Analyst Highlights Three Things For Roku To Worry About

Michael Nathanson has the ‘Sell’ sign out for Roku stock

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

At a time when Wall Street is pointedly negative about Roku, MoffettNathanson media analyst Michael Nathanson is pointing to three things the company has to worry about in a report released Wednesday (April 13).

Nathanson sees Roku shares falling to a target price of $100 from its $113.58 close Tuesday. Roku shares traded as high as $473 last July before plunging.

Roku benefited from the early days of the streaming boom, but Nathanson, who started urging investors to sell Roku shares back in November, said the market has changed.

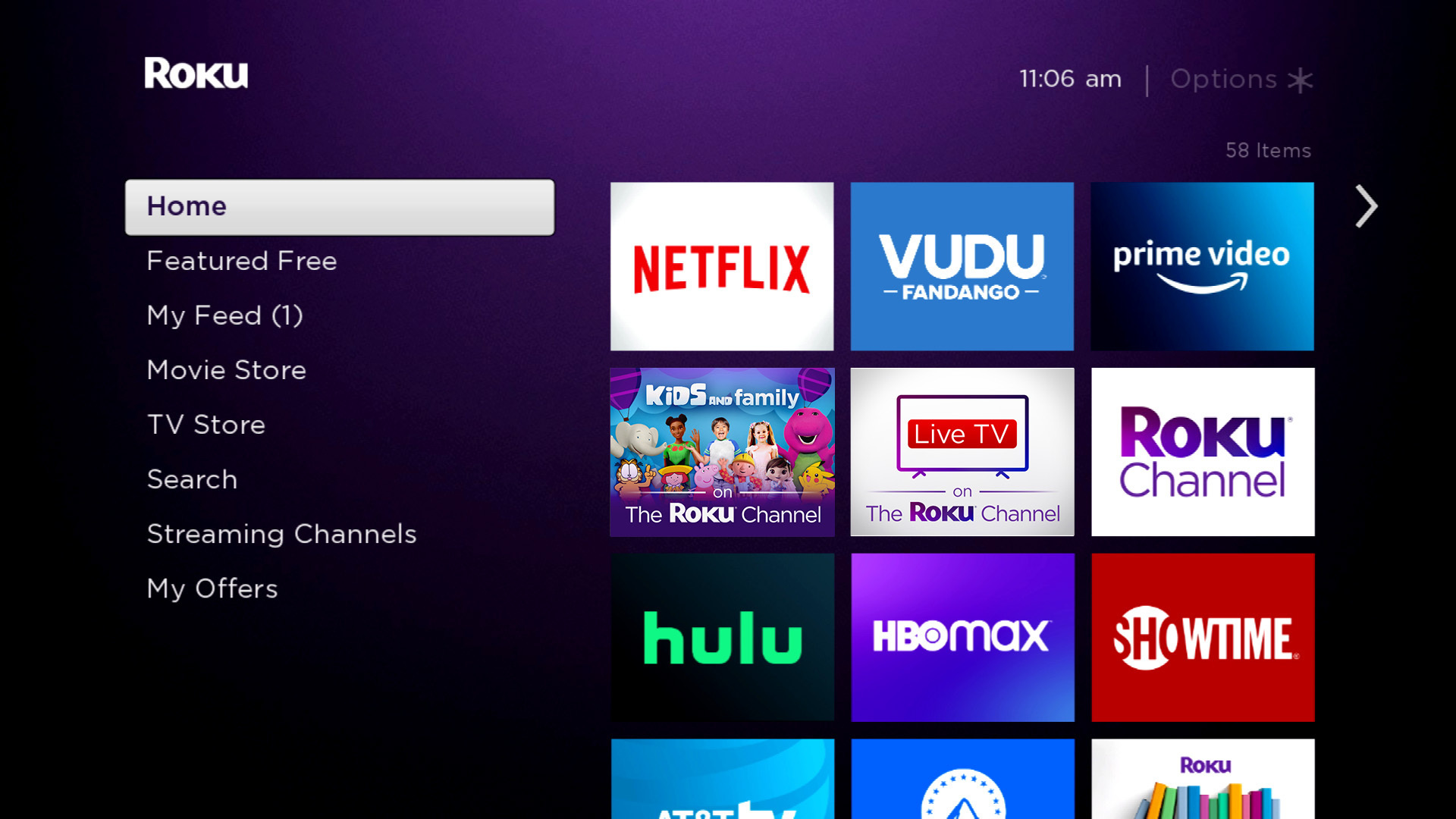

The strategic issues facing Roku start with slowing growth for high-margin content distribution revenue. Nathanson said Roku’s recent revenue growth was driven by launches of services such as Peacock, HBO Max and Discovery Plus. Roku was able to take a 20% cut of subscription revenues generated by the platform‘s users. But as content companies consolidate (see Discovery buying WarnerMedia) and top streaming services become more essential, he argued, programmers will have “greater leverage over Roku when the next deal renewal arrives.”

Also read: Roku Torpedoed by Yet Another Equity Analyst, Says Streaming Company Is Done Growing in the U.S.

Nathanson also pointed to more competition in the ad-supported streaming space where Roku is pushing The Roku Channel. Roku has been ramping up original content for The Roku Channel, which means spending more money to compete with the billion being shelled out by Netflix, Amazon, The Walt Disney Co. and the other heavy hitters.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Given this backdrop, Roku is starting to increase their investment in original content, which will likely pressure gross margins and free cash flow,” he said.

The last nail in the coffin is a shift among U.S. consumers away from the connected streaming devices sold by Roku to internet-enabled TVs.

“TV [original equipment manufacturers] and Google are driving hard to control these operating systems and create the same virtual cycle that Roku has enjoyed,” Nathanson said.

Another risk for Roku is that it is becoming especially reliant on just a couple of retail channels for the sale of its streaming media players. Nathanson identified the three as Best Buy, Amazon and Walmart. “Each of those partners has their own connected TV ambitions,” he noted.

“We believe Roku’s operating model will be less profitable in the long run than other digital advertising platforms, given Roku has to acquire content, compete with other streaming OS platforms and TV OEMs, negotiate terms with streaming services that are getting stronger each day, and invest in product development against numerous other platforms trying to serve the connected TV industry,” he concluded. ■

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.