Stock Market Tumble Not Affecting Ad Demand Yet

The smarter way to stay on top of broadcasting and cable industry. Sign up below

You are now subscribed

Your newsletter sign-up was successful

The plunging stock market doesn’t seem to be having an effect on the advertising market yet.

Media buyers say that as they are finalizing their upfront buys—turning “holds” into orders—few clients are making cuts and more are looking to step up their television ad budgets. Upfront volume was down at most media companies because of lower ratings and competition from digital advertising.

“Clients took a conservative approach in registering budgets at the upfront. Now they feel good about what we accomplished in the negotiations, and they want to see if they can add a few dollars,” said one buyer at a major agency.

“That doesn’t happen in years where there are broader concerns about the economy. Aside from a crazy stock market, most things are OK. Results are decent and that supports continued demand,” the buyer added.

Signs of demand are a good thing for TV networks. The problem is there isn’t much inventory to sell. Ratings continue to plummet in the third quarter, cutting the number of eyeballs available, and because networks have been falling short, they owe advertisers hundreds of millions worth of make-good advertising dollars in order satisfy ratings guarantees.

“The make-good situation is pretty dramatic in some cases,” the buyer said. “The expectation is that it’s going to impact the fourth quarter as well.”

The smarter way to stay on top of broadcasting and cable industry. Sign up below

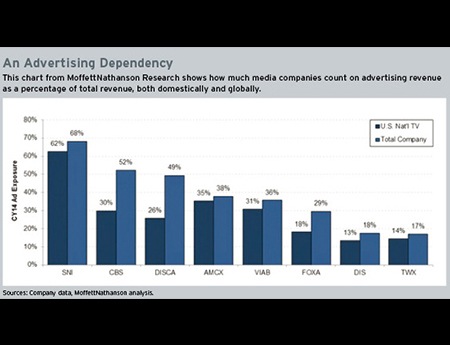

“That’s my presumption as to why scatter’s tightening. You have a lot of companies that are out of inventory in the third quarter,” said Michael Nathanson, analyst at MoffettNathanson Research. His crystal ball about what happens next was cloudy. “Fourth quarter to me is a long way off,” he said.

In Search of Spots

Though contractually obligated to fulfill guarantees by the end of the broadcast year, networks that took an especially big drop in the quarter are out of sale and can’t find enough spots to use as make-goods.

That leaves the networks with two options—rolling the make-goods into fourth quarter (the first quarter of the new broadcast year), which the networks hate to do. Or they can return the money for ads that will never run, which is something they hate even worse.

In some cases, networks are offering cash, said one media buyer.

“Nobody really wants that, but that’s in play as well,” he said. “They’d rather start the fiscal year clear, so it’s easier for them to just give the money back.”

The tightness in the market could continue into the new broadcast year. In fact, some networks are already calling to let buyers know that the fourth quarter is already tight, a buyer said. The message: If you didn’t buy time in the upfront, there might not be much of a window to get into business with us in the fourth quarter in scatter. “You don’t normally hear that well before a quarter begins,” a buyer said. “You rarely hear that before the fourth quarter, which is usually clean. They don’t owe you anything yet in the fourth quarter.” One way buyers are trying to cut down on the make-good issue is by pressing the networks to base ad guarantees on more realistic audience estimates.

“Everyone’s got to come to the realization that there’s just not enough viewership to go around, given the amount of programming that’s out there, both ad supported and non-ad supported. It’s too much of a good thing at this point,” a buyer said. Outside of a few huge series—The Walking Dead, Empire, Fear the Walking Dead, big events, award shows and sports, viewership is fragmented, making it hard for marketers to grab a really big audience in any one place.

“In the end, more realistic estimates going in would help everyone, but that turns TV into a smaller business with lower revenue for the media owners,” a buyer noted. “It’s hard to say ‘We’re not going to generate the revenue we did last year.’ Nobody wants to say that. But that’s what will happen, unless they can sell more digital or more on-demand.”

One of the reasons media stocks began falling even before the general stock market contracted was slow growth to declines in ad sales at some of the major media companies. On top of that, cord-cutting seemed to be a factor in a falling number for pay-TV subscribers, a trend that threatened what had appeared to be steady growth in distribution revenue.

“The media companies’ narrative failed them. They’re not telling a good story and the story of Netflix and digital is so much more compelling,” Nathanson said.

Jon has been business editor of Broadcasting+Cable since 2010. He focuses on revenue-generating activities, including advertising and distribution, as well as executive intrigue and merger and acquisition activity. Just about any story is fair game, if a dollar sign can make its way into the article. Before B+C, Jon covered the industry for TVWeek, Cable World, Electronic Media, Advertising Age and The New York Post. A native New Yorker, Jon is hiding in plain sight in the suburbs of Chicago.