The TV Industry’s Growing Wait Problem

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

CBS announced in September that it would include delayed-viewing projections in its ratings press releases for premieres in the then forthcoming new fall season. The announcement was “news” only in a strict sense. Fox had included such projections in its daily ratings releases since the previous fall, and ABC and NBC had also deployed them. But by making a to-do over the projections (with the announcement even including a quote from CBS Corp. president and CEO Leslie Moonves) CBS was attempting to advance a cause that the broadcast and cable networks, in collaboration and individually, are devoting increased energy to this fall— shifting discussion around television ratings away from live-plus-same-day and toward delayed-viewing.

That task is not easy. Live plus-same-day numbers have great appeal to the press and industry analysts because they are widely available the day after a show airs and are the yardstick by which the success or failure of shows and entire networks have been traditionally measured. Networks argue that audience fragmentation, the emergence of digital platforms and the growing acceptance by advertisers of delayed-viewing numbers as the currency of record have made live-plus-same-day, if not irrelevant, then a misleading or unfair measure when not reported alongside other metrics that reflect a wider—and thus more attractive from the network perspective— swath of viewers.

“I really think if you went back and spoke to some program guys who were working in this business 10 years ago, they would be stunned that a show with a 1 in front of its rating would be renewed,” says Alan Wurtzel, president of research and media development for NBCUniversal.

Wurtzel’s hypothetical programming executives would be nonplussed to learn that the Big Four broadcasters together renewed 37 non-news, non-sports series that averaged below a 2.0 live-plus-same-day rating last season. Travel back four years, and only six shows that fell below 2.0 in 2009-10 were renewed for the following season.

As live-plus-same-day numbers have trended downward, the inevitable comparisons of a show’s current ratings to past seasons have trended toward the unflattering.

“As more and more viewing shifted from a live base to a time-shifted base, the live audience was going down without the total audience going down,” says David Poltrack, chief research officer for CBS Corp. and president of CBS Vision. “Sometimes the total audience was going up and the live audience was going down.”

Ratings Days Are Numbered

The smarter way to stay on top of broadcasting and cable industry. Sign up below

Network efforts to emphasize delayed viewing metrics such as live-plus-three-days and live-plus-seven—live viewing plus three days of viewing and seven days of viewing, respectively— date back at least until September of last year, when research executives gathered at the Fox lot to meet with industry press and make the case for delayed-viewing numbers. The push was renewed this summer, when Wurtzel gave a half-hour presentation to reporters during the first week of the TCA summer press tour, which was followed a week later by a panel discussion featuring research executives from CBS, Fox, FX and Showtime.

But for observers looking to judge a show’s performance, delayed-viewing numbers are a drag—literally. Nielsen takes five days to deliver live-plus-three information. It takes 20 days to deliver live-plus-seven. Asking reporters to focus on an event that occurred 20 days earlier, when reams of data on things that happened only last night pour in from multiple sources every morning, is like asking a two-year-old to please, please eat her spinach.

But it is increasingly obvious that delayedviewing numbers affect ratings stories. Take, for instance, Fox’s Red Band Society, an hourlong drama that has drawn comparisons to Fox’s own Glee, and the recent motion picture The Fault in Our Stars—both big with the younger-skewing audience the network prides itself on attracting. The series premiered Sept. 17 to a soft 1.3 live-plus-same-day rating. Its second episode clocked in at 1.1, down 15% from the first week, creating a clear narrative—a show with the potential to resonate with the network’s core audience started out weak and faded immediately. But the liveplus- three numbers did not fit that story line. Episode 2 grew by 64% from live-plus-same-day to live-plus-three to a 1.8—the same number that the premiere had earned in live-plus-three. Red Band Society’s audience was still small, but it was holding steady and had posted greater percentage growth that week in live-plus-three (albeit against a low base) than any other show but one.

