Wheeling Dealmakers

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

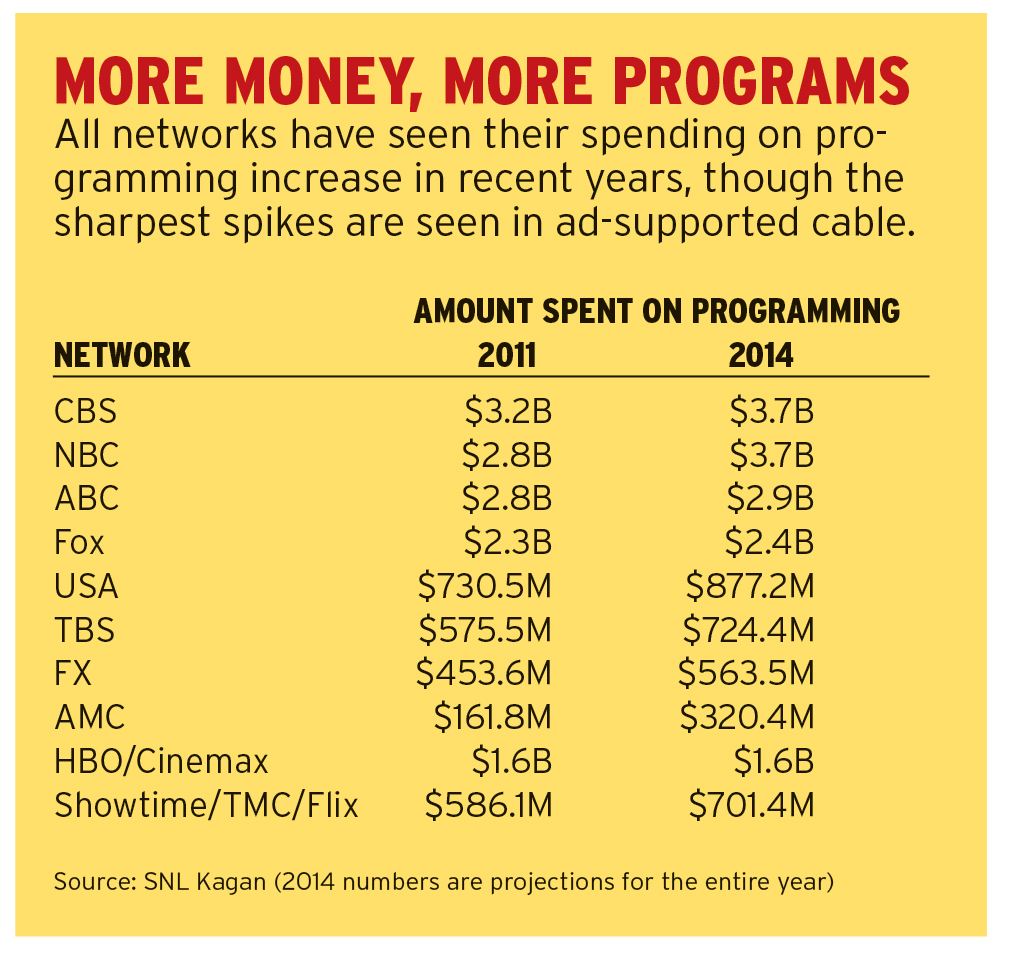

Network spending on television programming is surging. According to an estimate from SNL Kagan, this year the Big Four broadcasters will spend $12.6 billion on programming costs—up 14% from 2011. In cable, the growth tends to be more accelerated. USA Network will spend an estimated $877 million this year, up 20% from 2011. AMC will spend $320 million this year—up 98% over the same period three years ago.

Then there is the digital over-the-top space. In 2011, Netflix endured its New Coke moment when it announced that it would spin off its DVD-by-mail business, then backtracked from that plan three weeks later. Today, Netflix is a celebrated player in TV programming, earning 31 Primetime Emmy Award nominations last month for its original programming, and striking ambitious streaming video-on-demand syndication deals, such as the one announced in July for CBS’ forthcoming Zoo. Amazon and Hulu have also been ramping up their own originals and SVOD deals.

