YouTube TV Launch Marks Key Point for Pay TV

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

With Google having thrown its hat into the linear streaming ring with its YouTube TV service, analyst Craig Moffett of MoffettNathanson Research figures it’s time to take stock of the pay-TV landscape.

The drop in pay-TV customers has “meaningfully accelerated,” Moffett said in a report Wednesday. The big distributors that have released their fourth-quarter earnings finished 2016 down 1.7%, with the steepest declines coming in the fourth quarter. That drop was helped by the high-profile launch of AT&T’s DirecTV Now in December.

For programmers, to some degree the drop is being offset by the launches of virtual multichannel video programming distributors, including Google’s YouTube TV, which was formally unveiled Tuesday, Moffett said.

Moffett says the main thing that we have learned from the decline in traditional pay-TV subscribers and the rise of cheaper digital alternatives is that price matters above all else to consumers.

That means the low, low prices that the digital MVPDs are offering, in the $30 to $40 per month range—is attracting customers away from pay TV.

That price level might not be profitable. For AT&T DirecTV Now, the price was promotional and temporary.

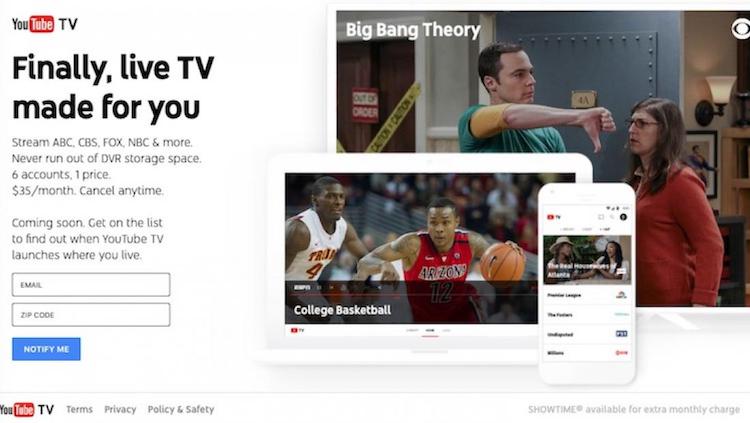

But YouTube TV’s $35 price tag does not appear to be going away. (At that low price, YouTube TV does not include networks from Time Warner, Viacom, Discovery, Scripps Networks, AMC Networks or A+E Networks.)

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Moffett says the stage is set now to answer questions about the new world that includes digital distributors.

- Will YouTube TV grow the market, take share from traditional pay TV, or share away from Sling TV and DirecTV Now?

- Will sports fans sign up for YouTube TV if it doesn’t have Time Warner?

- Will cable operators be insulated by broadband pricing?

- What is left for Hulu to do?

On the programming side, MoffettNathanson sees the industry being divided into have and have nots, with the haves owning rights to live sports, news and event programming, while the have nots have repeat, random, low-intensity content.

The haves will be in the skinnier bundles, the have nots won’t be in all of them, he notes.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.