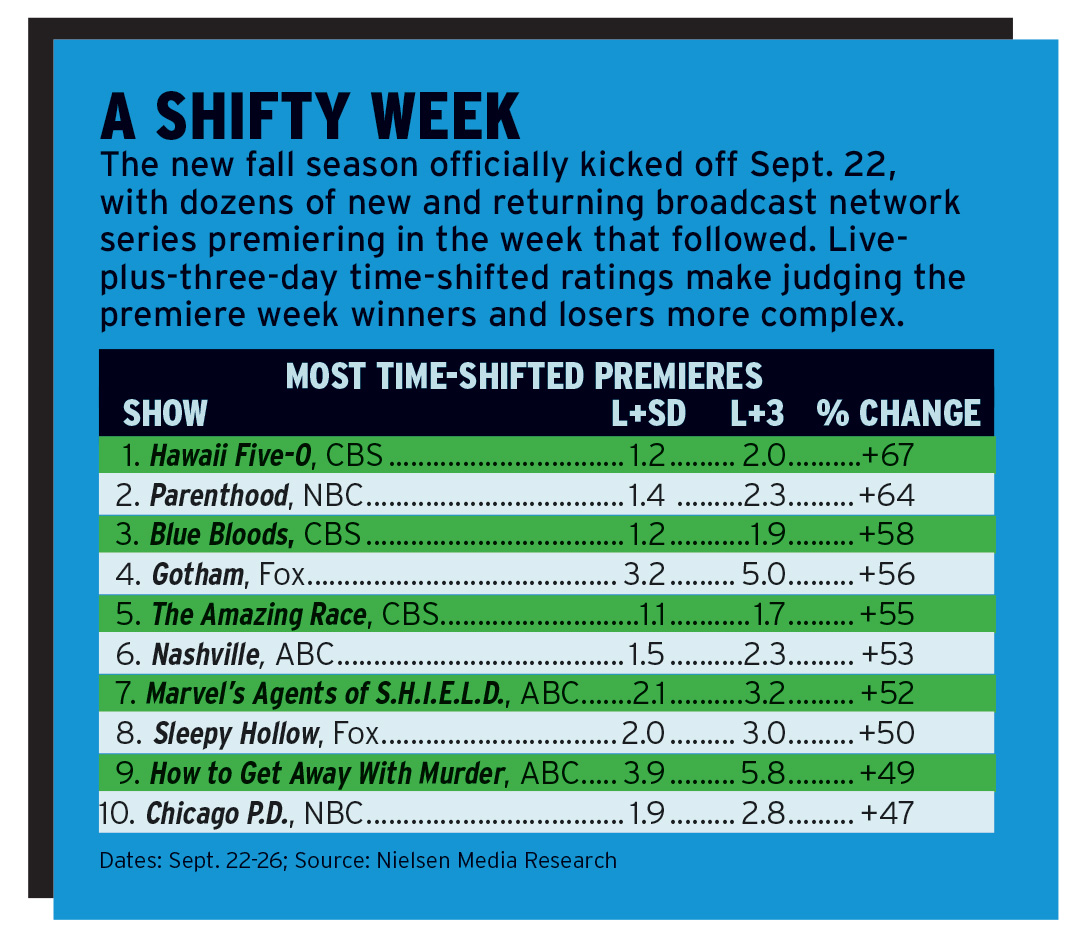

Other networks were able to mine their own bragging rights from delayed viewing as the season began. ABC’s Marvel’s Agents of S.H.I.E.L.D. and Nashville and NBC’s Parenthood premiered to unspectacular live-plus-same-day ratings but joined Fox’s Gotham and CBS’ Friday-night series Hawaii Five-0, Blue Bloods and The Amazing Race as the only premieres through Sept. 26 to grow by more than 50% in live-plus-three. ABC’s Modern Family and NBC’s The Blacklist both grew 44% from solid live-plus-same-day showings. CBS’ The Big Bang Theory, which has thus far had the biggest live-plus-same-day premiere rating of any show at 5.4, grew by two points in live-plusthree, the biggest points gain of any premiere. And ABC’s How to Get Away With Murder built on an impressive 3.9 live-plus-same-day premiere with a 49% jump in live-plus-three.