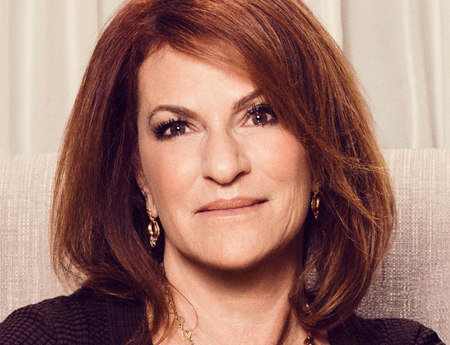

The increased activity and competition is, according to Sandra Stern, COO of television for Lionsgate, forcing executives to become more creative dealmakers. While the pie is bigger, it is being sliced up in more intricate ways than ever.

“In the old days, you would make a network deal, and you made another deal with a broadcaster 10 years later—other than the money, the deal would look exactly the same,” says Stern. “It was a fairly consistent universe.” Now, she adds, “It’s a brave new world.”

Stern is one of several executives who are attempting to navigate that brave new world by crafting deals that would have been hard to envision only a few years ago. Here is a sampling of some of the more innovative transactions and their architects:

Rich Ross, CEO, SHINE AMERICA Gracepoint, Fox

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Ross estimates there are currently around 50 U.S. outlets buying scripted dramas—good news for his Shine America, which has had recent success adapting dramas from other divisions of globe-spanning Shine Group into series for the American market.

Shortly before Ross joined Shine America in 2012, he sat down with Jane Featherstone, CEO of Shine U.K. production company Kudos. With The Bridge, adapted from a Danish-Swedish series, already headed to FX, Ross wanted to see what else was in the parent company’s pipeline. “In the mix was a number of properties— Utopia, Broadchurch and a project called Mayday,” he says.

Utopia is now in development at HBO with David Fincher producing, and Shine is in talks with a U.S. network on Mayday. Broadchurch was actually the first of the shows to come to fruition, with Fox in August 2013 ordering an American adaptation to be titled Gracepoint, set to premiere this fall. Broadchurch creator Chris Chibnall helped pitch to Fox and wrote and produced the adaptation. Featherstone also helped pitch and produce.

Ross and Shine America executive VP of scripted programming Carolyn Bernstein courted Chibnall and Featherstone big-time. Both the creator and the U.K. executive have financial stakes in the U.S. show, indicating the importance talent plays in securing certain network deals.

“They’re incredibly invested [in Gracepoint], frankly, at all levels.” Ross says. “They’re invested emotionally and invested financially. I think both of those are important.” He adds, “No business model or corporate structure is in place to circumnavigate the real heart of [the question]—do you want to work together?”

The successful recruiting of talent such as Chibnall and Fincher has helped Shine build prestige and grease the wheels for subsequent deals. And the large number of outlets for scripted drama has not made Ross’ job as a seller more difficult. Multiple networks competed for Gracepoint, The Bridge and Utopia. “When we go and look for homes, there are a lot of them,” he says.

Gary Newman, CHAIRMAN AND CEO, FOX TELEVISION GROUP AMERICAN DAD!, TBS

Newman is only two weeks into his new job as chairman and CEO, alongside counterpart Dana Walden, of Fox Television Group—a move that gave the longtime Fox studio chiefs additional oversight over Fox Broadcasting. It also came one year after the announcement in July, 2013 that animated series American Dad!, produced by 20th Century Fox Television, would move from Fox to TBS in late 2014 for its 11th season.

“I don’t know, necessarily, if our decision would have been different than the one that [former Fox Entertainment chairman] Kevin Reilly made, but I do know that the process would be different,” Newman says, noting that he and Walden would “be making a holistic decision,” weighing both the impact for the studio and network of renewing or canceling a series.

