Shrinking Media Industry Scrambles for Tech Talent

Employee turnover is higher than usual, PwC survey finds

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The television industry’s pivot to streaming is contributing to a new talent-management headache for senior media company executives.

In addition to having to wrangle the legendary egos of actors and the high-profile producers and directors who make the hits that make the cash register ring, technology talent are the industry’s new stars, according to a report from PwC.

Traditional media companies have been downsizing and consolidating at breakneck speed as cord-cutting and COVID cut into traditional revenue streams. Outplacement firm Challenger, Gray & Christmas said the media industry shed 30,711 jobs in 2020, up from 10,201 jobs the year before.

At the same time, there is still strong demand for certain skilled positions — some of them new to the telecom, media and technology (TMT) sector — and retaining those people is a top concern, according to PwC.

“Competition for TMT talent is as fierce as ever, with more than 90% of TMT leaders reporting higher-than-usual turnover,” the PwC report said.

Boom for Tech Workers

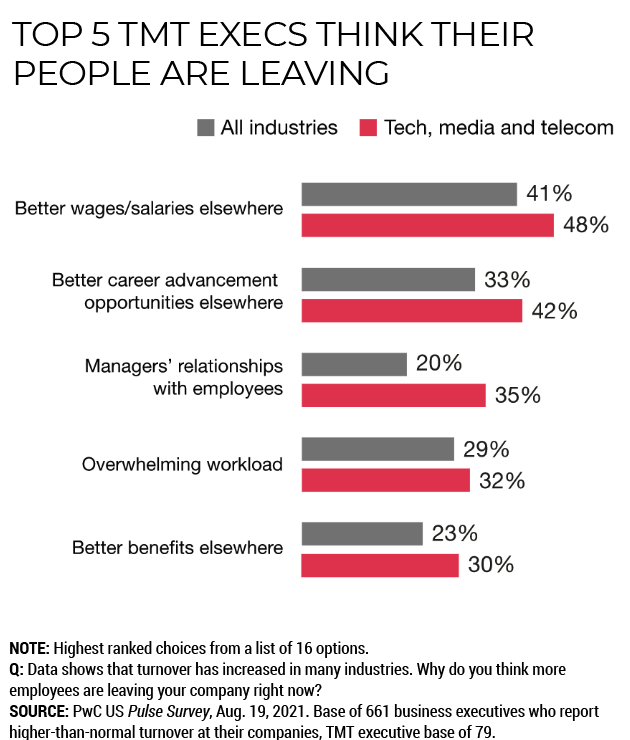

“More than other sectors, however, TMT workers are benefiting from the pandemic-related tech boom,” the report continued. “They’re switching jobs for higher salaries (48% of TMT executives versus 41% in all industries), top-notch benefits (30% versus 23%), upgraded career advancement opportunities (42% versus 33%) and improved relationships with managers (35% versus 20%). To compete for talent, TMT leaders are shoring up career-development opportunities (47% versus 34% overall) and offering flexible schedules (49% versus 43%).”

Mark Borao, Technology, Media and Telecommunications partner at PwC U.S., told B+C/Multichannel News that the media companies accelerated the hiring of technologists in order to launch streaming platforms. But they continue to seek tech expertise in order to increase the efficiency of both their new and legacy businesses.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Borao, who had helped media companies launch streaming businesses, noted that many legacy media companies “hollowed out” their traditional broadcast and cable businesses, putting their assets into their streaming business.

“There’s a narrative of media companies grabbing tech folks to launch these platforms, or to enhance an existing platform that needed work,” Borao said. “That was definitely a 2019, 2020 narrative.

“Now, what you’re seeing is now that they’ve launched these platforms, they’re looking at other processes they can put in the cloud and do more efficiently,” Boroa said.

After years of mergers, some media companies have hundreds of analog systems handling content. That industry consolidation will continue, he said.

Seeking Heads in the Cloud

The people media companies are looking for now are digital natives who think cloud-first, he said, calling them business technologists.

“They’re people who understand this digital thinking and can lay out the processes, lay out the organization and a model that is exponentially more efficient than the analog modes,” he said. “The cloud has changed the game for them.”

Media companies used to have to poach that talent from technology firms. Now, they are hiring away from other media companies, offering higher pay and better titles.

“I have a handful of clients that I personally work with who all in the past 90 days have moved from one media company to another because their skill set is in high demand,” the PwC exec said. “All of them got either title increases or significant pay increases. They’re effectively cashing in on those skill sets and those accomplishments.”

Borao said these weren’t top-level executives. “I’m talking about director-

level people, senior managers. It’s one thing to have a vision. It’s quite another to be able to execute on that. What I’m seeing is a good thing. We’re seeing high demand for those operators.”

The ability to use technology to legacy processes and the ability to be forward-looking about new business models will continue to be valuable, he said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.