Zombies Mean Green

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The Walking Dead is a monster. The AMC series, which was scheduled to return for season 5 on Oct. 12, is the highest-rated drama on TV in the demo that’s most important to advertisers, adults 18-49. Commercials on The Walking Dead are the most expensive for a scripted show on TV, despite the lower rates that most commercials on cable get compared to those that air on a broadcast network.

While zombies are clearly good business, the magnitude of their impact on AMC’s fi nancial fortunes—and the profits of parent company AMC Networks—are sometimes overlooked.

At financial conferences, AMC Nets CEO Josh Sapan has taken to comparing Walking Dead’s viewership to the NFL’s to remind analysts and investors just how enormous it is. “If you’re not a fan of it you may not be paying attention to it, but it’s the biggest show in America,” Sapan told investors last month. “Zombies are thriving and show no signs of atrophying notwithstanding that they’re not looking well.”

AMC built its reputation for high-quality original scripted programming with Mad Men and Breaking Bad. Those shows have won a lot of awards and gained a lot of attention. When Walking Dead also became a hit, AMC had a big three. With Breaking Bad ending last year and the Mad Men finale scheduled for 2015, Wall Street became concerned about how AMC would fare without them. (AMC is going to stop developing and producing new unscripted shows. “We have decided to make scripted programming our priority,” the network said.)

But from an economic perspective those fears seem out of proportion because while Mad Men and Breaking Bad racked up Emmy Awards and Golden Globes, The Walking Dead mints money. That money gives AMC breathing room to develop new shows and have patience with them, even when ratings aren’t sterling.

As one wise network executive notes, TV shows end for a reason. When series get to the age of Mad Men and Breaking Bad, costs rise as actors demand higher salaries and the studios seek larger license fees. That makes it hard for a network to make a profit.

The Walking Dead is an expensive program to produce, with a large cast, loads of special effects and high production values. But because AMC owns the show, it is in control. (Characters are regularly killed off, which helps keeps actor salaries down.) With ownership, AMC also controls ancillary revenue, including streaming, syndication, international sales and consumer products—something that most analysts know, but don’t always appear to take into account when they fret about AMC’s Big Three becoming a Big One.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

It’s as if the analysts are watching a 3-on-3 basketball game focusing on the flashy point guards while hardly noticing that Wilt Chamberlain is on the court. Once they spot the big guy, they fret that while he’s averaging 50 points a game this season, what happens when those numbers dwindle or when he retires?

“The numbers kind of spook people in the investment community because they’re just so large,” Sapan told investors. “How much bigger and better can it really get?”

Dead Keeps Killing It

The Walking Dead is indeed putting big numbers on the board. Season 4 drew a 9.6 rating among adults 18-49. And Talking Dead was TV’s seventh-highest-rated show in the demo, according to Ratings Intelligence.

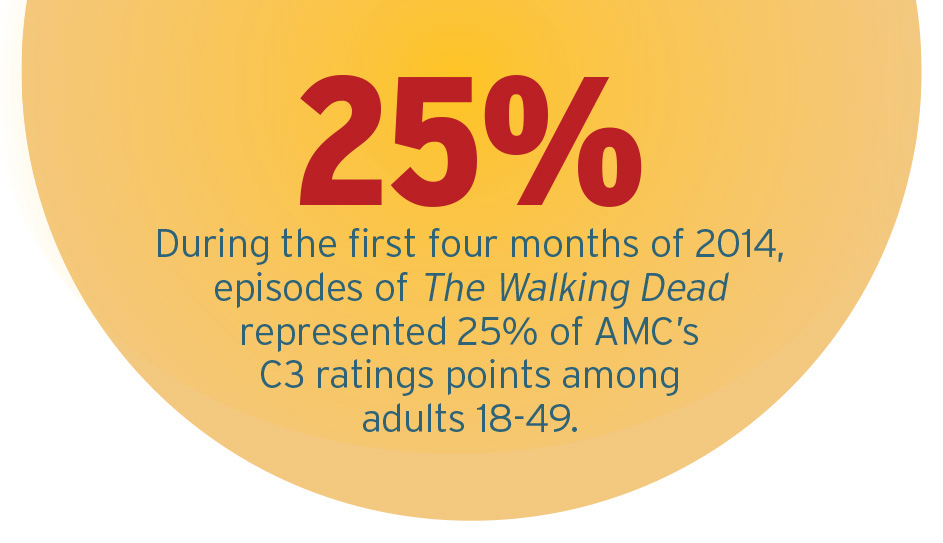

During the first four months of 2014, episodes of The Walking Dead represented 25% of AMC’s C3 ratings points among adults 18- 49, according to analysis of Nielsen data by MoffettNathanson Research. The series was only on the air three of those four months. No other original series on AMC accounted for more than 2% of AMC’s ratings points. (In all of cable, only a few shows, including Sponge- BobSquarePants on Nickelodeon and The Big Bang Theory on TBS, have shares that large.)

