Advertiser CTV Demand Could Help Traditional TV Companies

Advertiser Perceptions finds big spenders see safety in established networks

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Advertisers are planning to buy more connected TV and streaming video, and the biggest spenders are looking to offerings from established networks to reach cord-cutters and other over-the-top viewers, according to a new survey from Advertisers Perceptions.

The results suggest that traditional media companies will be selling more connected TV during the upfront, keeping some of those streaming ad dollars away from startups and digital natives.

Fox recently announced that its Tubi streaming service will be a part of its May upfront presentations. Hulu will be a part of the Walt Disney Co.’s presentation. ViacomCBS owns Pluto and CBS All Access (which will become Paramount Plus in March), NBCU launched Peacock last year and Discovery has an ad-supported version of its new Discovery Plus.

“Big TV networks have really beefed up their CTV opportunities at the right time,” said Justin Fromm, executive VP for business intelligence at Advertiser Perceptions. “They’re becoming safe harbors for the largest advertisers as fraud climbs in the medium. While the major Internet platforms will lead in volume of streaming ads, TV network safety is keeping them the gold standard in video as the platforms evolve.”

Also Read: Bad Audience Estimates Hurt Linear Television as Upfronts Approach

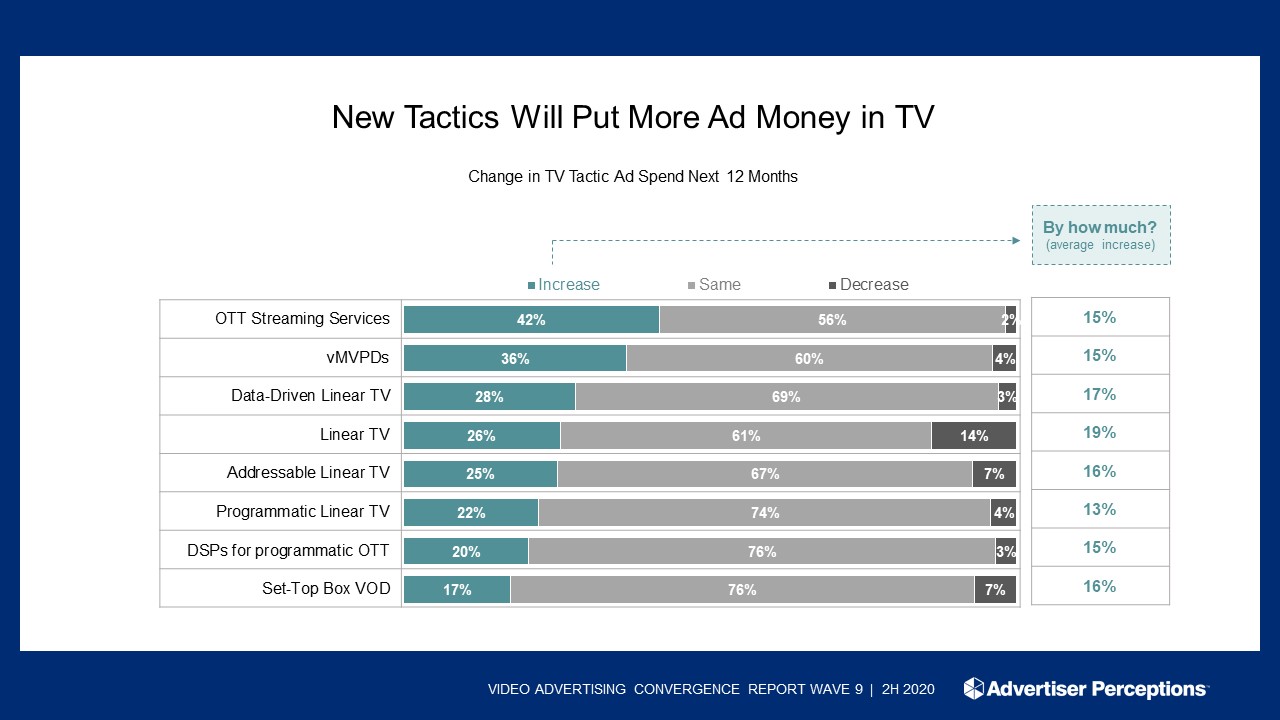

Advertiser Perceptions found that 52% of advertisers will increase their video spend over the next 12 months, with most of the rest keeping spending steady.