“Having seen the ratings this summer for American Dad!, I wish we still had it on the network,” he says—adding that when he’s wearing his “studio hat,” he’s glad to be in business with Turner on the show.

Series finding new life on second networks is not a new phenomenon. TBS became the home of Cougar Town in 2013 following three seasons on ABC. Now digital players such as Yahoo—which in June struck a deal with Sony to host a sixth season of erstwhile NBC comedy Community—have entered the fray. But for studios, such moves are not without challenges. For instance, 20th Century Fox had to bring down costs on American Dad!, a task made more difficult by having to amortize fixed costs over a shorter episode order. But a change in network remains an attractive way to extend the life of a series, expanding the library and thus the long-term value of the property to the studio.

“There are situations where you have a show that is better suited to a network that doesn’t require quite as broad an audience,” Newman says. “Sometimes you can move a show that is essentially failing on a big broadcast network and it can work very comfortably on a niche audience on a smaller network.”

Sandra Stern, COO, LIONSGATE TELEVISION MANHATTAN, WGN AMERICA

Manhattan, the second original scripted series for WGN America, is produced by Lionsgate, Skydance Productions and WGN parent company Tribune Media. The order for the series came through in September, 2013. More than 10 months later a fourth piece of the puzzle was added. One day after the series premiered July 27, the producers announced a deal that would give Hulu the rights to stream each episode to Hulu Plus subscribers one day after its initial WGN telecast.

“I don’t know—but I’d like to get to know—too many other networks that would have taken down the wall of exclusivity in favor of a next-day airing on a digital platform the way that WGN did,” Stern says.

More than money motivated WGN to sign off on the Hulu deal, according to Stern. The network, looking for footing with viewers who may still associate it most closely with Cubs games, is hoping that Hulu can do for WGN what Netflix did for AMC with Breaking Bad and Mad Men—direct viewers to the network telecast. In a unique move for Hulu, streams of Manhattan will include imbedded promos designed to drive viewers back to WGN.

The Hulu deal includes risk for WGN, and, by extension, its producing partners, should viewers like Manhattan enough to watch it on Hulu at their convenience but not enough to watch it Sunday nights on WGN. But the potential reward for all involved, if Manhattan grows into a hit, is sky high.

“We try to handcraft the deal for the particular show,” Stern says. “In this case, we handcrafted the Hulu deal to address WGN’s needs, and WGN’s needs were promotion as much as money.”

Steve Stark, PRESIDENT, TELEVISION PRODUCTION AND DEVELOPMENT, MGM FARGO, FX

When Steve Stark joined MGM in 2011, shortly after the recently bankrupt company had relaunched its television division, and was told that FX was interested in partnering with the company on a Fargo adaptation, “I was so scared,” Stark says. “My first reaction was there was no way we could touch that film. It was too sacred and too good. But there was clear value for MGM to use value that we had to slingshot us into the marketplace.”

After its bankruptcy filing, MGM had nothing in the television pipeline, so adaptations of properties from the company’s film library—such as Fargo and the MTV series Teen Wolf—made sense as a starting point. In a world where networks are becoming more integrated with their corporate sister studios (such as Fox under Newman and Walden), MGM claims that its library gives it an advantage.

For a show to differentiate itself in a crowded marketplace, Stark says, “either you need something undeniably unique and singular, and that’s hard to find, because there’s so much out there, or you need some element that makes you separate yourself from every other show that’s trying to get the same viewers that everyone else is looking for.”

To further sweeten the pot for prospective buyers, MGM has embraced bringing on its network partners as coproducers, as it did with Fargo and FX Productions. In coproduction deals, division of cost is easy. It’s division of labor that is hard.

“When we partner with networks, it’s MGM actually running lead point in production,” Stark says. “So we’re the hands-on producer who puts it together, manages the production, as we did with Fargo, but have complete transparency with our partners.”