7 Things You Need to Know About Nielsen’s New Tool

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Happy New Year? Depends on who you ask, but a newsy year is certainly on tap. The TV industry will mark 2016 by finally getting to try out Nielsen’s long-ballyhooed Total Audience Measurement tool.

B&C got an early look at the system this month in a living room-style conference room inside the company’s headquarters on the southern tip of Manhattan. Before we get to our takeaways, though, a quick refresher.

Promising to count all video viewing equally, the new offering is the response to years of declining TV ratings as viewers delay viewing and watch video on digital devices. Watching their house catch fire, media company CEOs have used Nielsen as a whipping boy.

The 92-year-old company counters that it does measure all viewing. It’s just that not all of that data is included in the current ratings because of the way the TV industry—not Nielsen—has defined what goes into the C3 and C7 commercial ratings used as currency for buying and selling ads.

Related: Nielsen Extends Watermarks to Second-Screen Viewing

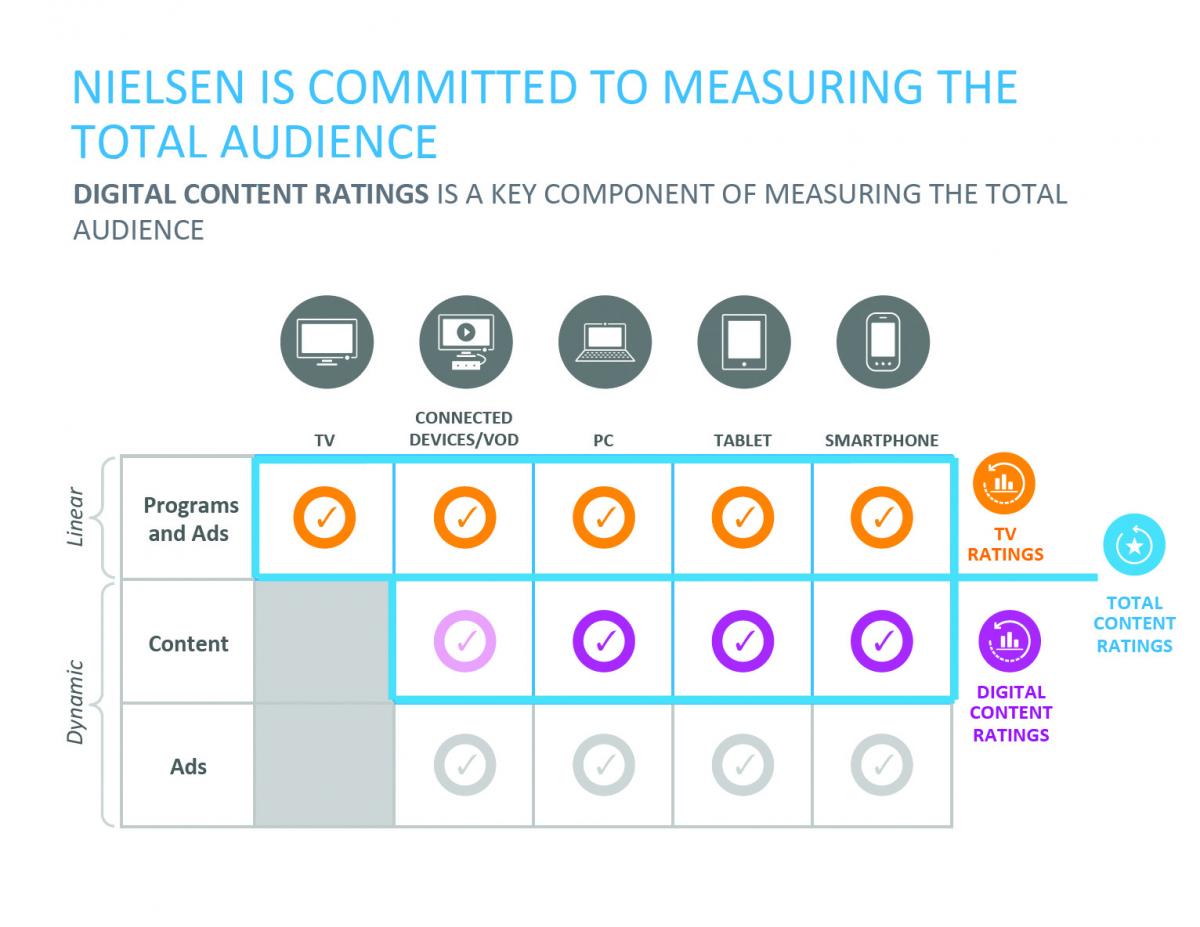

With its new system, Nielsen tracks any view, regardless of platform or ad format. Plus, it will track how many people are seeing the ads, whether those ads appear in a linear stream or are dynamically inserted into programs.