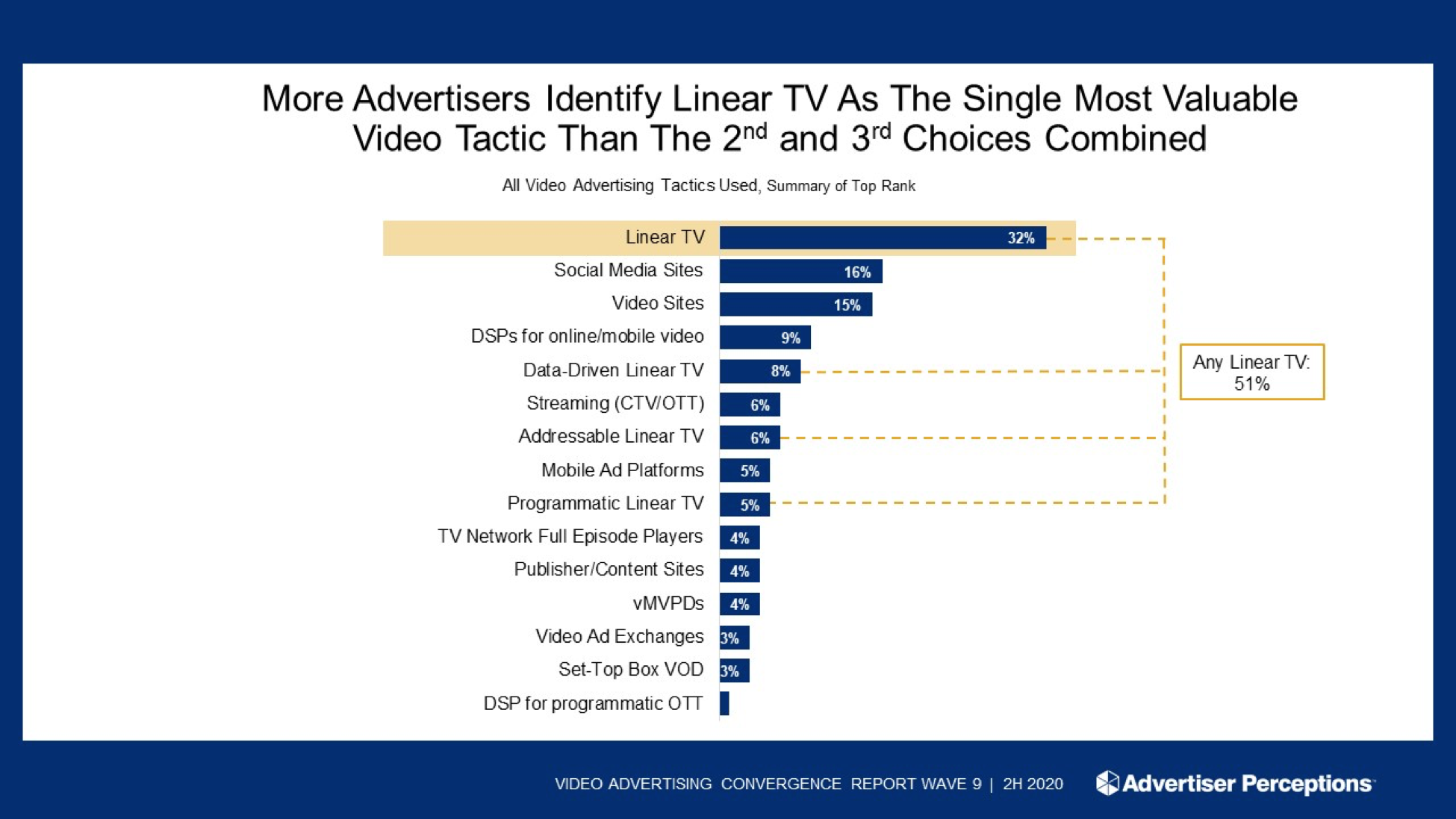

Advertisers said that video was the most important media to them, with 51% saying linear TV the most valuable video platform, compared to 31% for social media and 15% picking video sites.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

The bigger advertisers--with spending more than 25 million--were most likely to prefer linear TV to video sites or social media.

When it comes to online and digital video, about 80% of advertisers are concerned about fraud. As a result larger advertisers especially see relative safety in TV networks CTV offshoots. Advertisers are demanding the assurances they get from linear TV when the buy digital video, insisting that ads run on reputable sites, run in brand-safe content and run within professional content.

Advertisers who buy TV upfront are concerned about measurement issues, with 58% saying that as they buy non-linear video, it becomes harder for them to know the reach, frequency and effectiveness of their overall video advertising campaigns.

This will play big at the 2021 upfront, Advertiser Perceptions said, with 75% of advertisers saying they are primed to hear how media companies will balance expanding reach with innovation in personalization and cross-screen measurement.

Advertiser Perceptions interviewed 284 advertisers in November and December for its Video Advertising Convergence Report. Another 300 advertisers were interviewed in January about the upfront.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.