5 Ways to Fix Viacom

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

Related: Dauman Defends Turnaround Effort

Viacom, as Mr. Krabs might say to SpongeBob SquarePants, has “that smelly smell of something that smells...smelly.”

A week after Viacom’s board rewarded CEO Philippe Dauman with the official title of chairman, shareholders blasted the stock to new lows. Despite reporting lower earnings and profits, Dauman insisted the company was on the right course under his leadership.

Viacom, make no mistake, is struggling. Ratings for its stable of cable networks, including Nickelodeon, MTV and Comedy Central—once the envy of content companies worldwide—have deteriorated as young viewers who once flocked to those cool channels have turned to the next big things in streaming video and other forms of online digital entertainment. The lower ratings have put pressure on ad sales, which have declined faster—and further—than its competitors’.

The lower ratings have sapped the must-have mojo from the networks as distribution contracts with cable and satellite operators come up for renewal. Its networks have been dropped by CableOne, Suddenlink and a handful of other smaller cable systems that say subscribers hardly miss them. I want my MTV? Not anymore.

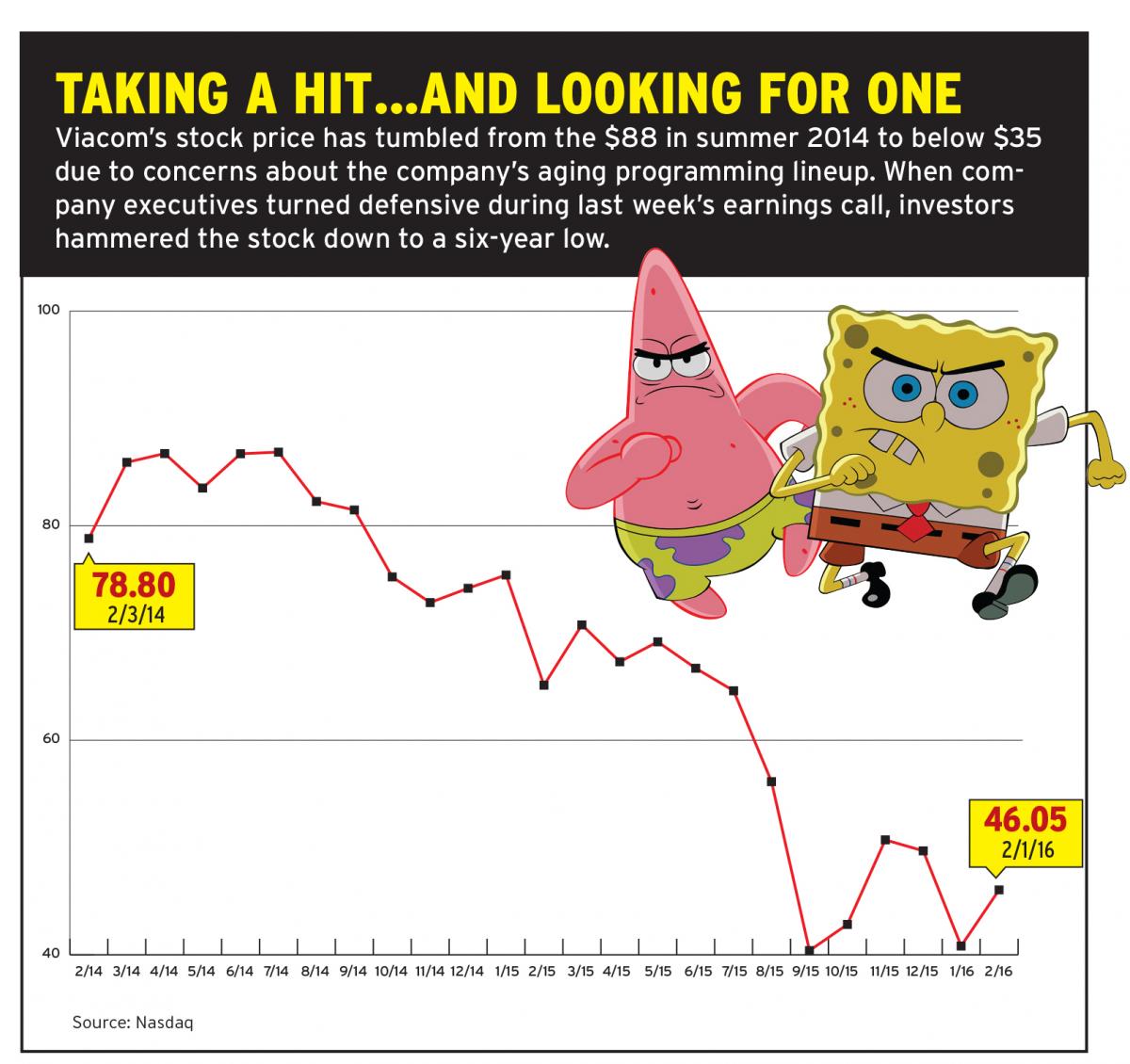

The sales pressure, in turn, has sent the stock price tumbling—to $35.15 on Feb. 10, a six-year low—as investors have cried foul and analysts openly questioned the embattled chairman on the latest earnings call. Amid the gloom, Dauman announced Viacom has a short-term carriage agreement with Dish Network, which had been rumored to drop the weakened networks at any moment. Still, a long-term deal is likely to have less-than-favorable terms, and analysts have lowered projections for affiliate revenue.

To be sure, pay-TV business has turned cold across the board for all content companies. At mighty Disney, its Jedi Master CEO Bob Iger is also giving frustrating answers on a quarterly basis about subscriber trends and climbing programming costs.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

But Viacom is in the crosshairs now, partly because of its recent financial performance, a bleak longer-term outlook and the turmoil surrounding impending ownership changes, created by the frail health of the once domineering 92-year-old chairman and controlling stockholder, Sumner Redstone.