Meetings with research executives from the networks and agencies are scheduled over coming weeks to gather initial feedback. Barring any major friction, the new ratings could take hold as early as 2017.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“The objective here would be that during 2016 they’re using the [new] numbers in parallel to the [current] ratings numbers to start to get familiar with what alternate stories can they see inside the numbers,” says Nielsen executive VP Megan Clarken.

As the long-promised waves of change finally reach shore, here are the seven things you need to know about Total Audience Measurement:

1. The Sample Gets Bigger

In January, the first big change comes when Nielsen integrates its new enlarged sample into its ratings numbers. The sample jumps to 100,000 people in 40,000 homes from 25,000 homes currently. That change alone will have a significant impact on ratings, pushing some networks higher and other networks lower.

Clarken says programmers are well aware of the effect the larger sample will have: “They’ve all seen the data. They’ve had that data in their hands for 12 months, so for those who have had upward or downward changes, they know what that represents. They know what that looks like and they know the reasons why.”

Clarken declined to say which networks were helped and which were hurt, or why. “I can’t generalize,” she says. “It’s different for different networks for different reasons.”

Related: Rentrak Notches Waterman Broadcasting Deal

2. Panel Still the ‘Source of Truth’

While some clamor for using the big data available from set-top boxes to create more accurate TV audience measurement, Nielsen stands by using its tried-and-true panel as the ratings foundation. “The TV panel is still the underlying source of truth. It’s the check and balance for every piece of data we get,” Clark says.

A TV set, by comparison, “is a dumb device. Until a TV set is able to identify itself and give you a data set that identifies its relationship to everybody in the home, you can’t do it.” Set-top box data also flows with the volume of a fire hose and whether the TV set is on or off, she adds. For each cable operator, even a giant like Comcast, set-top box data is representative only of that operator’s footprint.

Nielsen says it does get census-level data from some digital viewing. But it is not practical to try to measure TV based on a digital methodology.

“You can’t start from digital and tack on TV. You have to start from TV and then build out or extend to digital,” Clarken says. “It’s still underpinning $70 billion worth of advertising, and it’s 90% of the viewing.”

