Weaker Ad Market Expected To Cut Into 4Q Earnings

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

A slow ad market at the end of the year will have an impact on the fourthquarter earnings of the big media companies, analysts say.

Media companies starting with Comcast and Viacom reported earnings last week. Others will be reporting results through Feb. 21, when Crown Media and Starz take their turns.

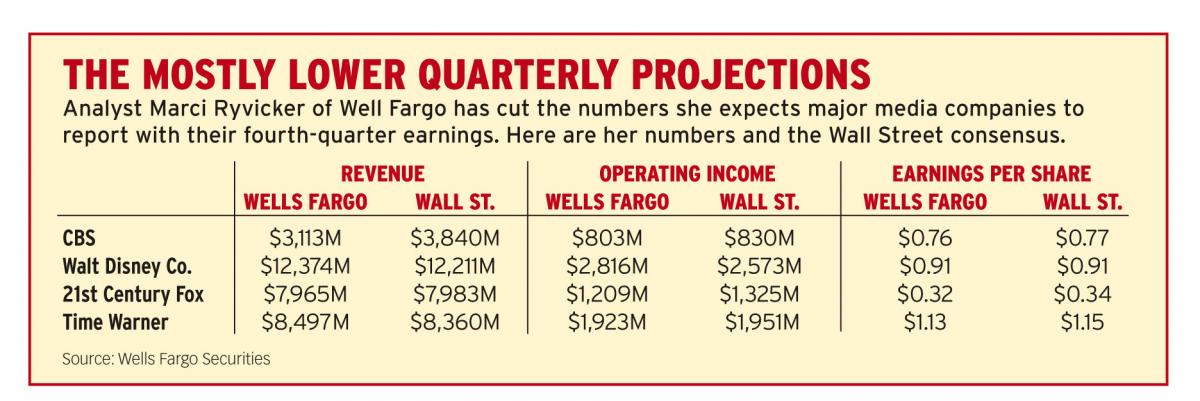

Marci Ryvicker, senior analyst at Wells Fargo Securities, said the quarter seemed challenging for media companies because of a slowdown in the national ad market, soft broadcast ratings and tough comparisons with strong political ads in 2012.

Citing a softer scatter market and weak ratings, Michael Nathanson of MoffettNathanson cut his estimate for calendar fourth-quarter TV ad spending growth to 4.7% from 5.9%. As a result, he reduced his estimates on several of the companies he covers.

What impact will ratings reports have on media company shares and how willing will companies be to bet money on programming? “We think investors have now turned their attention toward 2014, with the focus likely on picking media stocks with event-driven catalysts, and those with the best growth profile and longterm drivers,” Ryvicker said, pointing to Time Warner’s spinoff of its publishing assets as an example of the kind of event that could help a media stock.

At this point, Ryvicker said her favorite company in the sector was The Walt Disney Co., the only company for which she raised estimates for revenue, operating income and earnings per share.

Disney’s cable nets appeared to have solid affiliate revenue growth and strong ad growth because of better NFL and college football ratings, she said. On top of that Disney’s parks division did good holiday business and consumer products were doing well, particularly with products based on Disney Jr. channel characters.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

During Disney’s Feb. 5 earnings call, Ryvicker said she’ll be listening for more information about affiliate fee growth and any pending contract negotiations, such as the extended talks with Dish Network. She wants to hear comments on ABC’s ratings and a potential bid to put Thursday-night NFL games on the network.

For CBS, Ryvicker said she left her estimate for fourth-quarter earnings per share unchanged but made other adjustments to her forecast. She sees broadcast network ads coming in higher than previously thought because of strong ratings for the NFL and SEC college football. But Ryvicker lowered local TV revenue because she sees ads driven by the Affordable Care Act shifting from the fourth quarter to the first half of 2014.

Nathanson cut his earnings per share estimate for CBS by 10 cents, to 75. “The majority of the decrease to our quarter estimates is the result of better understanding of the timing of syndication revenues following 3Q earnings, including the recognition of some of its [satellite video-on-demand] digital money being pushed into 2014,” he said in a report.

Ryvicker said she trimmed 21st Century Fox’s earnings because of expected weaker cable results due to soft ads, lower ratings and investment in new channels.

Fox’s TV unit also faced higher programming and marketing spending. “We still like top-line growth and [long-term] drivers,” at 21st Century Fox, she said.

Meanwhile, analyst Anthony DiClemente of Nomura Securities said he liked 21st Century Fox’s deal to raise its stake in the YES Network to a controlling 80% from 49%. DiClemente thinks YES can add $175 million in incremental affiliate fee growth, and that synergies between YES and Fox’s local stations in New York could also boost ad sales.

Slight Fall, But a Rise With ‘Gravity’

At Time Warner, Ryvicker is expecting slightly lower earnings than the Wall Street consensus. Again, she’s expecting lower advertising revenue because of soft ratings and a weak market. But Time Warner is helped by consolidation of HBO in Asia and the performance of the film Gravity.

Nathanson has left his estimate for Time Warner earnings per share unchanged, but he shaved his forecasts for revenues and earnings before interest and taxes: “We anticipate difficult comparisons from a very strong 4Q 2012, but still expect the company to cap off a solid year and finish at the top end of its full year ‘mid-teens’ EPS guidance.”

The smaller programmers also took earnings haircuts from Nathanson. He noted that ratings at Discovery’s big networks posted double-digit ratings declines in the quarter, while Scripps Networks Interactive continued to invest to improve the performance of Food Network.

Nathanson made his biggest earnings cut at AMC Networks, despite expected strong ad revenue growth on a 24% ratings increase. He sees AMC having a write-down of $15 million for two canceled shows, Low Winter Sun and The Killing. That’s show biz.

COMCAST HAILS NBCU PURCHASE

Brian Roberts, head of Comcast, the nation’s largest cable operator, said the most important decision his company made in 2013 was buying from General Electric the 49% of NBCUniversal it didn’t already own.

“We feel great about the improvements at NBCUniversal, which have significantly exceeded our expectations,” Roberts said during Comcast’s earnings call with analysts last week. “The turnaround in broadcast is happening even faster than we had anticipated.”

NBCU’s operating cash flow was up 14.3% and NBC’s ad revenues were up 8.3%, beating expectations. And the company sees even better numbers in its future. “I think broadcast television has a long way to go. We now have ratings. First, you’ve got to get the ratings; then you can sell the ratings if there is sort of a lag variable. So I think broadcast has real upside,” NBCU CEO Steve Burke said on the call.

“And of course we’ve got a great group of cable networks. We do feel there’s a monetization gap between how we’re doing in terms of ratings and box office and everything else and the amount of operating cash flow we’re generating, but pretty much everywhere you look we still think there’s a lot of opportunity. We believe we’re off to a good start but there’s plenty more to go.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.