Women Influence the Remote As Well As the Cash Register

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

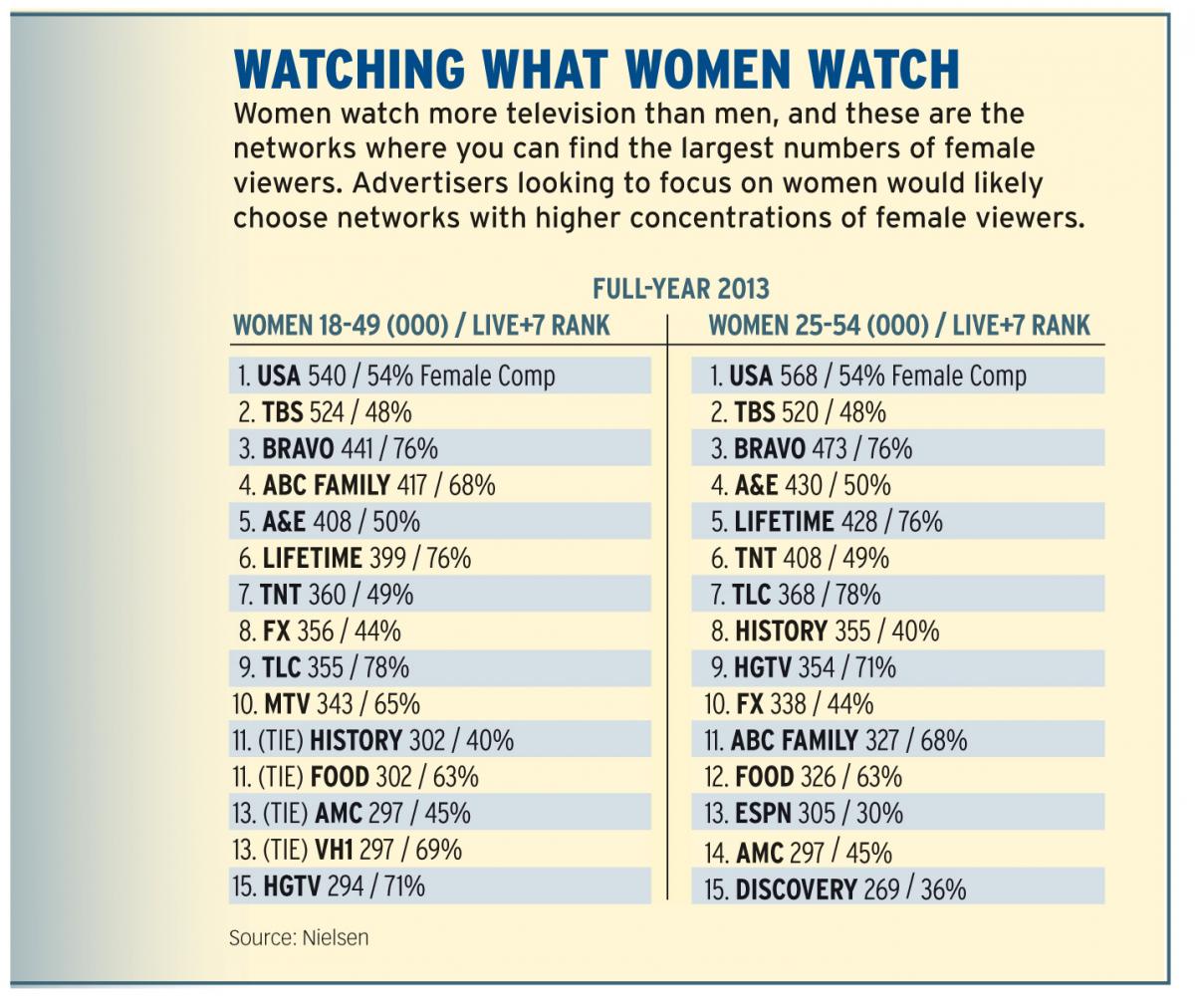

The influence of women extends to both what shows on television get watched in households and what products advertised on TV get brought home. That influence has expanded from the days when housewives were targeted via daytime dramas, those soap operas coming loaded with spots for the latest washday miracle. Now women are drawn to a variety of programming genres and are acknowledged as decision-makers when it comes to products including automobiles and financial services, once bastions of masculine rule.

