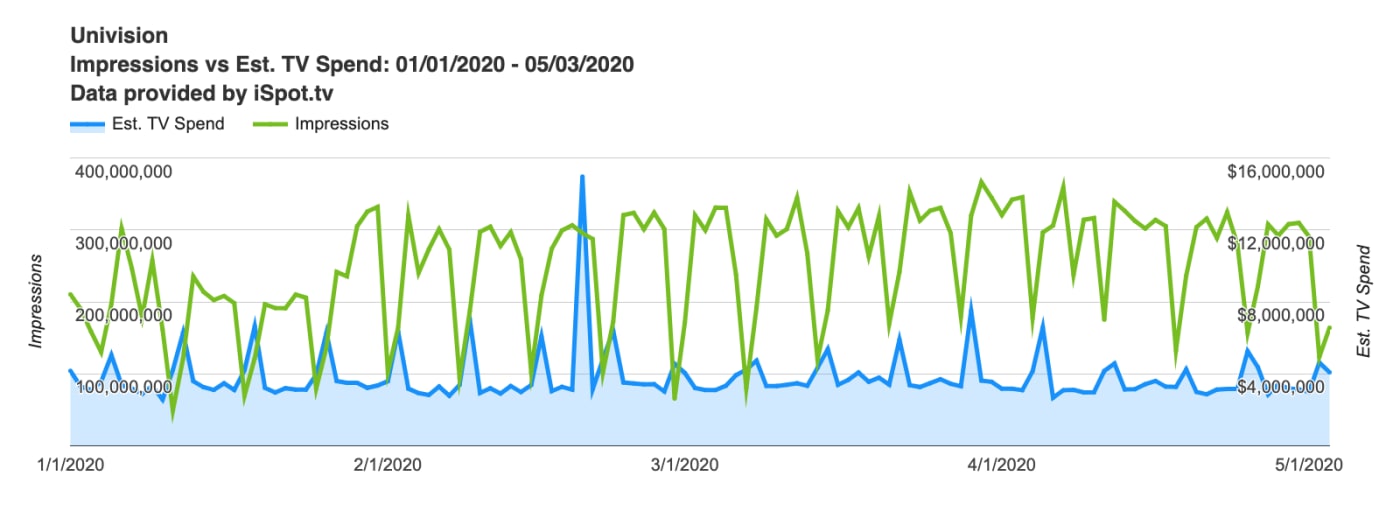

According to iSpot.tv, the always-on TV ad measurement and attribution company, there were 30.9 billion TV ad impressions served on Univision from Jan. 1 through May 3, representing a 12.73% increase from the same time period in 2019. Univision is ranked No. 19 for TV ad impressions so far this year (during the same time period in 2019, the network ranked No. 24 for impressions).

The volume of ad deliveries can be mapped out by genre, show, daypart or by brand or industry. Over time, Univision ad impressions look like this, with the vast majority of ad impressions (95.1%) occurring live or same-day:

In general, impressions are lowest on Saturdays and highest on Thursdays and Mondays.

When it comes to holding viewers’ attention during ad breaks, a few of the top brands with above-average attention (among advertisers with a minimum of 395 million TV ad impressions) on Univision include Finishing Touch (iSpot Attention Index*: 147, meaning 47% fewer interruptions than average), Walmart (iSpot Attention Index: 142, so 42% fewer interruptions) and Cicatricure (iSpot Attention Index: 120, so 20% fewer interruptions).

While impressions and attention are important metrics for TV advertising, every marketer is ultimately concerned about ad effectiveness. iSpot’s benchmarks, including the iSpot Lift Rating, measure the causal impact of TV advertising on key performance indicators (KPIs); put simply, lift reflects new business driven by TV ad placements.

Two recent highlights for Univision: In Q1 2020, it delivered a lift of 33.16% for the automotive industry, and a lift of 32.52% for the food delivery category, both above the quarterly lift average of 29.13% across all industries and networks that iSpot measured.

Viewership Insights for Telemundo

When it comes to Telemundo’s audience location, DMA data from Inscape shows higher rates of household tune-in in the Southwestern U.S., as well as some hot spots in Florida and the Northeast. (On the heatmap, the darker the color, the more households tuning in.)

The top shows on Telemundo so far this year, based on the percent of households watching, include Al Rojo Vivo con María Celeste, Exatlón Estados Unidos, Caso Cerrado, Noticias Telemundo Fin de Semana and La Voz.