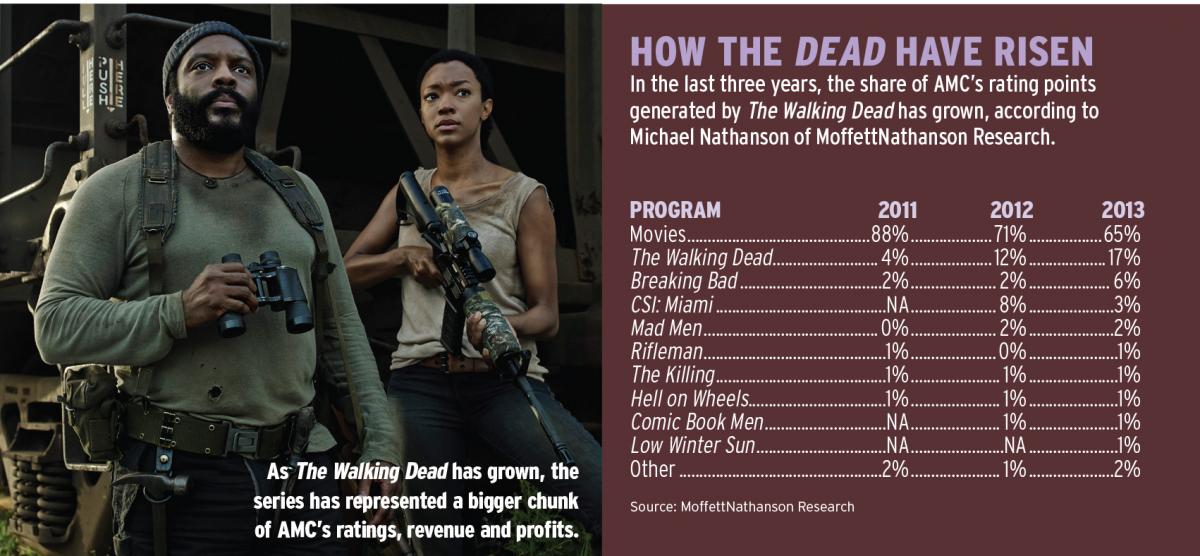

For all of 2013, Walking Dead accounted for 17% of AMC’s rating points, dwarfing the 6% generated by the acclaimed final season of Breaking Bad. Mad Men again represented 2% of AMC’s rating points.