Redstone’s health has declined and his ability to make decisions has been challenged in court by former live-in companion Manuela Herzer, who was evicted from his house and lost a $60 million bequest when his will was changed. Investors question who ultimately will be in control of Viacom not so long from now and what the uncertainty means for shareholders. And more than poor performance, Wall Street loathes uncertainty.

Related: Meet David Andelman, Who Might Decide Philippe's and Les' Future

Dauman has spelled out a strategy of investing in programming, finding data-driven ways to sell ads and monetize content, controlling costs and expanding internationally. While that blueprint seems similar to what other media companies are aiming to do, Viacom’s execution seems to be lacking.

“If status quo turns out to be an accurate representation of reality, then it could serve as the biggest long-term risk factor for the company,” Barclays analyst Kannan Venkateshwar said in a report.

That makes it a good time to look at Viacom and create a game plan to fix it. Here are five steps investors and analysts are talking about.

1. Change the Management

The 61-year-old, newly named chairman and longtime consigliere of Sumner, Dauman has weathered a storm of criticism from virtually every corner of Wall Street in recent weeks. “Wholesale leadership change is needed now to change [Viacom’s] non-creative culture,” activist shareholder SpringOwl Asset Management put it bluntly in calling for the removal of Dauman and his top lieutenants.

Beyond programming, SpringOwl points to strategic mistakes, from selling its stake in digital darling Vice Media, to suing YouTube rather than embrace its young users, and selling programming to Netflix, creating a long-term threat in exchange for short-term revenue.

Under Dauman, Viacom is investing in stock buyback instead of digital assets, a questionable strategy when your stock is heading down.

And while the stock fell, his compensation has remained among the highest in the media business. For 2105, Dauman received total compensation of $54.2 million, including a stock award of $17 million for extending his contract. Over the past three years, Dauman has been paid $135.7 million.

2. Hire New Talent

Many of the executives responsible for making Viacom’s brands hip have left the building. The sensibilities of Tom Freston, Brian Graden, Van Toffler and others—the ability to put a finger on the zeitgeist of the most fickle audience in television—haven’t been replaced.

Where to find new talent? Viacom stock holder Mario Gabelli suggests buying AMC Networks, which has a string of recent hits including The Walking Dead. Or perhaps with Dauman out of the picture, Viacom could be reunited with CBS under Leslie Moonves, who has a record of programming success.