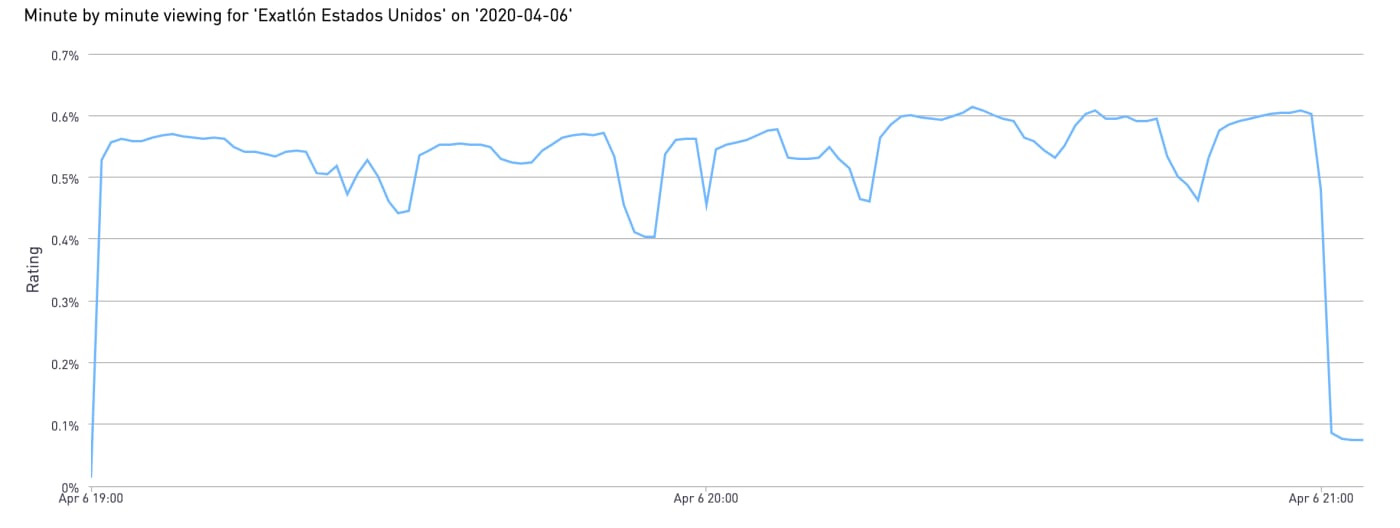

Here’s a minute-by-minute look at tune-in for the April 6 episode of Exatlón Estados Unidos:

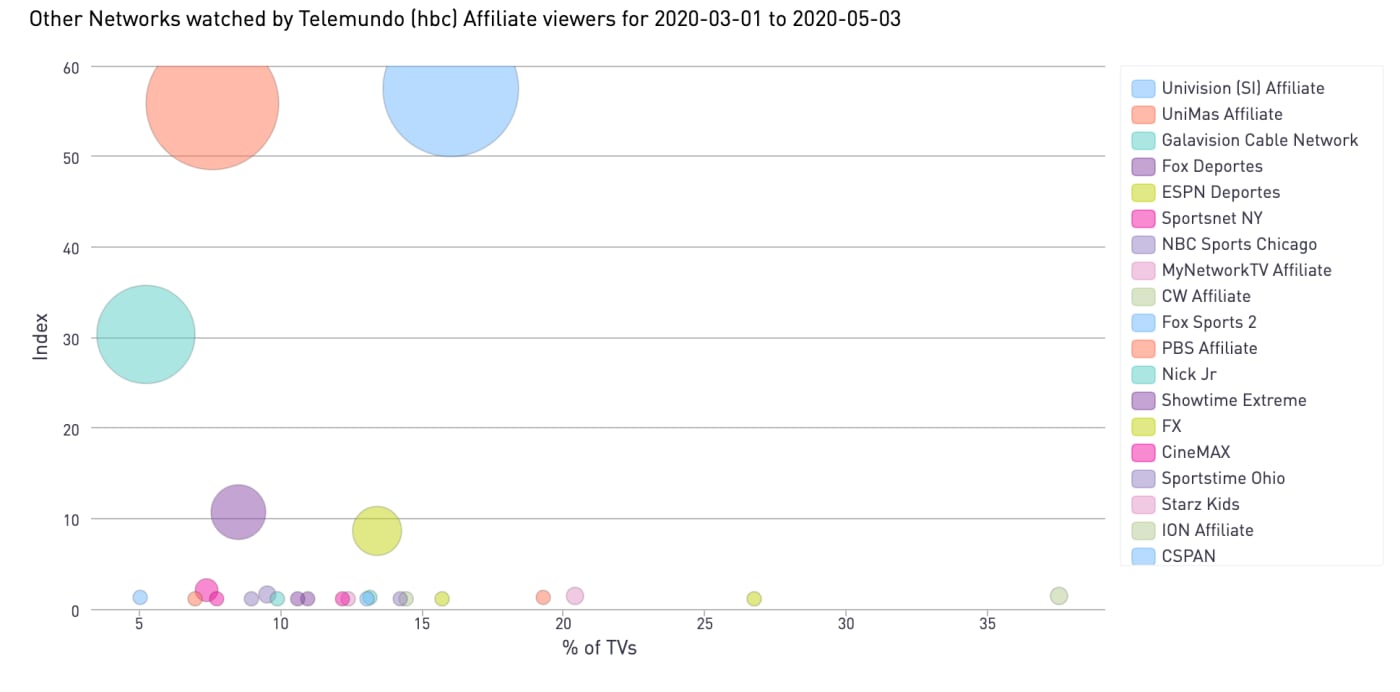

When it comes to the networks that were being watched by Telemundo viewers recently (March 1 through May 3), Univision tops the list, followed by UniMas, Galavision, Fox Deportes and ESPN Deportes. Off-network shows that the Telemundo audience is likely to watch include Noticiero Univision: Fin de Semana, Aquí y Ahora and Que te Perdone Dios... Yo No.

Advertising Insights for Telemundo

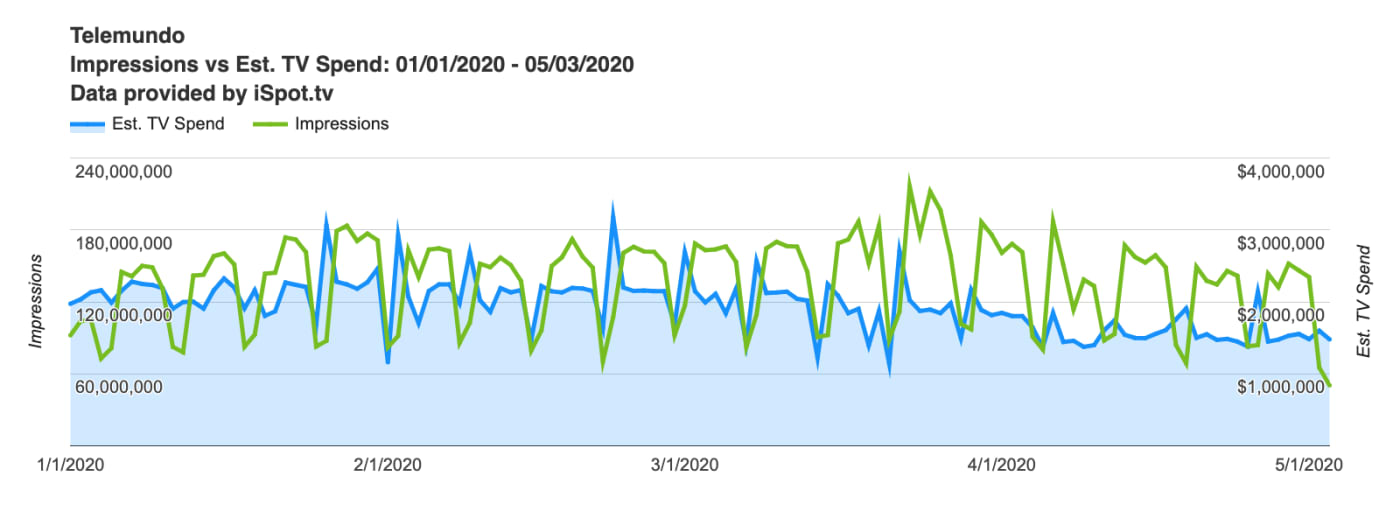

According to iSpot.tv, there were 17 billion TV ad impressions served on Telemundo from Jan. 1 through May 3, representing a 5.21% increase from the same time period in 2019. It’s ranked No. 38 for TV ad impressions so far this year (during the same time period in 2019, the network ranked No. 39 for impressions).

This is what ad impressions look like so far in 2020 for Telemundo, with the vast majority of ad impressions (95.5%) occurring live or same-day:

In general, impressions are lowest on Saturdays and highest on Wednesdays and Thursdays.

Looking at viewer attention, a few of the top brands with above-average attention (among advertisers with a minimum of 300 million TV ad impressions) on Telemundo include Sprint (iSpot Attention Index: 146, meaning 46% fewer interruptions than average), Zyrtec (iSpot Attention Index: 144, so 44% fewer interruptions) and Neutrogena Skin Care (iSpot Attention Index: 134, so 34% fewer interruptions)

When it comes to lift for Telemundo, in Q1 the network delivered an above-average lift of 33.54% for the food delivery category.

*iSpot Attention Index - Represents the Attention of a specific creative or program placement vs the average. The average is represented by a score of 100, and the total index range is from 0 through 200. For example, an Attention Index of 125 means that there are 25% fewer interrupted ad plays compared to the average.