Telemundo Gains in Flat Hispanic Ad Market: SMI

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

In a flat Hispanic television market, Comcast’s Telemundo is making gains while ad revenue is down at long-time industry leader Univision, according to new figures from Standard Media Index.

Including the World Cup, which had long aired on Univision but this year was broadcast by Telemundo, Hispanic Television Networks ad revenue was $2.1 billion in the 2017-18 season, little changed from the previous season. Excluding the World Cup, played earlier this year, ad revenue was down 5% to $2.1 billion, SMI said.

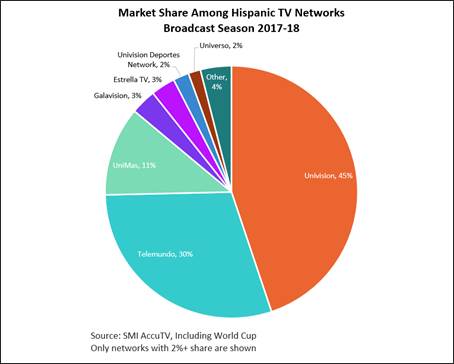

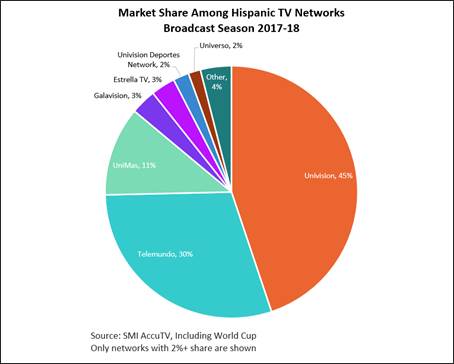

Univision remained No. 1 in ad revenue at $875 million, but that was down 9% from last year. Its share of the Hispanic market dropped to 45% from 49% in the 2016-17 season.

Related: NBCU Profits Slip 8.5% Despite TV Business Gains

Telemundo’s ad revenues rose 16% to $647 million. That includes $122 million generated by the World Cup. Telemundo’s share of the market jumped to 30% from 26% last season.

Among other Hispanic television networks, UniMas had an 11% share, Galavision a 3% share, Estrella TV a 3% share, Univision Deportes 2% and Universo 2%, with 4% going to “other.”

Primetime spots in Hispanic media cost an average of $3,753 for 30 seconds. The most expensive spot came in World Cup coverage during Copa Mundial de la FIFA: Homenaje al Campeón on Telemundo, which cost $197,000 for a 30-second spot. Univision’s Premio Lo Nuestro 2018 at $133,000 and Premios Juventud 2018 at $113,000 were the next most expensive shows on which to advertise.

The smarter way to stay on top of broadcasting and cable industry. Sign up below

“Results this season show the substantial impact that special events, like the World Cup and the Olympics, have in maintaining share for National TV,” said SMI CEO James Fennessy. “The World Cup managed to help Hispanic TV keep volumes at 2017 levels. When we back this out we see a fairly substantial fall in revenues for the just completed broadcast year.”

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.