Dauman says he’s ramped up programming spending and that ratings are starting to improve at some of Viacom’s networks. But the company can point to few successful franchises created by Viacom networks since Dauman was named CEO in 2006. South Park still rules on Comedy Central. And while Nickelodeon’s ratings have improved since Alvin (based on a character created in 1958) joined the lineup, analyst Todd Juenger of Sanford C. Bernstein notes that the kids network’s program schedule is “now almost entirely SpongeBob and Alvin” and asks if there’s a risk of fatigue.

Viacom says it’s hiring, but its networks need stars. Jon Stewart was once the face of Comedy Central and the most trusted man in news. His replacement Trevor Noah hasn’t had the same impact during this election season. And in his first month, ratings dropped 32% among adults 18-49. On Viacom’s conference call, Dauman noted that Noah’s ratings have built in the last three months and was the most-watched talk show with men 18-34.

3. Push Digital—And Metrics

Viacom has gone in for big data and its brands have substantial footprints online and in social media. Following viewers into the digital world ought to be priority for Viacom. Other media companies have pushed new over-the-top service harder and have invested in companies like Vice, Vox and Buzzfeed.

The company has brought in a cadre of data scientists and introduced ad products like Viacom Vantage and Viacom Velocity designed to sell advertising on metrics the company creates, rather than those of Nielsen, which the company believes sells it short. The company says 11 major advertisers are using Vantage and that number will triple this year. But Viacom has to make those relationships pay off in higher ad revenue and convince Wall Street that its ad revenue problem was a result of faulty measurement rather than the potency of its programming.

Some are skeptical that digital can make Viacom the choice of a new generation.

“The old business of serving kids/teens with linear TV networks is doomed,” said Juenger. “The new business of serving kids/teens with on-demand, digitally delivered entertainment is unlikely to be won by Viacom, and even if they do, the economics are vastly inferior to the 40%” margins in the cable business.

4. Ensure a Smooth Transition

Investors were disappointed when Dauman was elected chairman of Viacom over Shari Redstone’s objections. But that fight was just the beginning of the battle for Sumner Redstone’s media empire. When Redstone dies, his assets are supposed to go into a trust. Control of that trust will be the next battleground. In one corner is Dauman.

In the other is 61-year-old Shari Redstone, who ran the family’s theater chain and is vice chair of CBS and Viacom. Both are trustees and both have allies among the other five who will have votes. What will happen next has been the source of speculation swirling around the company.

“Part of the explanation for the stock’s chronic under-performance in our opinion relative to its peers is lack of clarity around the succession plans for Sumner Redstone,” Spring Owl said.

Neither a guessing game nor a protracted battle for control between Dauman and Shari Redstone would be helpful to a company that must focus on rebuilding its business. Unless the transition is clear and decisive, the company could lose more trust on Wall Street and its already depressed stock could plunge lower.

5. Sell Assets, Or the Company

To make investments in programming and digital, Viacom might need to sell assets. The Paramount movie studio might be available. Gabelli suggested selling a piece of it to China’s Alibaba Group, and Marci Ryvicker, analyst at Wells Fargo, noted that on the earnings call “we felt a little bit like CEO Dauman was ‘selling’ the studio—to anyone who might listen.”

RELATED: Redstone Moves Could Spark Industry Consolidation

But the best course might be to sell the company.

“Viacom has been in turnaround mode for such a long period of time that the market has clearly run out of patience,” said Ryvicker after last week’s earnings report and the 21% drop in Viacom’s stock price.

The trick might be finding a buyer for a company whose key assets are a collection of cable networks that are losing viewers.

With the stock slide, Viacom’s market value was about $12.4 billion last week.

Even at that price, shareholders might not be able to count on M&A to bail them out. “We don’t see enough asset value there to cash out Viacom equity holder at a meaningful premium to the stock price,” said Juenger.

He doesn’t believe any companies in media or Silicon Valley would have a desire to acquire linear networks in this environment. Paramount and Channel 5 in the U.K. might attract buyers, Juenger says, and “once those assets were sold, then what do you have” he asked.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.