Estimated Value

All of which does nothing to make delayed-viewing numbers available sooner. Hence, the network projections. But while network researchers insist that they have a strong interest in advancing projections rooted in data science and that those projections often tend toward the conservative, an estimate developed by an organization that stands to benefit from the distribution of a high number has less obvious journalistic value than a number generated by an impartial third party does.

For John Landgraf, CEO of FX Networks and FX Productions, projections were not enough. In July, FX announced that it would no longer release ratings for its shows before live-plus-three numbers were available. The network pegged that decision to the release of premiere ratings for drama The Strain, which had performed strong in live-plus-sameday— inoculating the network from accusations that it was withholding ugly figures. But by delaying its own ratings releases, FX cedes influence over the first stories written about its own shows. Multiple outlets, for instance, reported on the live-plus-same-day ratings for Sons of Anarchy in September before FX released them alongside the live-plus-three. Landgraf’s hope is that FX will be joined in their decision by other cable networks, thereby establishing a new industry standard. “I think we’re going to win this one,” Landgraf says.

“I think our competitors are going to follow us into the breach, because ultimately I think it’s better for the industry.”

Landgraf was speaking about his cable competitors. For broadcasters, refusing to release ratings info until delayed viewing is available would be an even greater challenge, as their ratings are widely distributed on a daily basis via multiple sources. Still, Fox has in the past held internal discussions about possibly holding ratings until delayed viewing figures are ready. The idea has found less traction at CBS and NBC, but currently, all four broadcasters release varying degrees of information on each other’s ratings daily. It is hard to imagine any one network giving up the ability to spin its own ratings unless its competitors agreed to do the same.

But even if live-plus-three or live-plus-seven were to become more quickly distributed and widely embraced, neither represents an unchallenged gold standard. The most popular currency between network and advertiser is the C3 rating— a number based on live-plus-three ratings that measures the viewers watching over three days who also watch the commercials. At this year’s upfronts, the networks were able to cut some deals with advertisers based on the C7 rating.

“Part of the motivation to focus more and more measurement on the time-shifted viewing was to help demonstrate to advertisers how much value there is after the third day and to get more and more of them to move to the seven-day base,” says Poltrack. But the C3 and the C7 are lower, less widely disseminated and less quickly calculated than the respective live-plus-three and live-plusseven ratings from which they are extrapolated, making them unlikely to ever become the subject of press release crowing.

Digital Divide

Then there is the digital gap. Prior to this season, Nielsen did not measure viewing via digital platforms. This fall, the company will begin measuring mobile viewing—but as B&C recently reported (go to broadcastingcable.com/Sept29), networks have been reluctant to opt in to mobile measurement from Nielsen, which requires that networks add the company’s software to its mobile apps, and that all shows carry the same ad loads that they do in TV in order to be counted. And Nielsen’s mobile measurement doesn’t cover other forms of digital viewing, such as viewing over PCs via the Web.

“It would be fantastic if Nielsen could measure everything, but I don’t think it would necessarily change the fact that people still want the information” that is most immediately available, says Paul Pastor, senior VP of strategy and analytics, Disney/ABC Television Group. And Nielsen being able to calculate a number that includes digital, he adds, leaves open the question: “When is that data point going to be available to you to have impact in the marketplace?”

Still, it would be a valuable data point. Though the networks are able, to some extent, to measure their own digital viewing, there is no uniformity that exists when it comes to what constitutes digital-platform viewing. Is it a viewer clicking ‘start’ on a video? Is it a viewer watching a show for a particular amount of time? And how much time? Consistent measurement could potentially even help broadcast and cable networks pressure digital services such as Amazon and Netflix, who decline to release viewership numbers, to adopt similar standards. It could also help the industry settle on a number to replace live-plus-same-day as the one true metric of record.

“I think that multiplatform is going to become the de facto way that we compare programming as we move forward,” says Will Somers, senior VP of network research for Fox. “We’d be remiss if we didn’t take a multiplatform view and try to compare programming across that particular set of metrics.”