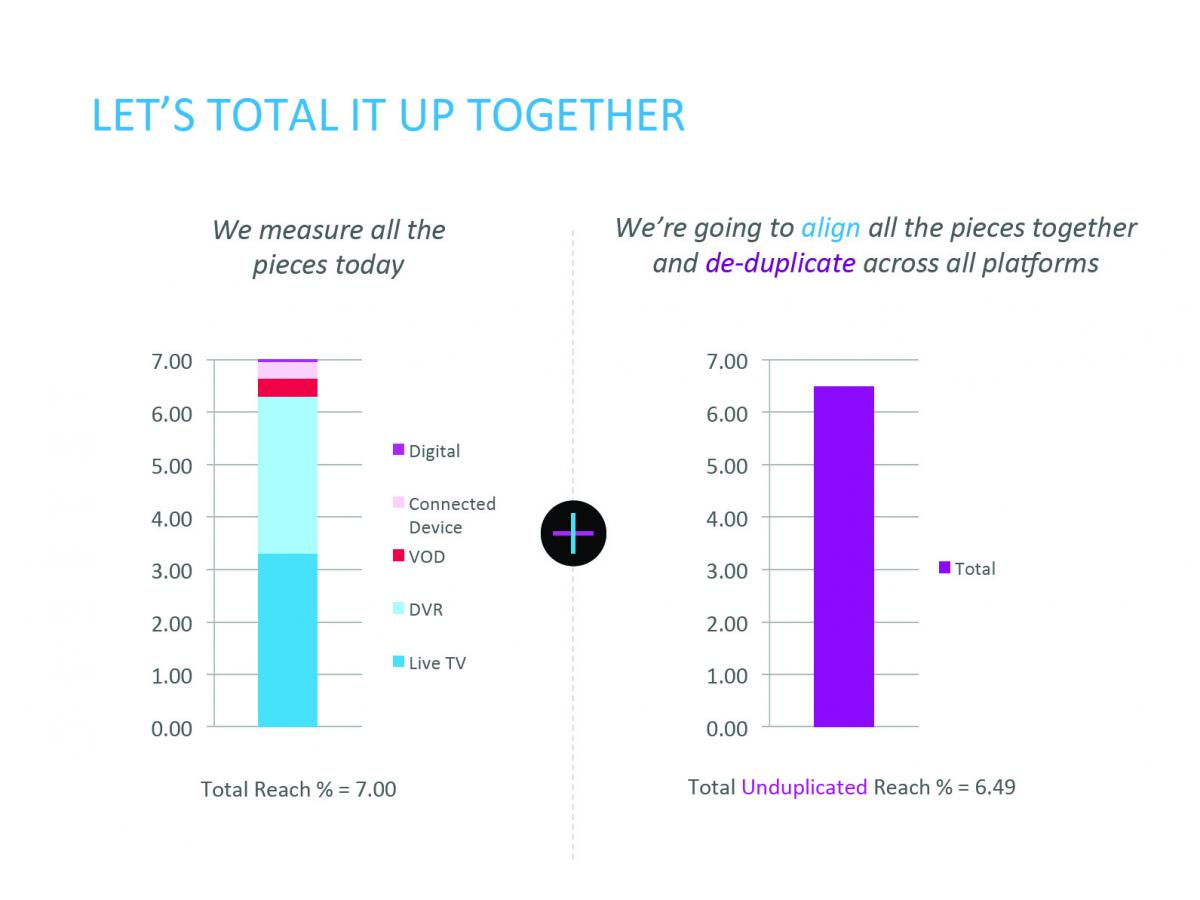

3. A Point Is a Point is a Point

Not only does Nielsen plan to count viewing of all video on all platforms, it wants to count them all in the same way, so a ratings point on TV is equal to a ratings point on a tablet or smartphone. Up till now, digital viewing has been counted in a number of ways, some of which seem to indicate huge amounts of online viewing—but don’t really measure up to TV.

Clarken pointed to the recent NFL game streamed by Yahoo. The NFL claimed an audience of 15.8 million viewers tuning in at one point or another, but that really didn’t compare to the average audience of 18.2 million viewers that normally watch an NFL game on TV.

“We have to make sure that we’re doing apple-to-apples measurement,” Clarken says.

That’s also important to marketers looking to decide between spending their ad dollars on TV and digital, Clarken says, adding that digital video sources want a level playing field as well. “YouTube has said to us they want to be able to use the same language as CBS and NBC,” she says.

4. Mobile Is Measured

Nielsen says it not only measures mobile video, but does a superior job of it. Nielsen’s system relies on having networks, studios and MVPDs embed software in their video players, whether browser-or app-based. “This means that now we’re doing census measurement, we’re counting every single video that we see,” Clarken says.

Getting the software into the players has been a slog, though Clarken says the pace has picked up recently. Still, there are some major media companies that haven’t been testing Nielsen’s software, and only a third of those that have are producing useful numbers.

At this point that mobile data is private. “They need to get used to the data and make sure it lines up with what they’re seeing inside of their internal server logs and are happy with that story. And we need to get a certain amount of penetration across the market before we syndicate that and everybody can see each other. And the aim for us is to make that happen during quarter one of next year,” Clarken says.

The only mobile data included in public ratings are those from CBS because of its CBS All Access product.

5. The Facebook Factor

One reason Nielsen likes its mobile ratings is because of its partnership with Facebook. When Nielsen’s software picks up identifying information about a mobile device, it sends it to Facebook, which is able to match that ID with its registration database.

“They’re the biggest mobile platform on the planet, and their ability to match that identifier with their registration database is second to none,” Clarken says of Facebook. That gives Nielsen age, sex and other info about mobile viewers.

“When we did the deal with Facebook about six year ago, we did it for that matching capability. What we didn’t realize at the time is they add another layer of power to this, which is their ability to de-duplicate,” she says, because while people have multiple mobile devices, they usually have only one Facebook account.

6. What’s the Currency, Kenneth?

A big issue for the TV industry is the decline in C3 and C7 ratings, the numbers used to buy advertising and guarantee audiences to marketers.

Clarken says industry set the rules for what viewing gets included in C3 and C7 back in 2006 and that Nielsen simply delivers the data. Those rules have caused the commercial ratings to become “unstuck” from content viewership, she says. The difference is accelerating with the adoption of dynamic ad insertion in shows on VOD and online.

While Nielsen will be providing more complete data about how many people are watching content across platforms, Nielsen won’t decide what the new ad currency will be.

Clarken says Nielsen met with ad buying and ad sales execs on Oct. 15.

“We threw a couple of options at them in terms of what this might do in terms of tweaking the currency…or making a more drastic shift toward something else,” she says. “What we heard from that room was that there was definitely a sense of urgency and momentum around getting this framework into the market so they could use it during 2016 and get used to the numbers. So they’re looking for a framework to be in place before the upfront.”

7. Solving the Netflix Problem

Consumers are spending a lot of time viewing Netflix and other streaming services with varying levels of commercial support. Netflix strips out the watermark Nielsen uses to identify programming, making measurement difficult. Nielsen is getting around that problem by creating a library of audio files—4,000 so far—to identify shows with no watermark.

It is important for studios to know how much viewing of the programs is happening on Netflix. Many media companies are reevaluating the SVOD deals they’re doing because of the damage they seem to be doing to the traditional pay TV business.

“There is an absolute need for them to get numbers from us so they can make better strategic decisions around whether or not there’s a trade-off here, whether they’re cannibalizing their ad revenue for subscription revenue,” Clarken says. “Without apples-to-apples numbers, they’re running blind.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.