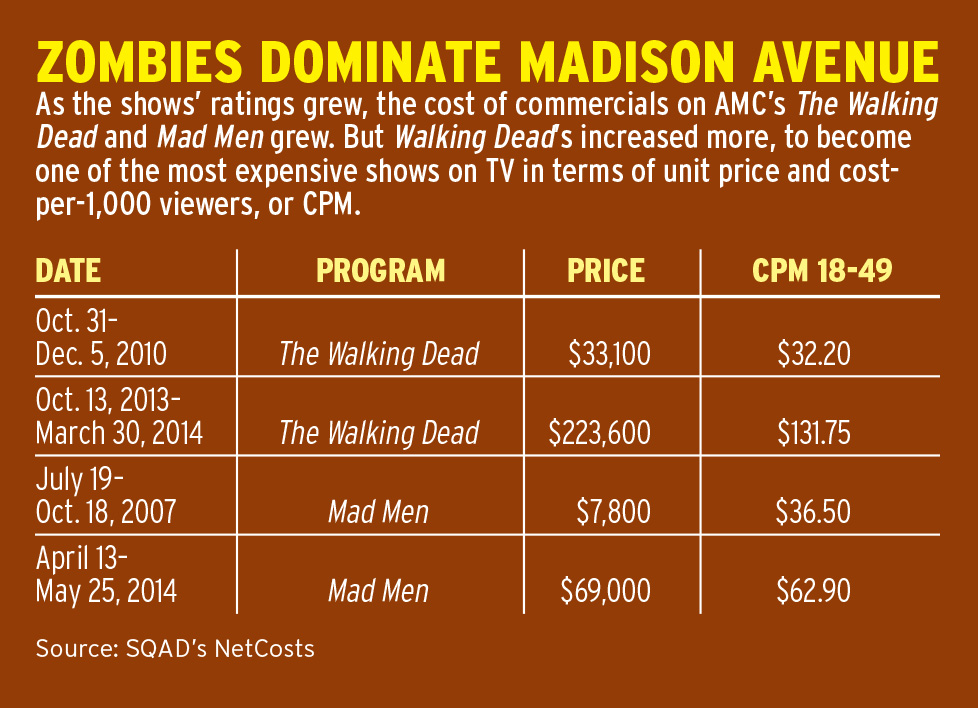

Advertising rates have risen as well. In its first season in 2010, 30-second spots in The Walking Dead cost $33,000, according to SQAD, which draws its data from the media invoices of most of the largest advertisers. Last season, spots sold for $223,600 according to SQAD. During the upfront, this season’s Walking Dead inventory sold for upwards of $400,000, putting it in the league with the NFL.

By contrast, spots in last season’s Mad Men, billed by the network as the most upscale show on TV, cost $63,000, up from $8,000 when the show was brand new in 2007.

To maximize how much it will get for spots in the last episode of Mad Men, AMC is selling some of those spots in a package with a Walking Dead spot. Total cost of the package—dubbed Brains and Brawn—is north of $1 million Analyst Michael Nathanson of MoffettNathanson Research figures that The Walking Dead generates about $120 million in ad revenue, not counting Talking Dead, or 20%-25% of AMC Networks’ total. In quarters when The Walking Dead is on the air, AMC Networks’ cash fl ow is 25% higher than when it’s not on. Nathanson said that while it’s hard to allocate items like subscriber fees directly to Walking Dead, he estimates the show generates a profi t of $50 million to $100 million.

Speaking to an investor conference in September, Sapan noted that some science fiction franchises slip the normal bonds of time, such as Dr. Who, which is marking its 50th year on the air. “What that creates certainly the hope for is that in genre material, Dr. Who, Star Wars, Star Trek, and on, there are qualities that seem to be sustainable for a much longer period of time and larger audience than nongenre areas. There really aren’t standard dramas that go on for those sorts of durations,” he said.

“We’re treating this as a franchise and I hope we treat it with the care and the opportunity that allows it to have an extremely long life. And that’s what guides us,” Sapan added.

How much can a high-rated, long-running franchise make? CBS CEO Leslie Moonves often tells investor conferences that his company has figured out how to take CSI and NCIS and turn them into franchises that have generated $2 billion in profits. A couple of years ago, Moonves said that Hawaii 5-0 was on its way to becoming a $1 billion franchise. The formula includes owning the show so that CBS can maximize—and keep—ad revenue, syndication revenue, international revenue and digital revenue.

In some ways, The Walking Dead can follow that blueprint.

Take spinoffs. In addition to Talking Dead, AMC is developing a companion series to The Walking Dead. Last month, the network ordered a pilot for the series, which is being created by Walking Dead executive producers Robert Kirkman, Gale Anne Hurd and David Alpert. The show will be set in a different location with a new cast of characters. The new show is set to go into production later this year and could go on the air in 2015.

AMC has also sold The Walking Dead for digital streaming and is getting $800,000 per episode from Netflix, according to a source. AMC believes that putting its series on Netflix a year after they appear on cable can help boost ratings for new episodes.

But in other ways, it appears it will be difficult for the zombies to approach the CBS shows’ financials. Earlier this month, The Walking Dead began to run in syndication, appearing on MyNetworkTV. In its first airing on Oct. 1, the show drew a 0.5 rating among adults 18-49, the best premiere ever on the weblet. AMC is not getting a cash license fee from MyNet, and instead did a barter deal in which revenue will depend on ratings and ad rates.

Syndication to other cable networks, a lucrative business for broadcast shows, is unlikely with The Walking Dead, until much later in the show’s lifespan, if ever.

Internationally, The Walking Dead is distributed by Fox and appears on Fox International Channels, where the new season is premiering in more than 125 markets on Oct. 13. The show has tripled its numbers on the Fox networks since its launch.

Regardless of how much money AMC makes from its international deal with Fox, it might have been better for AMC to be able to put the show on its own international channels that it has acquired and is rebranding.

Nevertheless, Nathanson says, “It’s an amazing show and great for business. Everyone’s looking to create their own Walking Dead.” —with reporting by Paige Albiniak.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.