Control of the remote control has historically and anecdotally been a man’s prerogative. But in new research by Magid Generational Strategies, even husbands give their wives credit for influencing what they watch. And the influence grows with each generation.

Baby boomer wives have influence over what’s being watched in their homes, according to 54% of boomer husbands. Only 50% of boomer wives credit their husbands with influencing decisions about what’s watched. In Generation X households, 69% of husbands say wives have influence over TV show selection while 61% of Gen-Xer wives says their husband influences them. And among millennials (who are now all adults in the key 18-49 ad buying demographic) 74% of husbands say their wives are involved with deciding what TV shows they watch, while only 61% of millennial wives credit their husband for influencing program choice.

“These millennial wives do a lot to wield that influence—more so than their husbands—so you could argue they’re putting more effort into it, which is important to a network or content creator,” says Sharalyn Hartwell, executive director of Magid Generational Strategies. “These are ones you want to win over; they’ll bring more to the party.”

Millennial women’s influence over TV viewing extends beyond their husbands. Compared to her husband, the millennial wife is more likely to “like” shows on Facebook and recommend shows on other social media sites like Twitter or Tumblr.

They also send emails about shows and send links to the show’s website and even links to commercials for the show.

“We really see this as an extension of the empowerment so inherent in this generation of women. Not only that these women are empowered, but their male peers are basically OK with it,” Hartwell says. Women are empowered when it comes to consumer spending as well.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Think about how women have changed and how their role has changed and their place as opinionmakers and their place of economic power,” says Mel Berning, president for ad sales at A+E Networks, which owns Lifetime, a network that has targeted women as viewers and consumers for 30 years. “The most amazing thing that we’re seeing is the amount of spending power and consumption that women and an audience like Lifetime’s represents in the marketplace.”

Purse Power

According to 2013 figures from GfK MRI, women control $701.5 billion in spending power, or about 52% of total expenditures across all categories.

Not surprisingly, women control more than 60% of spending in categories including health & beauty aids, children’s toys and games and retail. They also account for at least half of the spending in home improvement, cell/mobile phones and restaurants. Even in some traditionally male-skewing arenas, female influence is catching up. Women account for 48%, or $229 billion, in the key car category; 49% of electronics purchases ($34.4 billion); and 50% of credit/debit card choices.

Don Robert, senior VP of research at A+E Networks, notes that two-thirds of business owners are women. “That to me is a very surprising stat,” he says.

It’s no wonder that part of Lifetime’s presentation to ad buyers is called “Power of the Purse.”

“It’s all of that kind of big aggregate data that we’re really now starting to walk into the agencies, the planners and the clients’ offices to talk about the overall spending power of women,” says Berning. “There are just astounding percentages of wealth, and really the buying decisions that we’re looking to influence when we talk to that audience.”

Though women have become more important consumers in more categories, those advertisers have not shifted their sights to aim simply at adult audiences. “My impression is that the demographic targets have not changed dramatically,” says Berning. “We still do roughly the same percentage of business across the portfolio on women and adults that we did. Within those targets, there’s probably some hyper-targeting that’s going on at the planning level. But I’m not noticing an overall shift of advertisers away from the women’s demographic. It is a huge and important demographic.”

Lifetime has been refreshing its brand and its programming mix to reach these high-power women. Once known for its women-in-peril made-for-TV movies, it programs across a variety of genres, including new scripted series such as Devious Maids and Witches of East End and reality shows such as Dance Moms.

“What’s that done is that it’s given us a broader reach. More women will come to us because they’re expecting that more in life, just like they do outside of television viewing,” Berning says.

Lifetime has also benefited by making its programming available online and via apps. “We already see Lifetime getting more viewership on the viewer’s schedule,” Robert says.

One thing that has not changed is that a lot of women watch syndicated programming.

According to the Syndicated Network Television Association, at least three of the top 10 highest-rated shows each weekday air in syndication. Over the broadcast day, syndication generates 66% of women in the 25-54 demo. And the price is much more efficient.

The SNTA points to an example of a food company that buys network primetime and gets 26.1 million impressions among women 25-54. If that advertiser spent 80% of its money on network prime and 20% on syndicated sitcoms and entertainment news shows, it would increase its impressions by 14% to 29. 8 million and its reach by 12%.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.